11 Celebrity Apps That We Hate to Love

Celebrities may get a bad name for bringing out products just to make a quick buck, but if we’re being honest…. some of their swag isn’t actually half bad. But instead of last season’s celebrity perfumes and clothing lines, the current go-to celebrity products are going mobile. From emoji keyboards to shamelessly addicting mobile games, here are 11 celebrity apps that we actually kind of love.

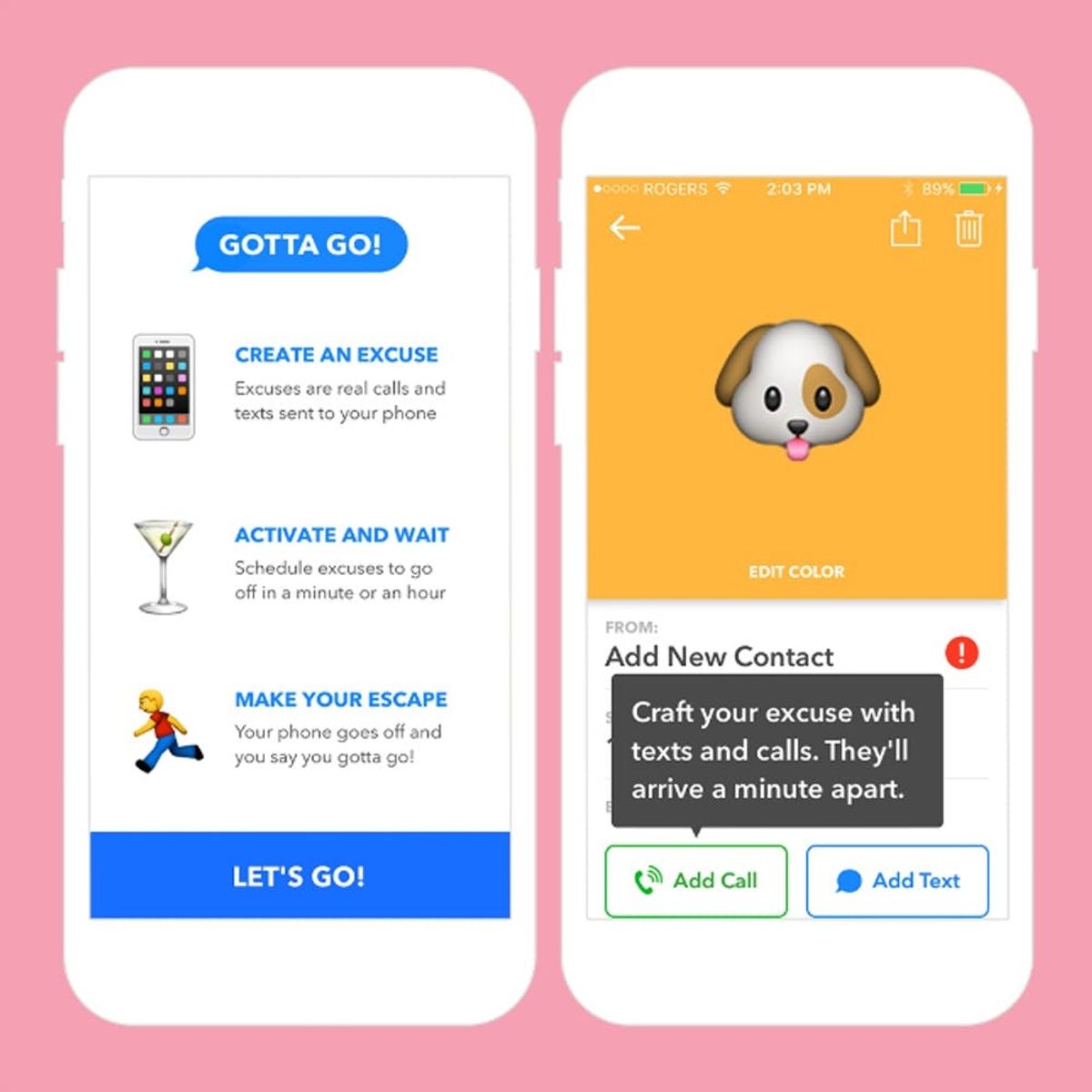

1. Chelsea Handler: Gotta Go!: From bad dates to over-crowded parties, Chelsea Handler’s latest app has you covered when you need an excuse to leave an awkward event. Just choose an excuse, set a timer and the app will actually text and call you with an excuse from a newly created contact.

DL It: Free on iOS

2. Britney Spears: American Dream: If you’ve ever wanted to live like everyone’s fave 2000’s heartthrob, here’s your chance. In this addicting game, users make hit songs and climb the music charts like Brit. Just be sure you have WiFi, as the game requires a network connection to play.

DL It: Free on Android and iOS

3. Katy Perry Pop: Another winner by celebrity app designers Glu Games, Katy Perry’s interactive game app is all about making it big. From building your music career to developing your pop star persona, this game will turn you into an unforgettable California girl in no time.

DL It: Free on Android and iOS

4. Psych!: After the crazy success of her first game, Ellen DeGeneres is back again with a new party game that might just rival Cards Against Humanity. The concept is simple: Players join a specific game IRL via a connection code and have to make up fake answers to real trivia questions to stump their friends. It’s time to get creative, folks!

5. Snoop Dogg’s Snoopify Mobile Photo App!: When Snapchat filters aren’t quite cutting it anymore, check out this awesome cheesy photo editing app by Snoop Dogg. Although the editing features are basic at best, the sheer amount of Snoop Dogg-related stickers available are insane (and yes, there’s a lot of marijuana, FYI).

DL It: Free on Android and iOS

6. Kimoji: Controversial, opinionated, hella in-shape… no matter what you think about Kim Kardashian, she does know how to create a good emoji. I mean, is there ever a bad time to use Kim’s ugly crying face? We think not.

DL It: $1.99 on Android and iOS

7. Demi Lovato: Path to Fame: With two successful seasons under her belt, Demi Lovato’s newest addition to her mega popular game is amazing. A choose-your-own-adventure story where you are in charge of your own career, it’s equal parts #girlboss inspiration and drama-packed fun.

DL It: Free on Android and iOS

8. Kylie Jenner Official App: Following in her sister’s app mogul footsteps, Kylie Jenner’s new namesake app is anything but ordinary. Although on the surface it looks like any other boring superstar app (AKA a bio and a few pics), Kylie’s interactive platform includes behind-the-scenes photo galleries, videos, personal blogs, beauty tutorials and live streams.

DL It: Free on Android and iOS

9. Tidal: Coming in and out of the news every time Kanye goes on a Twitter rampage, Jay Z’s Tidal is actually kind of awesome… if you’re willing to pay the $12.99 or $25.99 per month premium fees. Made and curated by music journalists, artists and experts, it’s an all-encompassing music experience that celebrities like Beyoncé, Rihanna and Madonna are standing behind.

10. Sheenoji: Charlie Sheen Keyboard: This app is WINNING! For anyone who’s ever wanted a little more Charlie Sheen in their life, this emoji keyboard is everything you could ever dream of.

DL It: $0.99 on iOS

11. Bonk! Presented by The Tonight Show Starring Jimmy Fallon: Take your lame unfiltered selfies to the next level with this cool photo editing app courtesy of The Tonight Show Starring Jimmy Fallon. We don’t know what’s better… the fact that you can turn your friends into crazy sub-human creatures or how the app brands itself as having “a state of the art facial squish technology.”

DL It: Free on iOS

Do you have any celebrity apps on your phone? Tweet us which ones by mentioning @BritandCo.