CMA Awards 2018: Country Music's Cutest Couples on the Red Carpet

Country music's best and brightest took over Nashville's Bridgestone Arena on Wednesday, November 14, for the 2018 CMA Awards. This year's show was hosted (for the 11th time!) by Carrie Underwood and Brad Paisley, with performances by nominees including Luke Bryan, Maren Morris, and Kelsea Ballerini — all of whom made it a date night with their significant others. Click through to see the cutest red carpet couples from country music's biggest night! (Photos via Jason Kempin/Getty Images)

Carrie Underwood and Mike Fisher: Underwood — who's co-hosting the awards show for the 11th time with Brad Paisley, and is also nominated in two categories — stunned in a blush-colored gown as she walked the carpet with her hockey player husband. The couple are expecting their second child together. (Photo via Jason Kempin/Getty Images)

Caroline Boyer and Luke Bryan: College sweethearts Boyer and Bryan were all smiles ahead of the big awards show. Bryan is among the night's performers and is also nominated for Entertainer of the Year. (Photo via Jason Kempin/Getty Images)

Maren Morris and Ryan Hurd: Morris, who's nominated for Female Vocalist of the Year and Musical Event of the Year (for the song "Dear Hate," featuring Vince Gill), glittered in gold on the red carpet. Her husband, whom she married in March, wore a matching gold tux jacket. (Photo via Jason Kempin/Getty Images)

Kelsea Ballerini and Morgan Evans: The "I Hate Love Songs" singer, who's nominated for Female Vocalist of the Year at the 2018 CMAs, turned heads in hot pink as she walked the carpet with her husband of almost a year. (Photo via Jason Kempin/Getty Images)

Lauren Akins and Thomas Rhett: Akins wowed in an ombre hot pink gown as she walked the carpet with Rhett, who's nominated in three categories, including Male Vocalist of the Year. (Photo via Jason Kempin/Getty Images)

Garth Brooks and Trisha Yearwood: The country music power couple, who have 17 CMA Awards between the two of them, bundled up in black on the red carpet. Brooks is set to perform a special song dedicated to Yearwood during the show. (Photo via Jason Kempin/Getty Images)

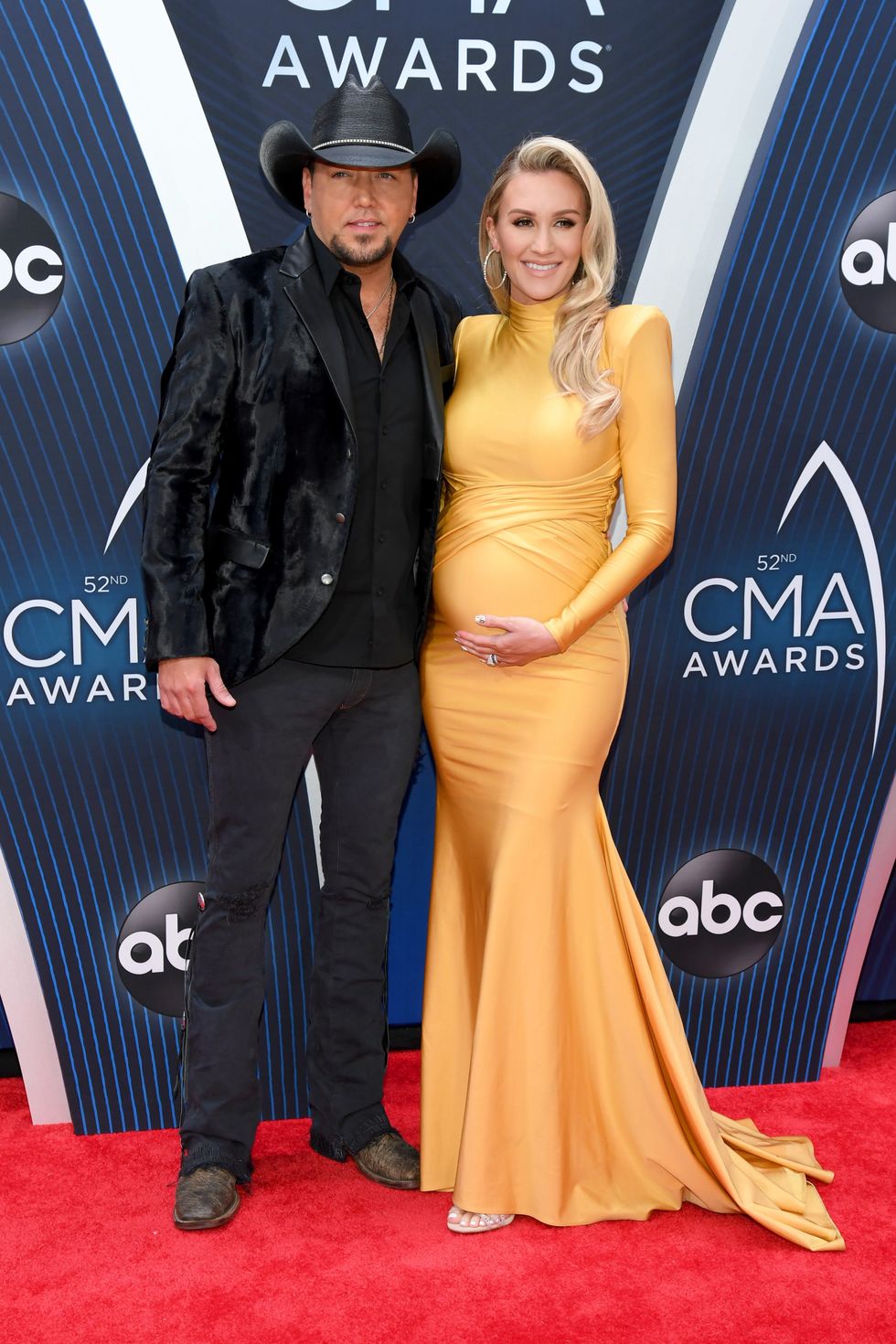

Jason Aldean and Brittany Kerr: The "Drowns the Whiskey" singer, who earned nominations in four categories, including Entertainer of the Year and Single of the Year, walked the red carpet with his pregnant wife, who stood out in buttercup yellow. The couple are expecting their second child together. (Photo via Jason Kempin/Getty Images)

Tyler and Hayley Hubbard: The Florida Georgia Line musician and his wife, Hayley, made it a family night with daughter Olivia Rose, who turns one year old in December. (Photo via Jason Kempin/Getty Images)

Brittney-Marie and Brian Kelley: The Florida Georgia Line musician walked the red carpet with his wife of almost five years. (Photo via Jason Kempin/Getty Images)

Alex Hopkins and Lauren Alaina: The "Road Less Traveled" performer, who's nominated for New Artist of the Year, brought her fiancé as her date to Wednesday's awards show. (Photo via Jason Kempin/Getty Images)

Brantley Gilbert and Amber Cochran: Two-time CMA nominee Gilbert walked the red carpet with his wife of three years, who inspired some of his many songs, including "You Don't Know Her Like I Do" and "More Than Miles." (Photo via Jason Kempin/Getty Images)

Christina Murphy and Frankie Ballard: The "Sunshine & Whiskey" crooner and his wife made a stunning couple outside Nashville's Bridgestone Arena. (Photo via Jason Kempin/Getty Images)

Kailey and Russell Dickerson: The "Blue Tacoma" singer-songwriter couldn't keep his hands (or lips) off of wife Kailey on the red carpet. (Photo via Jason Kempin/Getty Images)

Gabi Dugal and Scotty McCreery: The American Idol alum and his longtime love, who tied the knot this past June, coordinated in black at the awards show. (Photo via Jason Kempin/Getty Images)

Brett Young and Taylor Mills: The New Artist of the Year nominee and his longtime love were the picture of newlywed bliss — they said "I do" on November 3! — outside Nashville's Bridgestone Arena. (Photo via Jason Kempin/Getty Images)

Jordan Davis and Kristen O'Connor: The "Singles You Up" singer and his wife coordinated their red carpet looks in shades of blue. (Photo via Jason Kempin/Getty Images)

Katelyn Jae and Kane Brown: Newlyweds Brown and Jae, who married in Nashville just last month, were a perfect match in head-to-toe black ensembles. (Photo via Jason Kempin/Getty Images)

Summer Duncan and Jon Pardi: The "Heartache on the Dance Floor" crooner coordinated with Duncan in black and red. (Photo via Jason Kempin/Getty Images)

Kelly Lynn and Chris Janson: The "Drunk Girl" singer, who's nominated for three awards including New Artist of the Year, was all smiles with his songwriter wife on the red carpet. (Photo via Jason Kempin/Getty Images)

Chris Lane and Lauren Bushnell: The country singer and the Bachelor alum walked the red carpet together just hours after news of their romance broke. (Photo via Terry Wyatt/Getty Images)