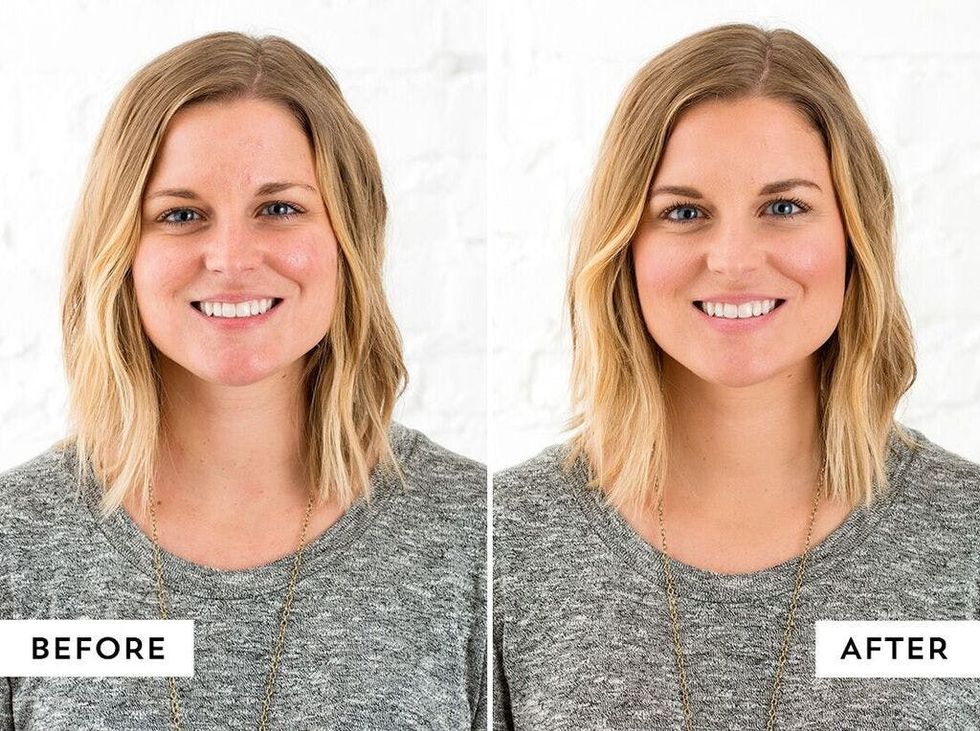

Here’s How to *Actually* Conceal a Blemish

We all know what it’s like to have an unexpected, annoying, confidence-busting blemish — they’re the worst. Lots of us often turn to weird ways to actually get rid of blemishes (or use Miley Cyrus’ zit hack) because they’re stubborn and hard to completely conceal. It’s so frustrating when we end up drawing more attention to a zit in the process of trying to cover it up. Agh!! News flash, ladies: There’s more to covering up a blemish than just smearing on concealer. As a makeup artist, I rely on this specific technique any time I need to truly cover up a breakout. Here’s how to seriously conceal a pimple.

Step 1: Apply Foundation

It’s best to start by applying your base makeup to get a flawless face: foundation, tinted moisturizer, BB cream or whatever foundation-like product you’re loving. This first step is key because it will provide a base layer of coverage for your blemishes.

Cover up those zits! The best way I have found to cover blemishes or spots is to apply a simple swipe of concealer that’s slightly bigger than your blemish. I even make little “X” shapes; I like the way it blends out onto the rest of my skin.

Step 2: Conceal Those Spots

This what I like to call “the tapping technique” — it’s a total game changer! This step is typically where I see a lot of gals go wrong in their concealing process, because they straight up rub concealer over their blemish. The reason you don’t want to do this is because you end up wiping most of the product on an area of your face that doesn’t need to be concealed. Instead, *tap* your finger gently over the area and slightly beyond it to blend the product into the rest of your skin. The heat from your finger will help melt the product into your skin directly over your blemish.

Step 3: Tap, Tap, Tap

Now, let’s pull this look together! Gently apply bronzer and blush as you normally would, but make sure you don’t avoid any areas that you have concealed — adding a light dusting of blush and bronzer on top will actually make it look more natural.

Step 4: Top It Off With Blush, Bronzer + Powder

Throw on your favorite lipstick and a couple coats of mascara and you’re ready to hit the day feeling confident and totally beautiful!