The Worst Career Advice Erin Andrews Ever Got Is Pretty Terrible

If you Google “Erin Andrews career advice” (say, to prep for an interview with the Fox Sports/Dancing With the Stars host) you’ll see that she’s been asked to give it about as many times as Beyoncé has likely been asked what beauty products it takes to “wake up like this.” And, since the career that Andrews is crushing it in is mostly populated by men, the FAQ usually goes like this: “What is your best career advice for women trying to break into a male-dominated field?” While the sportscaster was in the same town as Brit HQ for this weekend’s Super Bowl, we sat down with her and asked a totally different career question that stumped her. For a minute.

Forget the good advice — from a female Silicon Valley resident to a female sportscaster, I asked Erin to reveal the worst thing she’s ever been told as a woman in a mostly male field. After thinking about it for a second, she shared this story: “People ask me all the time — which I always say if I ever write a book would be the title — ‘Do you really like sports?’” She paused, looking at me as if to say, “Can you believe that bulls@#!#t?” (I couldn’t.)

“No. I live out of a suitcase. I am never home. I have no life. I miss Thanksgiving every year. I don’t [like sports]” Erin laughed. “So I think one of the worst pieces of advice is that you can get by being pretty and you don’t really have to like sports. Or — if you’re in a male-dominated industry and it’s not sports — that you don’t need to really like the job you have; just look cute and get away with it.

“I carry a huge Trapper Keeper on the field and people say to me — ‘did you do this yourself?’ Another favorite one is: ‘Do people tell you what to say or do you make it up on your own? Are they feeding you questions?’ Are you insane?” The sanity query is a fair one to anyone who would doubt Erin’s commitment to the game or the hustle. The sportscaster is her own glam squad and research team, getting up before each game to fill said Trapper Keeper with all the necessary info she needs to know, doing her own hair and makeup for showtime.

The other defense Erin regularly has to run is making it clear that women in male-dominated industries can be friends, catfight-free, naming fellow Fox anchor and EXTRA co-host Charissa Thompson as an MVP in her support squad. “It’s a very competitive industry,” Erin admits. “I’ve learned that from a very young age. Someone asked me a question the other day, ‘Do you look over your shoulder and see who’s coming up the ranks?’ Yeah, you’re aware of who’s in the industry but… I think any time a guy senses there’s a little bit of edginess or jealousy, the boys like to stir it up, ‘Whoa! She’s wearing this! And she got this interview!’ stuff like that.

“Charissa is one of my dearest friends in the industry. We’re both so honest with each other and have been through a lot of the same stuff. I genuinely cheer for her. After she does something I’ll text her, ‘First of all, you look amazing. Second of all, you were fabulous.’ Relationships like that, you do hold near and dear to your heart because there aren’t many in the industry.”

Now *that* is much better career advice.

What’s the worst career advice you’ve ever gotten? Give it up on Twitter or Facebook.

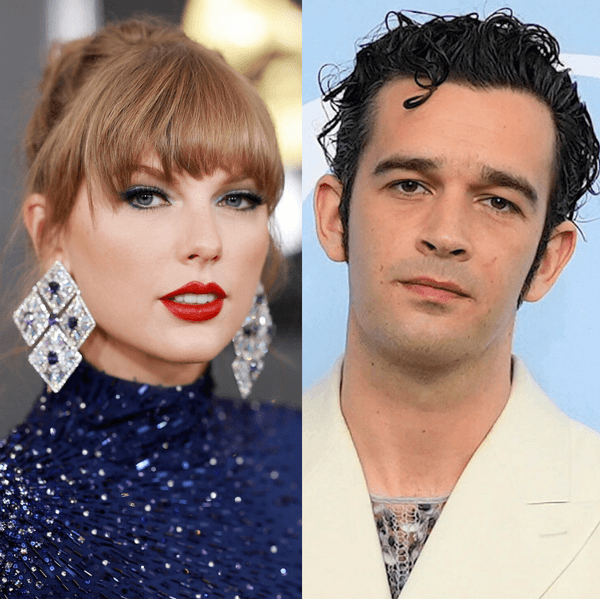

(Photos via Steve Jennings + Michael Tullberg/Getty)