These Are the Longest-Running Scripted Shows Currently on Primetime TV

Some TV shows seem to come and go far too quickly, while others feel like they've been around forever. These are the latter. From animated classics to multi-camera comedies and live-action series, here are the longest-running scripted shows currently on primetime TV (not daytime — those soap operas are eternal).

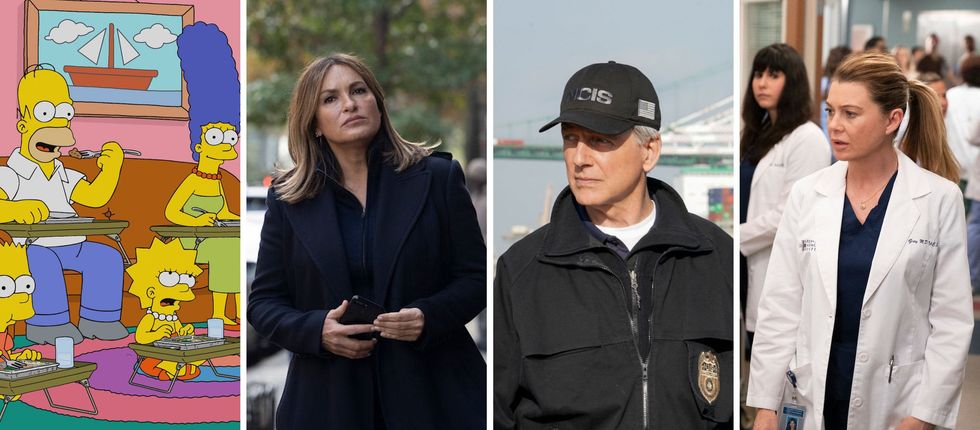

Note: "Longest-running," in this case, refers to the number of seasons a show has had, not the number of episodes. And for the sake of simplicity, we did not rank series that were rebooted after more than a decade off the air. Sorry, Murphy Brown and Will & Grace. (Photos via Fox + Peter Kramer/NBC + Cliff Lipson/CBS + ABC/Mitch Haaseth)

The Simpsons (1989 to present): With a whopping 30 seasons and 659 episodes at the time of writing, The Simpsons is the longest-running primetime scripted series not only currently on the air, but of all time. In April 2018, with its 636th episode, it surpassed CBS' Gunsmoke, which aired 635 episodes from 1955 to 1975, to take the title. (Photo via Fox)

Law & Order: SVU (1999 to present): The beloved Law & Order spinoff is the second-longest-running primetime scripted show currently on the air. With its season 21 renewal, it also takes the top spot as the longest-running primetime live-action series in TV history (measured by seasons). When season 20 ends, it will have aired more than 450 episodes. (Photo via Peter Kramer/NBC)

Family Guy (1999 to present): Of all the scripted primetime TV shows still on the air, Family Guy takes the third spot for longest-running — this, in spite of a short hiatus when Fox canceled the show in 2002, only to bring it back in 2005 due to blockbuster DVD sales. It was recently renewed for an 18th season. (Photo via Fox)

NCIS (2003 to present): What started as a JAG spinoff has taken on a long-running life of its own. With 16 (going on 17) seasons, the Naval Criminal Investigative Service team takes the spot as the second longest-running, scripted, non-animated, primetime TV series currently airing, and the seventh spot in overall TV history. (Photo via Cliff Lipson/CBS)

Grey's Anatomy (2005 to present): As the fifth longest-running primetime scripted series still on the air, Grey's also became the longest-running medical drama ever when it surpassed ER in episode count in February 2019. It's currently in its 15th season. (Photo via ABC/Mitch Haaseth)

American Dad! (2005 to present): Not unlike creator Seth McFarlane's other massive animated hit, Family Guy, American Dad! has persevered through network cancellation and reshuffling to become the sixth longest-running primetime scripted series still on the air. Its 256 episodes over 15 seasons just misses out on the top 10 overall. (Photo via TBS)

Criminal Minds (2005 to present): At the conclusion of its 14th season in early 2019, Criminal Minds had logged 314 episodes and earned its place as the seventh longest-running primetime scripted show still on the air. The show will take its final bow with its 15th and final season in 2019-2020, adding 10 more episodes to its all-time total. (Photo via Cliff Lipson/CBS)

Supernatural (2005 to present): With 305 episodes (and counting) over 14 seasons, Supernatural is right behind Criminal Minds on the list. And like Criminal Minds, the CW show will come to an end after its upcoming 15th season. (Photo via Diyah Pera/The CW)

The Big Bang Theory (2007 to present):The Big Bang Theory is the ninth longest-running primetime scripted show still on the air, and it claimed the title of the longest-running multi-camera sitcom in history earlier this year, when production wrapped on the 276th episode. (Cheers previously held the record with 275 episodes.) The hit CBS comedy will conclude after its current 12th season, with a series finale airing May 16. (Photo via Michael Yarish/CBS)

NCIS: Los Angeles (2009 to present): A successful spinoff of NCIS, this LA-based procedural has 10 seasons under its belt and is the 10th longest-running primetime scripted show still on the air. (Photo via Bill Inoshita/CBS)

Modern Family (2009 to present): Like several of the top-tier shows on this list, Modern Family — which currently sits as the 11th longest-running primetime scripted show still on the air — will take a bow after its 11th season, airing in 2019-2020. (Photo via ABC/Byron Cohen)

Hawaii Five-0 (2010 to present): The reboot of the classic 1970s series has run for nine seasons and more than 200 episodes, putting it at number 12 on the list of longest-running scripted primetime shows currently on the air. (Photo via

Blue Bloods (2010 to present): Blue Bloods joins several police procedurals on the list, coming in at number 13 on the list of longest-running primetime scripted shows still on the air. So far, the show has not been renewed for a 10th season, but if it comes back, it'll push the CBS drama into the impressive 200+ episodes arena. (Photo via Patrick Harbron/CBS)

Bob's Burgers (2011 to present): Although Bob's Burgers, at number 14, is a little further down the overall list of longest-running primetime scripted shows still on the air, it's actually the fourth longest-running animated series of the same designation. The show has been renewed for an upcoming 10th season — and may the Belchers live to see many more. (Photo via Fox)

Chicago Fire (2012 to present): Although a newer entry than many of the longer-running procedurals, Chicago Fire still has an impressive seven seasons and 155 episodes under its belt. The show was renewed for season 8 earlier this year, and will likely continue to keep some footing in the scripted primetime rankings. (Photo via Elizabeth Morris/NBC)

Arrow (2012 to present): The show that spearheaded the CW's Arrowverse will come to an end after its upcoming eighth season, but in its successful run, it became the 16th longest-running primetime scripted show still on the air. (Photo via Jack Rowand/The CW)