Make Your Dad a Bow Tie in Under 30 Minutes!

Summer is right around the corner. And you know what that means? Father’s Day is also around the corner. We’ve started to think about dear old Dad (and the dear young dads out there, too!), and we’ve got loads of gift ideas to share with you. Among them is a DIY that will make him feel extra special whether he’s a suit-wearing kind of guy, a loungewear guy, or maybe really into jean shorts.

Either way, we believe that Father’s Day is an occasion to get dressed up. And what better way to encourage Dad to get fancy than gifting him a hand-crafted bow tie? We’ve shown you how to make felt bows before, and even a collar bow tie for your pooch, so now we’re going to whip out the sewing machine and make a hand-stitched bow tie. Yeah, we’re sophisticated like that (and now Dad can be, too!).

<br/>

– fabric

– fabric

– iron-on interfacing

– paper

– chopstick or other small dowel

Tools:

– sewing scissors

– craft scissors

– pencil

– measuring tape

– pins

– sewing machine

Instructions:

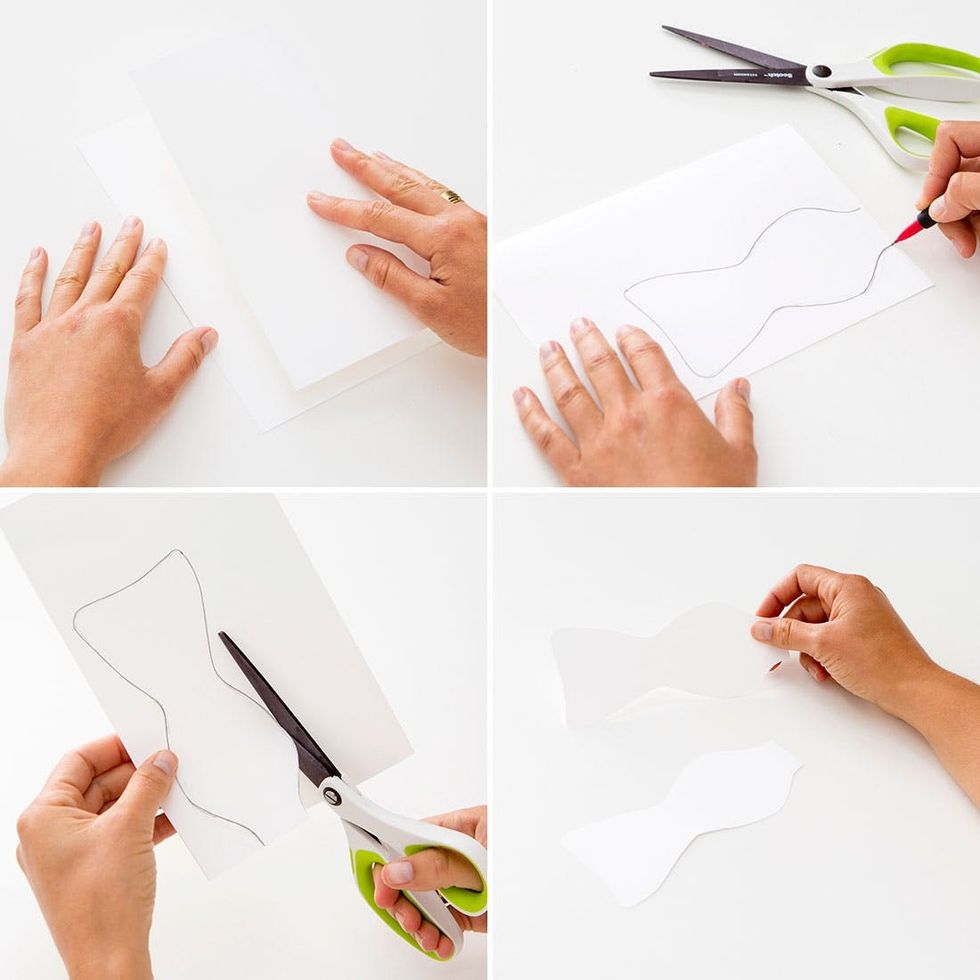

1. Fold your paper in half. Then, draw a paper bow tie. This should look like a mix between a bow tie and a fish with a square snout. We made ours about six inches long.

2. Cut out your drawing. You will have two identical paper bow ties.

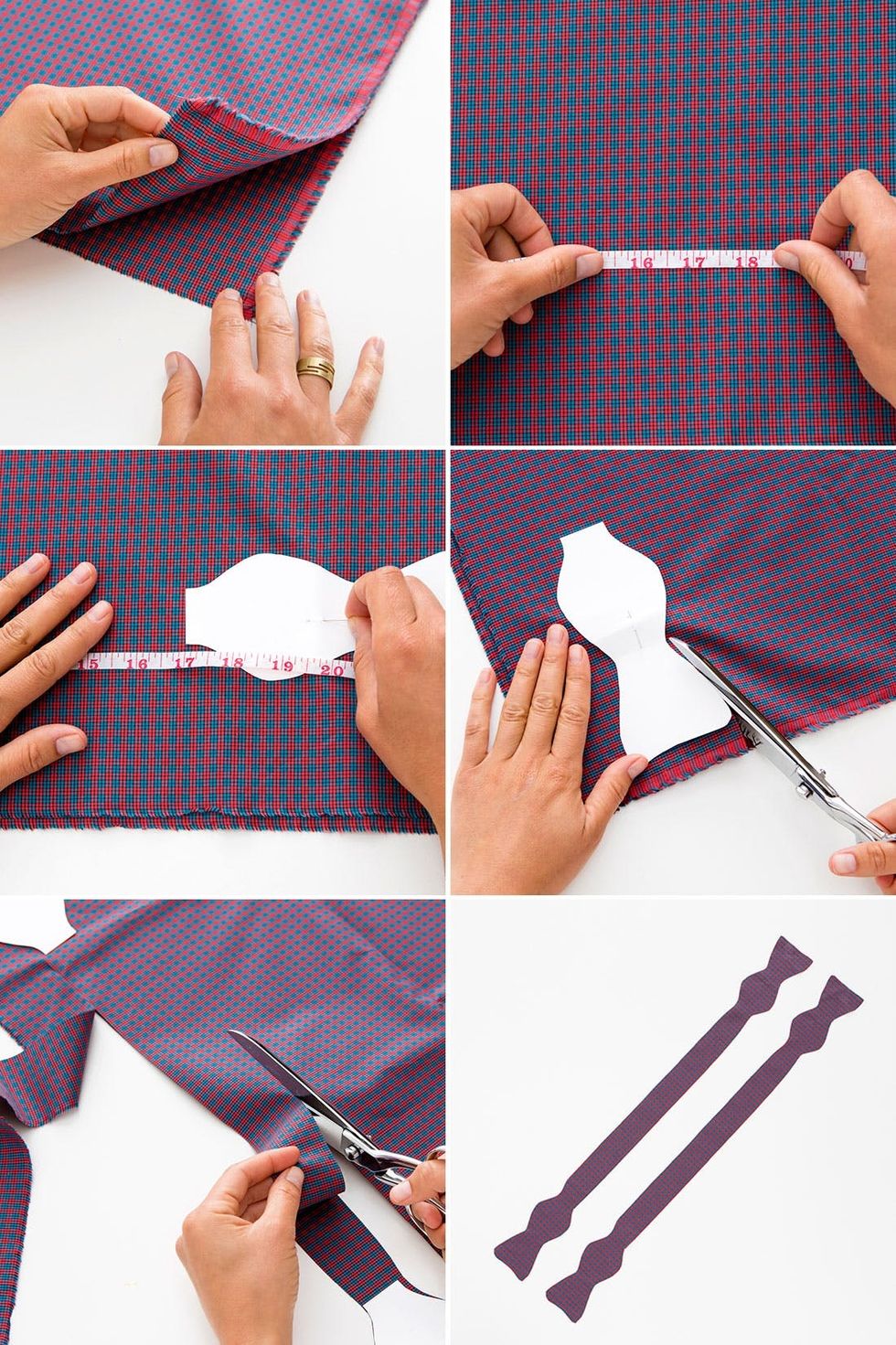

3. Fold your fabric in half and measure your dad’s neck size on the center of the fabric (this may require some sleuthing. We used 17 inches as our measurement). Be sure that there’s at least six inches of fabric on each end of your measurement. Mark both ends with pins.

4. At each end of your measurement (1 inch and 17 inches) pin your paper bow ties.

5. Cut the fabric around your paper bow ties and cut a strip between the two. Detach the paper bow ties after you finish cutting out your tie. You will have two very long identical bow ties.

6. Place one piece of your tie on top of the iron-on interfacing and trace around it. Cut out the iron-on interfacing, cutting slightly inside your line so that it is a little bit smaller than your fabric bow tie.

7. Iron the interfacing to one of your fabric bow ties. Be sure to iron it to the backside of the fabric.

8. Place the other fabric bow tie inside out on top of the one with the interfacing. Pin them together.

9. Starting in the middle of the bow tie, sew around the edges leaving a 2-3 inch opening.

10. Carefully turn the bow tie right side out using the chopstick or small dowel to push out the corners. Iron your now crinkly bow tie.

11. Sew the opening using your machine. The stitch will show but that’s okay because this is on the back side of the bow tie.

12. Watch our “How to Tie a Bow Tie” tutorial and you’re all set!

Start by folding your paper in half and then grab your pencil. You’re going to have to draw, which can be intimidating, but we know you can do it! Think about drawing a fish. It’s got a tail and an almond-shaped body. And this fish is going to have a funny little nose. Do fish even have noses? It’s more of a nose-mouth-beard-chin. A muzzle, if you will. Your fish (or paper bow tie we’ll call it) should be about six inches long. Cut out your paper bow tie. You should have two identical pieces.

Okay, here’s the hardest part of this tutorial. You need your dad’s neck size. We recommend creeping around in his closet or casually bringing up your newfound interest in the difference between a chimp and a human neck and measuring your dad’s neck in the name of science. It works every time. We’re willing to bet you should be safe with a measurement like 17 inches.

Fold your fabric in half and then measure your dad’s neck measurement on the fabric, leaving at least six inches on each end. Pin your paper bow ties to the ends of your measurement (there will be one pinned at 1 inch and one pinned at 17 inches). Cut around the paper bow ties and along the strip in between the two. Think of it like this — your two fish should be connected by a long piece of spaghetti, Lady and the Tramp style. Separate your fabric and you should have two identical bow ties.

Get out your iron-on interfacing and place one of the fabric bow ties on top. Trace around the edges and then cut slightly inside the line. Iron the interfacing to the backside of one of your fabric bow ties. This will help stiffen the bow tie.

Now place your other fabric bow tie on top of the one with the iron-on interfacing. Make sure both are facing inside out. Pin these together. Starting at the center of the bow tie (the middle of the spaghetti), sew around the bow tie leaving a 2-3 inch opening.

Turn your bow tie right side out using the chopstick or small dowel to encourage it through and poke out the edges. Get the iron out and press your bow tie. Close the opening using your sewing machine. The stitch will show but that’s okay because this part will be on the back of dad’s neck under the collar. That’s it! You’re done. All that’s left is to figure out how to tie one of these suckers. Good thing we’ve got a tutorial!

Not too shabby, Mike! Let’s hear it for our stand in Brit + Co. Dad!

So dapper! We love that you can tailor the look to your dad’s (probably awesome) style. It’s so much easier than choosing between boring patterns in a department store. Plus, we’re sure he’ll love anything made by his doting daughter and wear it proudly. Aww, Daaaad!

Happy Father’s Day to all, and to all a good bow tie!

What other DIYs are you making for your dad this Father’s Day? We’d love to hear your ideas!