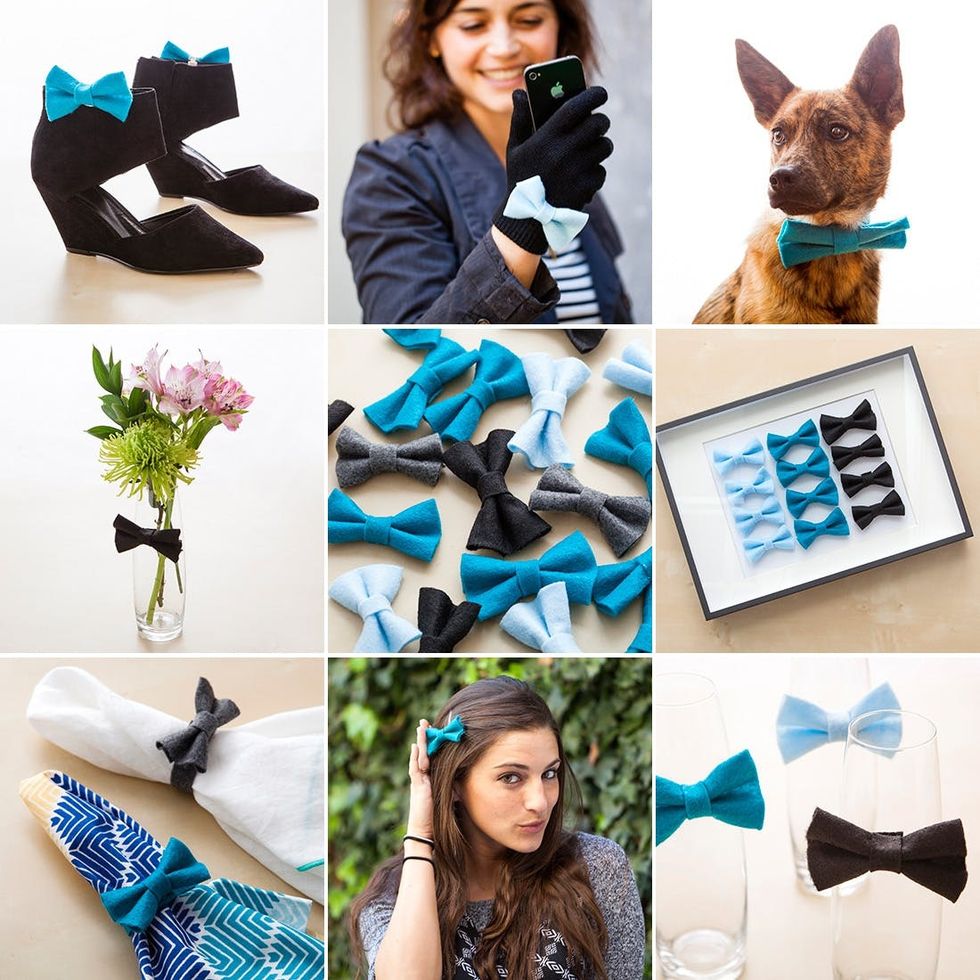

Put a Bow on It! 10 Ways to Use Felt Bows

Today we’re getting dapper with felt bow ties. These accessories don’t only belong around the neck of your hottie BF: there are so many ways you can deck out your house, your party and yourself with bows—check out these 10 adorable ways! From a dog bow tie to a shoe clip, we’re sure you’ll find at least one you love (though we’re partial to all 10!).

<br/>

– felt (use whatever colors you like!)

– felt (use whatever colors you like!)

– glue gun + glue

Tools:

– fabric scissors

Instructions:

1. Cut a rectangle out of your felt, about 3 inches by 2 inches to match our size—the width will be the length of the bow tie. Then cut a small strip of felt for the center of the bow.

2. Fold the short sides of the rectangle over so that they meet in the middle, then glue the ends in place.

3. With the folded side facing up, pinch the middle section of fabric inward to create a bow shape.

4. Glue the pinched fabric, then turn the bow over and glue the center.

5. Add a dollop of glue to the back and press one end of the small center strip to the bow. Wrap it around the bow and glue in place.

First, we’ll show you how to make a felt bow. Since it’s a DIY basic, it’s no biggie to make—you’ll see!

Fold it, pinch it, wrap it—and you’re done! We told you, it’s way easy to achieve maximum cuteness.

You definitely get in the groove—we couldn’t stop at just one! Luckily, there are so many ways to use ’em. Check out our 10 fave ways below!

For our first trick, we made hair clips. All you need for these hair accessories are classic clips you can probably find in your bathroom drawer. Place a drop of hot glue on the end of the clips and stick on your bow. Then, toss it up in your ‘do. Done and done.

Hair Clips

Next up, we made shoe clips. Remove the padding from the clip, add some glue and press your bow tie to the clip. Then, take your plain black pumps and spice them up with some removable flair.

Shoe Clips

What else have we got up our sleeve? Stir sticks. Get some plain wooden stir sticks and glue a bow on one end. This is such a simple way to class up your Oscars party! Gatsby would definitely approve.

Stir Sticks

Moving on to wall art. Isn’t it amazing how lots of little things can create beautiful art? For this one we got a shadowbox from Crate and Barrel and placed a dozen bow ties inside. Make sure you glue them to a piece of paper so that it is flexible enough to fit into the frame—you won’t be able to slide it in like you would a picture.

Wall Art

The weather outside still calls for gloves, so why not take a solid black pair and adorn them with cuteness? You can also learn how to make equally adorable rosettes with this tutorial!

Gloves

We love tricking out vases here at Brit + Co, so of course we embellished a few with bow ties. These would be great for a black tie party or even a wedding. Keep it classy like Ron Burgundy.

Vase

No party is complete without garland. For this one, you’ll need to make a bunch of bows. Place them face down on a table and spread them out evenly. Cut some string, add glue and then place the string on top. Just make sure you leave the same amount of space between each bow.

Garland

Put a bow tie on a clutch! We’ve done it before and we’ll do it again. It adds just the right amount of pizazz.

Clutch

Here’s one more dinner party idea: napkin rings. Cut a small strip of felt and glue it into a circle large enough to fit your napkin. Add the bow tie and then slide it onto your napkins. Cute? We think so.

Napkin Rings

Not only does your boyfriend look amazing in a bow tie, so does your dog friend. So finally, we made a bow tie adorned collar for our office pooches. Cut out a long strip of felt and add VELCRO® to each end. Add the bow with hot glue and you’ve got the dog collar equivalent of a tuxedo!

Pet Collar Bow Tie

That Porter is such a stud.

Then Turkey had to get in on the action. Bow tie success!