12 Essentials for a Romantic Dinner Date at Home

Everyone loves a dinner date with the one they love, but no one likes going out in the freezing cold, which presents a bit of a problem this time of year. However, there’s one oldie-but-goodie idea that solves your romantic dilemma: a dinner date at home! In order to make it date-night special, we’ve corralled 12 fun items to take your at-home date to the next level.

1. Copper-Wrapped Glasses ($56): This set of four copper-wrapped glasses adds just the right amount of sparkle to your beverages.

2. Cocktail Mixers ($27): From classic to spicy and tropical, these mixes can create a drink that pairs perfectly with any meal you cook up.

3. Heart Stirrers ($20): Speaking of cocktails and date nights, these drink stirrers were basically made for the night in question. These stirrers will keep your fancy creations tasting their best.

4. Sushi Kit ($20): If there ever was a reason to try making your own sushi, a date night at home is certainly it. With this kit, you’re only steps away from 48 pieces of sushi glory.

5. Pure Maple Syrup ($16): Breakfast for dinner is always a fun treat. If you’re going for banana pancakes or something equally as awesome, this maple syrup is the cherry on top of a unique dinner date for two.

6. Patterned Table Runner ($60): Add a little color to your table setting with this beautifully patterned table runner that features an eye-catching Mayan design.

7. Azul Dinner Napkin ($28): If you’re having a romantic night in, regular ol’ napkins simply won’t do. This elegantly designed napkin is printed on a fabric made of hemp and organic cotton.

8. BBQ Sauce ($8): Bring a bit of summer sunshine to your cozy night in with this hot and smoky sauce.

9. DIY Bitters Kit ($65): If cocktails are on the menu, take them to the next level with this DIY bitters kit.

10. Burrata and Mascarpone Kit ($25): If you plan to go all out and start dinner with an appetizer, cheese that you’ve made with your own two hands is simply the best way to do it. This kit contains everything you need to make eight entire batches of cheese. Did someone say leftovers?

11. Salted Chocolate Cookie Kit ($18): No dinner is complete without dessert. Chocolate chip cookies are the quintessential favorite of sweet tooths everywhere.

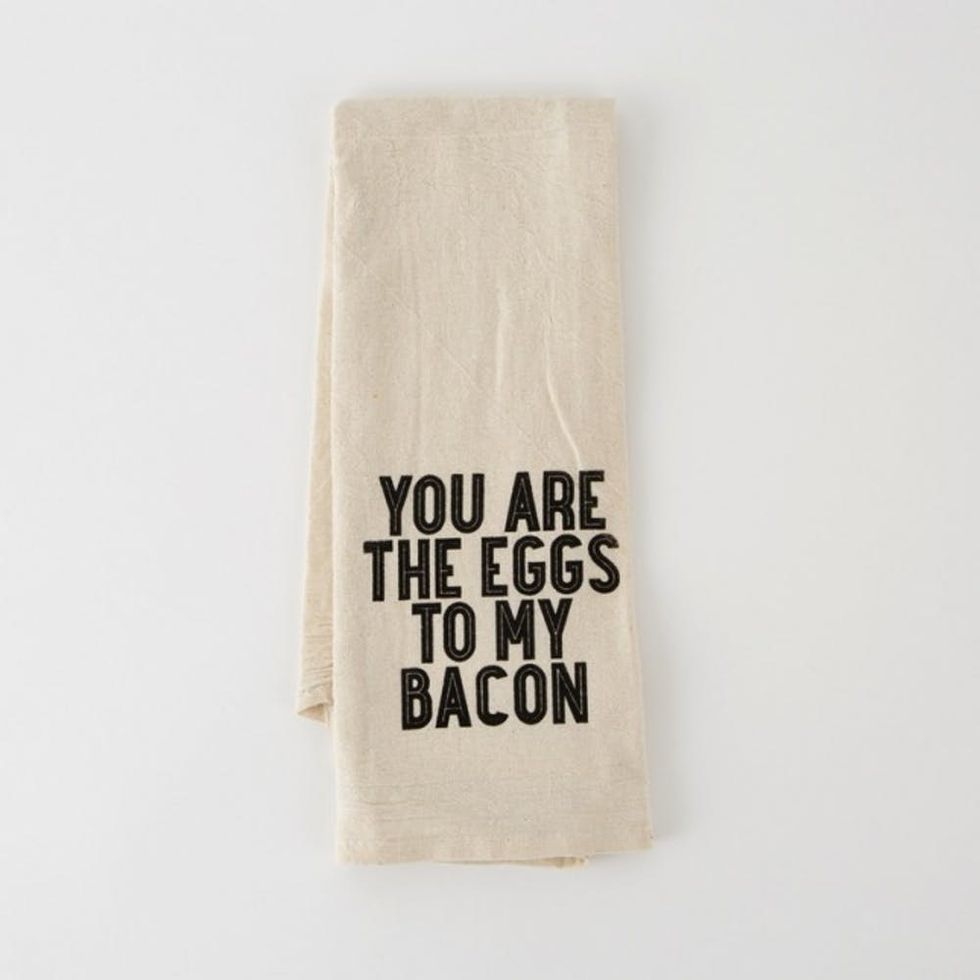

12. Eggs to My Bacon Towel ($24): At the end of it all, you’ve gotta do the dishes. This towel takes the date night romance all the way through to the end with one of the most adorable sayings.