27 Cheeky Letterpress Birthday Cards You’ll Love

In our opinion, one of the best parts about being a part of the maker community is that you get to see all kinds of neat things that other people create. We’ve always been amazed by letterpress printing, specifically letterpress printed cards. They’re simplistic, yet so witty and creative — making them fabulous additions to all gifts (they’re practically gifts in themselves)! With the start of the New Year, now’s a great time to stock up on birthday cards to give out throughout 2014. Here are 27 letterpress birthday cards that we found to be extremely clever.

1. Healthy Cake ($5): A perfect card for your friends who are constantly trying out every crazy diet that pops up. The tiny sentence at the bottom definitely makes this one of our favorites. (via Richie Designs)

2. Chic Birthday ($5): Didn’t you hear?! Getting older is in. (via Richie Designs)

3. Not So Happy ($5): Ha, this one makes us giggle. We’re loving the handwritten font as well! (via Life is Funny Press)

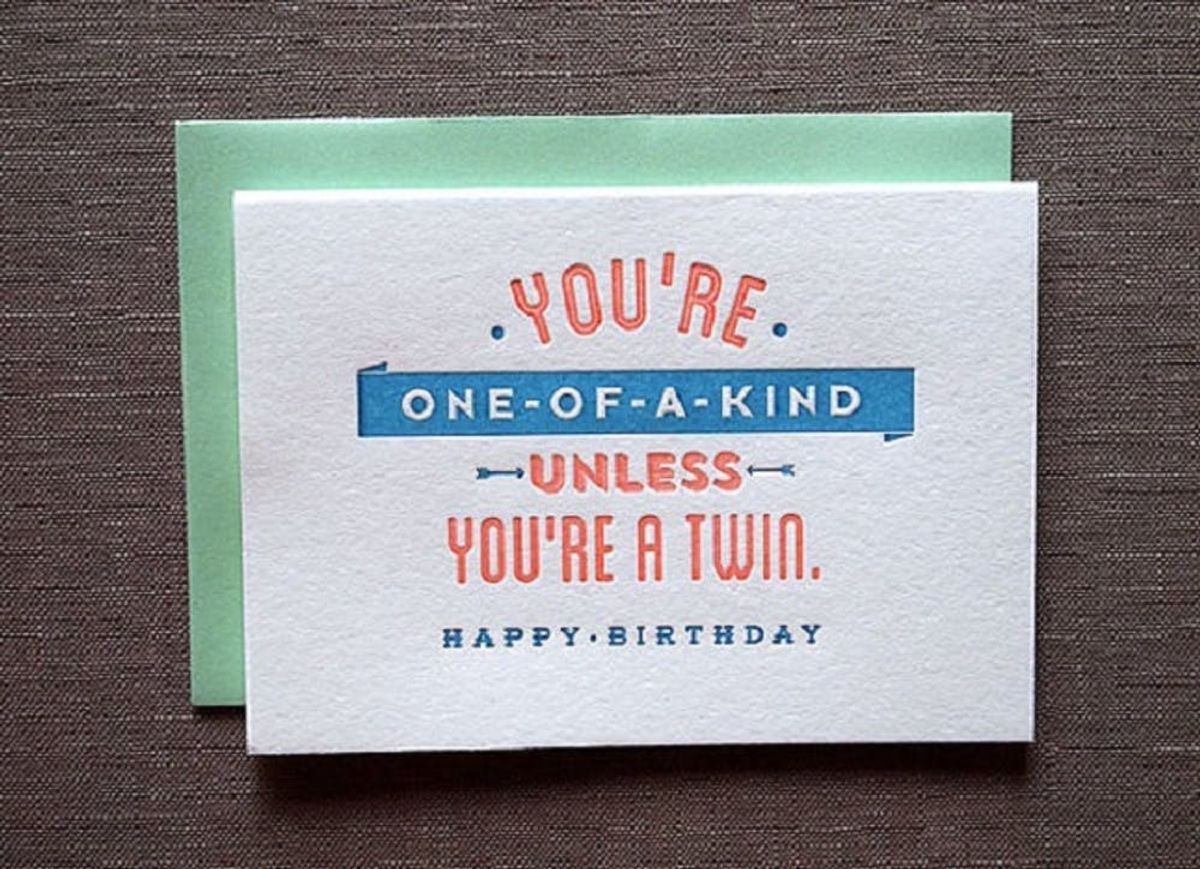

4. One-of-a-Kind ($5): We absolutely love the colors in this, but nothing tops the message. Whether or not you end up giving it to a twin, it’s hilarious! (via Farewell Paperie)

5. No Bad Dance Moves ($6): Very, very true. Time to bust out the Sprinkler, everyone! (via Farewell Paperie)

6. Bangin’ Birthday ($5): Everyone loves a pun. Plus, she created another one for your bearded friends! (via Made by Michelle Brusegaard)

7. View Master ($4): This card goes out to all our ‘ 80s and ’90s kids. Pairing this card with an actual View Master would definitely make it the best gift ever! (via Smudge Ink)

8. Barrel of Fun ($4): Wait, it’s a mini brain teaser and a birthday card in one? Even better. (via Smudge Ink)

9. Mr. Handsome ($6): This badge-shaped card was made just for your tough guy! (via HAMMERPRESS)

10. Forever 29 ($5): Me? Thirty?! There must be some mistake. (via Kiss and Punch)

11. Sad It’s Not Mine ($5): Let’s be real. The cake, the presents — we all wish it was always our birthday. (via Paper Bandit Press)

12. Your Actual Age ($5): Truthful? Yes. Hilarious? Of course! (via McBitterson’s)

13. Crapping Your Pants ($5): Oh, the circle of life (props if you thought of the Lion King). (via Brown Dog Paper)

14. Un-pho-gettable ($5): Puns are always welcome on any card that we purchase. Food-related ones get bonus points. (via Kiss and Punch)

15. Checklist ($1): This is perfect for you Forgetful Joneses who never seem to remember anyone’s special day each year. You can even use it for more than just a birthday! (via Quiet Tiger)

16. Classified ($5): We did what last night?! (via Bench Pressed)

17. Prescription for Fun ($5): Yes, getting older means taking more medications. But here’s a prescription you’ll actually want to receive! (via a. favorite design)

18. Age Meter ($5): I think I’m somewhere between awesome and perfection ;) How about you? (via a. favorite design)

19. Next Year ($5): Well, there’s something to look forward to! (via The Little Blue Chair)

20. Vintage ($4): Bringing the vintage trend into birthday cards? Yes, yes, yes! (via pixies & porcupines)

21. Error 404! ($5): Technological humor is the best humor ;) (via Sign Fail)

22. You’re Still Pretty ($5): Some pretty good consolation for the pretty but aging birthday gal (or guy)! (via McBitterson’s)

23. Older, Not Up ($5): A great card for all of your friends who are still kids at heart. (via MLK&toast)

24. Only if You’re Cheese ($4): More food-related humor? Check. (via SweetWater Letterpress)

25. A Long Time Ago ($5): We’re all about the simplicity and subtle insult of this card. (via MLK&toast)

26. Mad Lib ($6): Who doesn’t love a good ol’ Mad Lib every now and then? It’s both a game and good wishes in one. (via eva b paper goods)

27. Now Let’s Party ($5): Let’s cut to the chase — we all really came here to party! (via Typecase Industries)

Which card is your favorite? Drop us a line down below!