7 Expert Tips on Why and How to Use the Loverly Virtual Wedding Planner

In the ever-advancing world of wedding planning, people are turning to apps to help prepare for the big day. Not to say paper wedding planners aren’t great, but if you’ve always been more of the techie type, you should consider checking out The Loverly Virtual Wedding Planner™. We chatted with Loverly, who gave us the scoop on how best to make use of their wedding planner app. To check out their expert tips, read on and learn how you can plan the wedding you’ve always dreamed of!

1. Why should couples digitize their wedding planning?

Nowadays, everything is digitized, and wedding planning should be no different. You can ship a package, order ice cream or even set up a puppy play date from your phone, so you can certainly plan your big day from your phone too. Having an on-demand, personal wedding planner available through your phone makes it super easy to plan on the go and make the “I Do” to-dos work within your schedule. Whether you’re a bride fraught from finding a florist on your lunch break or a bridesmaid brainstorming bridal shower ideas on your commute home from work, your Loverly Wedding Concierge will be there to help — whenever, wherever you need it.

2. What features does The Loverly Virtual Wedding Planner™ include?

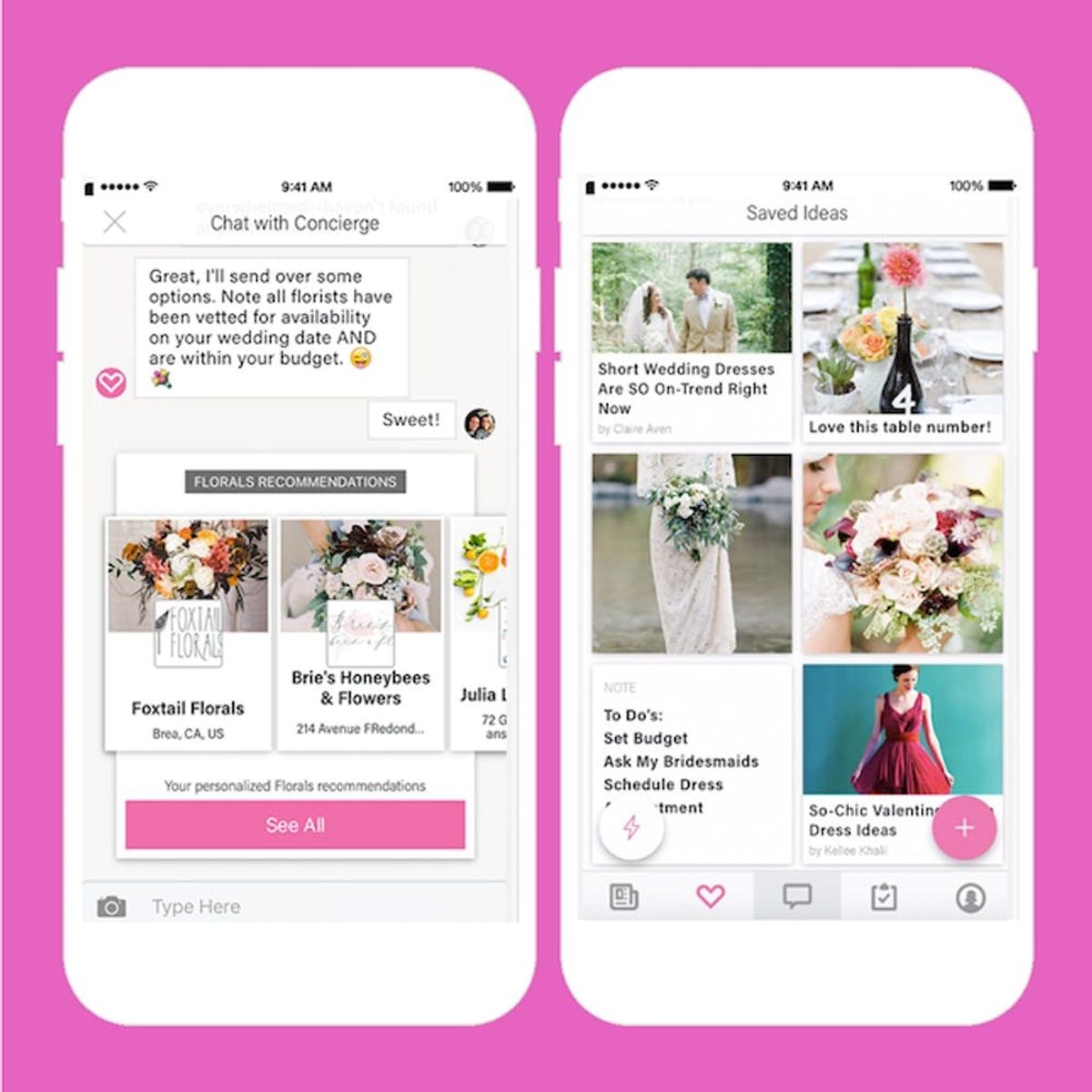

The Loverly Virtual Wedding Planner™ is basically a planner in your pocket. The biggest perk is our Virtual Planning feature, but couples who prefer not to activate this function can still use the app for its inspiration and discovery functionality. They can save inspiration “faves” from anywhere on the web and annotate them with notes of their own. Additionally, brides and grooms have access to a steady stream of Loverly wedding, style, etiquette, etc. content straight from the website, along with a helpful suite of tools and wedding planning checklists to track progress.

3. How can couples use the app to avoid overspending?

One of the hardest parts of wedding planning is making sure your dreams can match the reality of your budget — negotiating between what you want and what you have. So our app and Virtual Wedding Planning feature allow couples to chat live with an expert at Loverly HQ and dream up a big day that’s as magical as it is manageable. Chatting is a completely free option, available to all of our users, but we also offer three affordable flat-fee planning packages to help brides and grooms tackle some of the tough stuff (like finding vendors, setting up their wedding website and/or registry, strategizing their wedding day social media — i.e. creating their hashtag, etc.), and the packages start out as low as $49. Any and all recommendations that come from the Loverly Wedding Concierge are pre-vetted and budget-aligned to ensure the couple never has to experience “sticker shock.” It’s all part of our stress-free philosophy.

All of our wedding planning packages also come with budget planning tools so that couples can stay organized and feel comfortable prioritizing their big day details.

4. Can you explain the different kinds of planning packages and what kind of user would benefit most from each?

We’re currently offering three planning packages to fit our couples’ wedding planning needs — ranging from a la carte counsel to more hands-on help. Here is a snapshot of the packages, and what each includes.

A La Carte Package ($49): Best for our users who’ve secured a venue and have the majority of their vendors locked and loaded for the day (like their entertainment and photographer), but might need help tying up a few loose ends (finding a florist, researching bridesmaid dresses, finding an officiant, etc.).

— One vendor recommendation pack (florist, stationer, etc.) with five options

— Registry creation

— Chat support & expert advice

— Budget planning tool

— Exclusive promotions from our hand-selected partners

— Custom hashtag creation

— Snapchat wedding geofilter template

Signature Package ($399): Best for our users who may have just started planning their wedding and need help booking venue visits, setting up their wedding website or honing in on their greater wedding vision (color palette, theme, aesthetic cues) to help streamline their conversations with vendors.

— Unlimited vendor recommendations

— Curated style guide to match your vision

— Personalized budget sheet

— Registry creation and wedding website setup

— Custom Snapchat wedding geofilter

— Plus, all the perks of the A La Carte package

Custom: Best for our users who can use just a bit more help — choosing a custom package requires a consult first, to determine exactly what our Loverly Wedding Concierge can lend a hand with — but includes help beyond recommendations: booking/scheduling appointments with vendors, help reviewing vendor proposals, etc.

5. Does Loverly’s Virtual Planner provide customized recommendations?

Absolutely! At Loverly, we believe that a wedding should be perfectly you in every way. That means personalization is a priority for all of our recommendations. We have an extensive network of vendors across the US, from the Big Apple to Emerald City, and know their aesthetics exceptionally well. When our Loverly Wedding Concierges start chatting with a bride or groom through the app, they gather the “good stuff” in their first few exchanges to make sure their recommendations are totally tailored. They determine budget, of course, and then dig for all the defining characteristics of the couple’s relationship and what is most important to them for their wedding. As part of our Signature Package, our Concierges work out your wedding style and build a mood board (including color swatches, decor ideas, etc.) that brings your wedding story and tell-tale taste to life. So once we have the bridal blueprint mapped out and loved-up by our happy couple, we know exactly where to start with assembling their wedding day dream teams.

6. What is one feature that everyone should take advantage of?

Wedding planning is hardly a piece of cake, but the harsh reality is that only 16 percent of couples hire a pro for pre-wedding help — the big deterrent being price (even partial planning services can run $3,300, on average). With the Loverly Virtual Wedding Planner™, we’re bringing affordable planning help to the masses and doing so in a way that’s convenient, comfortable and oh-so-millennial — with chat support via their iPhone and help on demand. Gone are the days when couples need to leave work early or take time off to meet with vendors or planners. Our Concierges are ready to chat whenever works best for our brides, grooms, maids, moms, etc. Even if our users don’t want to purchase a package, they can still chat for free with a wedding expert and have all of their “I Do” q’s answered. For brides, our Concierges can offer advice when their S.O.’s or bridesmaid’s POV isn’t enough. For bridesmaids, our Concierge can serve as a non-squad someone to vent to when her friend, sister or cousin is having a bridezilla moment. All of the Concierge advice is relatable and nonjudgmental — something that Loverly has championed from the start.

7. How do we get started?

It’s super easy to get started! Just download the iPhone app and start chatting with your Virtual Wedding Planner to find the right wedding planning package for you!

Are you getting ready for your dream wedding? Tweet us @BritandCo and let us know how The Loverly Virtual Wedding Planner is helping you prep for your special day!