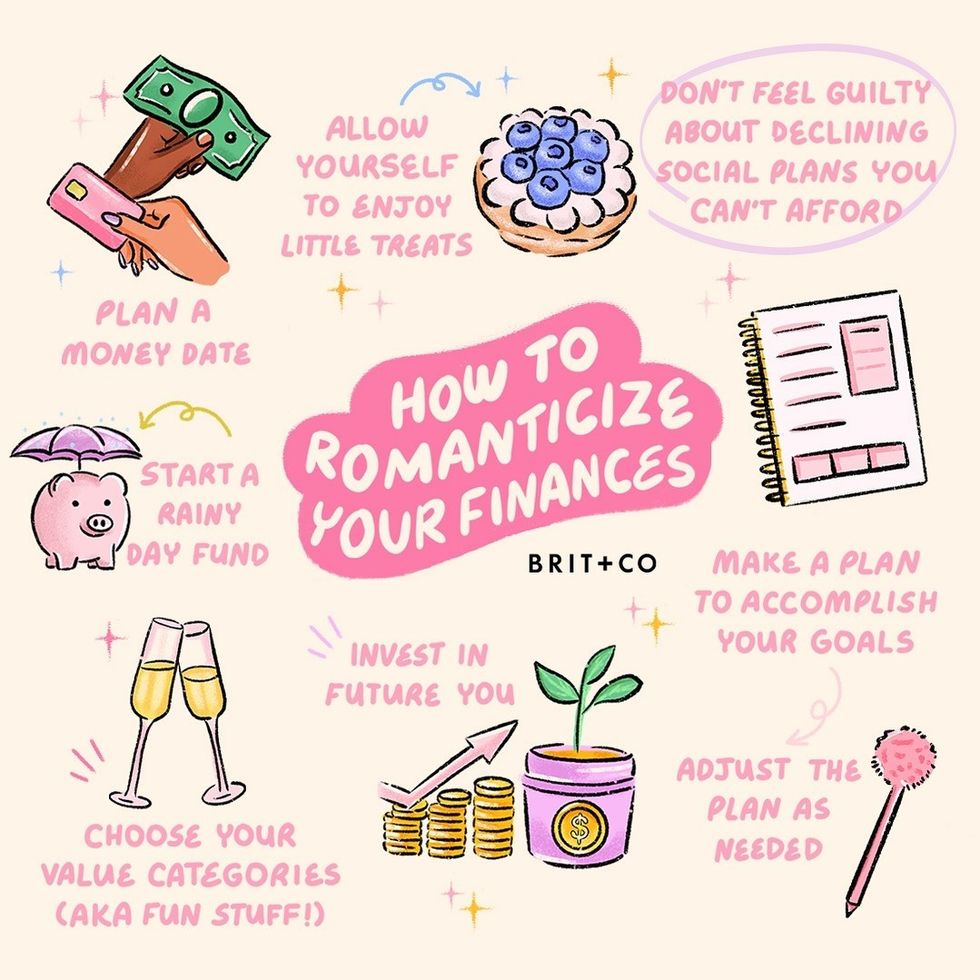

8 Tips To Romanticize Your Finances (And Grow Your Bank Account) From Tori Dunlap

Haley Sprankle is B+C's Content Editor, leading coverage across pop culture, beauty, style, home, and beyond. You can find her previous work at WIRED, Wirecutter, and VH1. Outside of work, she's probably drinking a dirty martini, walking her french bulldogs, or quoting School of Rock somewhere.

Talking finances feels like a lot, to put it most simply. So many factors beyond the literal nickles and dimes of money come into play when you're considering what comes next in your financial life — how your parents approached money, if your friends are always talking money, how much you make, the things you want for yourself. All of these add up faster than your savings account, often leaving you high and dry.

Tori Dunlap, the author of NYT bestseller Financial Feminist and the money expert behind Her First 100k, wants to take those notions and break them. Industry disruptors á la Dunlap are nothing new — and yet, everything Dunlap says is refreshed and real and nothing like what anyone else is saying in the finance world. She's not blaming avocado toast or your daily Starbucks for your lack of home ownership. She's not saying you can't go on vacation or dine out with your friends if you have a future savings goal in mind. She's not saying that you have to restrict, restrict, restricts in order to gain, gain, gain.

What Dunlap is saying? To romanticize your finances by making them an approachable focal point with attainable goals you can set for yourself. Financial advice isn't ever gonna be one-size-fits all — and TBH it shouldn't be, according to Dunlap — but these eight financial tips can help you start on a steady path towards actually meeting your money goals.

Photo by Ivan Samkov/PEXELS

Make A Plan To Accomplish Your Goals

Dunlap noted that most women are actually really good at saving money, but that we just don't know what it's for. Instead of saving to have some arbitrary number in an account, Dunlap suggests making clear goals for why you're putting that money away. You can do this for housing, you can do this for a big European trip, you can do this for a rainy day fund, you can do this for that Prada bag you're eyeing — whatever! But by putting a name to the goal — and emotionally attaching yourself to it — it gives it life and momentum.

Dunlap's biggest advice here is that you can have as many savings accounts at your banks as you'd like and name them to fit the goal they're aligned to. For example, if the European trip is your number one goal right now, you can open a savings account and call it "European Adventure 2026" so you know what it's for and when you need it by.

Photo by Karolina Grabowska/PEXELS

Adjust The Plan As Needed

In case you can't tell, Dunlap's approach to money is real-life minded. Your finances don't live in a bubble, unaffected by circumstance and the world around them, just because you set a goal. And while we'd like to not have bumps in the road, it happens!

Instead of letting a shift completely throw you off course, take a moment to sit with the old plan and find a way to adjust without tossing caution to the wind. For example, if you unfortunately lost your job and your European Adventure 2026 account was the most funded savings you have, maybe you want to reallocate that some (or all, depending on the circumstance) money to ensure all your financial necessities (bills, food, etc) are taken care of. That doesn't mean your European vacation dreams are gone for good, though — the timeline may shift, or your saving strategy may shift as you navigate your income situation.

Photo by Anna Nekrashevich/PEXELS

Start A Rainy Day Fund

Like I said, stuff happens. And while you should be able to adjust your financial plan to fit your current needs and circumstances if you need to, having a rainy day fund can help alleviate some of that stress.

What is a rainy day fund? This is a savings account that you pad for emergencies like flat tires, unexpected medical costs, and job losses. What isn't a rainy day fund? A pool of money for you to dip into when you've had a bad day and need a night out with the girls. (That fun funding comes later, I promise!)

Photo by Cora Pursley/Dupe

Allow Yourself To Enjoy Little Treats

See, I told you the more fun parts were coming! There's a whole chapter about spending in Financial Feminist, but for now we'll break it down simply for you: spending money is OKAY. While plenty of people have saved money with no-buy months, or other more restrictive measures to their spending, Dunlap doesn't see those practices as the sole way to increase your funds.

Photo by Leah Tackabery/Dupe

Choose Your Value Categories (AKA Fun Stuff!)

Instead of not buying anything, Dunlap suggests setting three "value categories," AKA finding what gives you "the most joy" when you spend money. "For anyone at home, you can literally figure out, 'What are the three places I want to spend the majority of my discretionary money?' and then making sure your money's actually going to those places," she said.

Her value categories at the moment? Travel, food out, and plants. Once those categories are set, obviously you can (and likely will) spend outside of them, but you want to ensure you're not frivolously spending in every category all the time. Invest your money where you find value, and cut back a bit on the rest.

Photo by LB/Dupe

Don't Feel Guilty Declining Social Plans You Can't Afford

Listen, we're all out and about these days, especially when the warmer weather creeps in and the Aperol Spritz comes out. However, giving your value categories, it's likely that you can't do everything all of the time. Instead of stretching yourself thin financially or letting FOMO take over your life, just tell your friends that you're gonna sit this one out. In doing so, you're increasing your chances of being able to attend future plans with your pals because you've worked towards your goals the way you intended to.

Photo by MART PRODUCTION/PEXELS

Invest In Future You

Aside from saving for your more tangible goals — a house, a vacation, a bag, etc — Dunlap highly recommends saving for the more nebulous "future you." Basically, Dunlap wants you to retire and approach old age comfortably with financial security. But sometimes that's hard! We've already said that goals need emotional attachment or even visualization to make them stick. How can you picture what old you wants and needs when you can barely decide what you want and need in the coming weeks?

Well, Dunlap visualizes that goal, too! She pictures the little old lady version of herself that has all her needs — AND WANTS — taken care of because of the way she handled her money early on. In doing so, Dunlap's able to make savvy financial choices to amass money right now for much later.

The best way she suggests doing so? "You can't just save for your own retirement — you have to invest," Dunlap said. These investments can come in the form of your job's 401k, or it can be through your own investment portfolio. Each has their many advantages, whether that be a percentage match at work (you put in 3% of your annual salary and they match that) or having a diversified portfolio full of some of the best companies on the stock market right now.

The two things she wants you to do in regards to both investments?

- Actually go into your 401k account and set it up properly once you have it instead of letting it sit untouched.

- Don't try to be a "day trader" and switch up your stocks based on the whims of the market.

Photo by Emilie Faraut/Dupe

Plan A Money Date

This is a time for you (and your partner, depending on the situation) to sit down with your finances regularly. It could be once a week, once a month, once a quarter — whatever works best for you to keep it consistent. Dunlap suggests this to go hand-in-hand with the plan you set for yourself at the beginning of your financial journey.

A money date can look however you want it to as well. You could hold it at home over coffee with your spouse, or you could belly up to the bar with your favorite cab sauv and your laptop. The most important thing is to actually check in with your goals, follow your spending habits, and make sure you're on the right financial track overall.

Be sure to follow the conversation with Tori Dunlap on Instagram!

For even more financial advice, check out Financial Feminist and sign up for our weekly email newsletter!

Brit + Co may at times use affiliate links to promote products sold by others, but always offers genuine editorial recommendations.

Header image via Getty

Haley Sprankle is B+C's Content Editor, leading coverage across pop culture, beauty, style, home, and beyond. You can find her previous work at WIRED, Wirecutter, and VH1. Outside of work, she's probably drinking a dirty martini, walking her french bulldogs, or quoting School of Rock somewhere.