Say Cheese! 9 Recipes to Kick Up Your Queso

We have been selected by ConAgra Foods to be spokespeople for Velveeta and Ro*tel. While we have been compensated for our time, our opinions are our own.

Having three native Texans on staff here at Brit + Co., we have a special place in our hearts for queso. And to be clear, not just any queso. The only real queso out there is made using just two ingredients: Velveeta and Ro*tel. Don’t be fooled by any impersonators! That’s why when Velveeta and Ro*tel reached out to us to kick up the traditional queso recipe, we jumped right on board.

Now as much as we love the classic, we can’t help but get creative with our recipes sometimes. So without further ado, here are three new ways to add a little kick to your queso, plus six of our favorite queso recipes from around the web.

Basic Queso: We’ll start things off with a basic recipe, so you know what the traditional version looks like.

Ingredients:

– 1 16 oz. package Velveeta

– 1 12 oz. can Ro*tel

Chop Velveeta into half-inch cubes and place into a crockpot turned to high. Add Ro*tel and heat until smooth and creamy, stirring every 15 minutes. (Tip: No crockpot? No problem. You can hack this recipe using the microwave. Just heat Velveeta on high for 2 minutes, stir, then heat for an additional 30 seconds before stirring again. Repeat this 30-second process until your cheese is fully melted. Just be sure not to burn it!)

Cilantro Lime Queso: Next up, a version that would go perfectly with a margarita on the rocks. Who can resist that?

Ingredients:

– 1 16 oz. package Velveeta

– 1 12 oz. can Ro*tel

– 4 ounces cream cheese

– 1 handful cilantro

– ¼ cup green onions, chopped

– ½ jalapeno, seeded and chopped

– Zest of one lime

Follow the recipe for basic queso and stir in cream cheese, heating as necessary until melted. In a small food processor, blend together cilantro, green onions, jalapeno, and zest from one lime. Add cilantro pesto to queso, stirring until combined. Serve with a dollop of cilantro pesto on top.

Chipotle Bacon Queso: How can we leave bacon out of the mix? That would be very un-Brit + Co. of us, wouldn’t it? Pro tip: this queso brings all the boys to the yard :)

Ingredients:

– 1 16 oz. package Velveeta

– 1 12 oz. can Ro*tel

– ½ cup bacon, chopped

– 1 can (7 oz.) chipotle peppers in adobo sauce

Follow the recipe for basic queso. In a small pan, cook bacon until crispy. Separately, open the can of chipotle peppers and remove the seeds from each pepper. Finely chop and add to queso with bacon, stirring until combined. Serve topped with chopped chipotles and bacon.

Cajun Crawfish Queso: This gumbo-inspired recipe packs a serious punch. Bookmark this one for Mardi Gras, or any occasion when you’re feeling extra saucy.

Ingredients:

– 1 16 oz. package Velveeta

– 1 12 oz. can Ro*tel

– 4 ounces cream cheese

– ½ green bell pepper, chopped

– ¼ cup green onions, chopped

– 1 cup crawfish tails or frozen langoustines (found at Trader Joe’s), thawed

– ½ teaspoon Tony Chachere’s or other cajun seasoning

Follow the recipe for basic queso and stir in cream cheese, heating as necessary until melted. In a small pan, cook green bell pepper for 5 minutes, or until softened. Add green onions and crawfish tails and cook for 3-4 minutes, or until cooked through. Toss with cajun seasoning and then stir into queso. Serve with some of the cooked cajun mixture sprinkled on top.

So beyond creating our own new recipes for queso, we love scouring the web for new ideas. Here are six of our favorites from around the web.

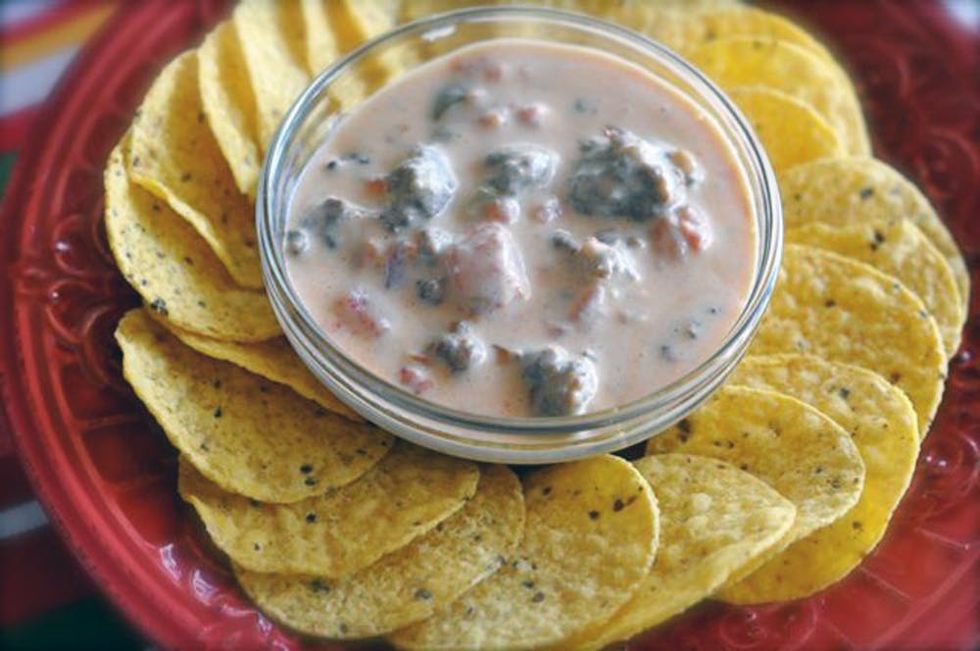

1. Creamy Sausage Queso Dip: For a little more heft in your queso, protein it up by adding sausage. We also love the addition of cream cheese and sour cream in this one, creating more of a creamy taste overall. (via CopyKat)

2. Spinach Queso Dip: We love us a good spinach dip, so why should the queso department be any exception? The genius move? They used frozen spinach artichoke dip to make for a ridiculously delicious mix. (via Plain Chicken)

3. Very Creamy Cheese Dip: Cream of mushroom soup turns this ridiculously creamy dip all the way to 11. (via Yummly)

4. King Ranch Chicken Mac ‘n Cheese: After all, Velveeta did earn its fame from being a go-to comfort food classic in the form of mac ‘n cheese. This recipe combines two of our faces, and adds a little chicken in for good measure. (via Stirring the Pot)

5. Velveeta and Rotel Baked Chicken Pasta: This scrumptious number incorporates panko bread crumbs, lots of fresh veggies, and good ol’ Ro*Tel and Velveeta. We’re in, if only for that crusty cheesy topping! (via A Southern Fairytale)

6. Velveeta Chicken Spaghetti: Apparently, Velveeta and chicken go together like peas and carrots. We love all the fresh ingredients in the mix of this one. (via Cully’s Kitchen)

We have been selected by ConAgra Foods to be spokespeople for Velveeta and Ro*tel. While we have been compensated for our time, our opinions are our own.

Have you ever made queso? Got any homespun recipes we should try out? Talk to us in the comments below.