Pin This! 11 Beautiful DIY Bulletin Boards

You may have spent the summer enthusiastically pinning ideas to make your life more functional but the season is ending and your home is still sadly in need of a refresh. Just in time for school to go back in session, we've rounded up some fun — and functional — ideas to turn any cluttered area into a command center, provide a catch-all for papers that you need to keep handy or to simply cultivate your creativity. Just below, 11 perfect IRL pinboard ideas. Forget Pinterest. These pretty pinboards will make all your real-life pinning better.

1. DIY State-Shaped Memo Boards: Show off your state pride and conquer clutter at the same time? These cute memo boards are a no-brainer. (via Brit + Co)

2. Color Block Mood Board: Color-blocking is still seriously stylish, whether we’re talking about a tank dress or a bulletin board. All your most cherished mementos and inspiration pieces just found a beautiful place to call home. (via A Beautiful Mess)

3. Tufted Bulletin Board: Gray textured fabric and silver upholstery buttons transform an ordinary cork board into a perfectly polished place to keep your goodies organized. (via Thistlewood Farm)

4. Travel Map Bulletin Board: We may be living in the age of Google Maps and mobile phones but even in a digital age, the most meaningful way to keep track of all your road trips might be a bit old-fashioned. Display this travel map board in your home as a proud memento of your travels and enjoy bragging rights every time a guest points out the curio. (via Lil Blue Boo)

5. Colorful Crafting Board: Give your crafting area a colorful, functional focal point. This version is tricked out with handy utensil holders and even a couple clipboards to hang up your latest inspiration pieces. (via Love Print Studio)

6. Metal Mesh Pinboard: Focusing on your studies/grown-up things is a cinch when your desk area is clean and free of clutter. This metal mesh pinboard lends a cool architectural feel to any space. (via Catview)

7. IKEA Placemats to Oversize Striped Framed Cork Board: Give yourself a beautiful home office that reflects your style and promotes dreaming. A striped cork board is a creative backdrop and catchall for bits of inspiration that you collect over time. This one is crafted from cork place mats and a bit of white paint. (via Infarrantly Creative)

8. Real Life Pinterest Board: Take a good look. This pinboard is made from some unexpected items: clipboards! Now you can cleverly clip every inspiring visual piece you discover to create your own real-life Pinterest boards. (via Brit + Co)

9. DIY Bulletin & Dry Erase Board: Want a better bulletin board? Welcome to a two-in-one solution. This clever version was crafted from the end of an old baby bed. (via Houseologie)

10. Geometric Wall Art Board: We love this combo of colors, lines and geometry. (via Brit + Co)

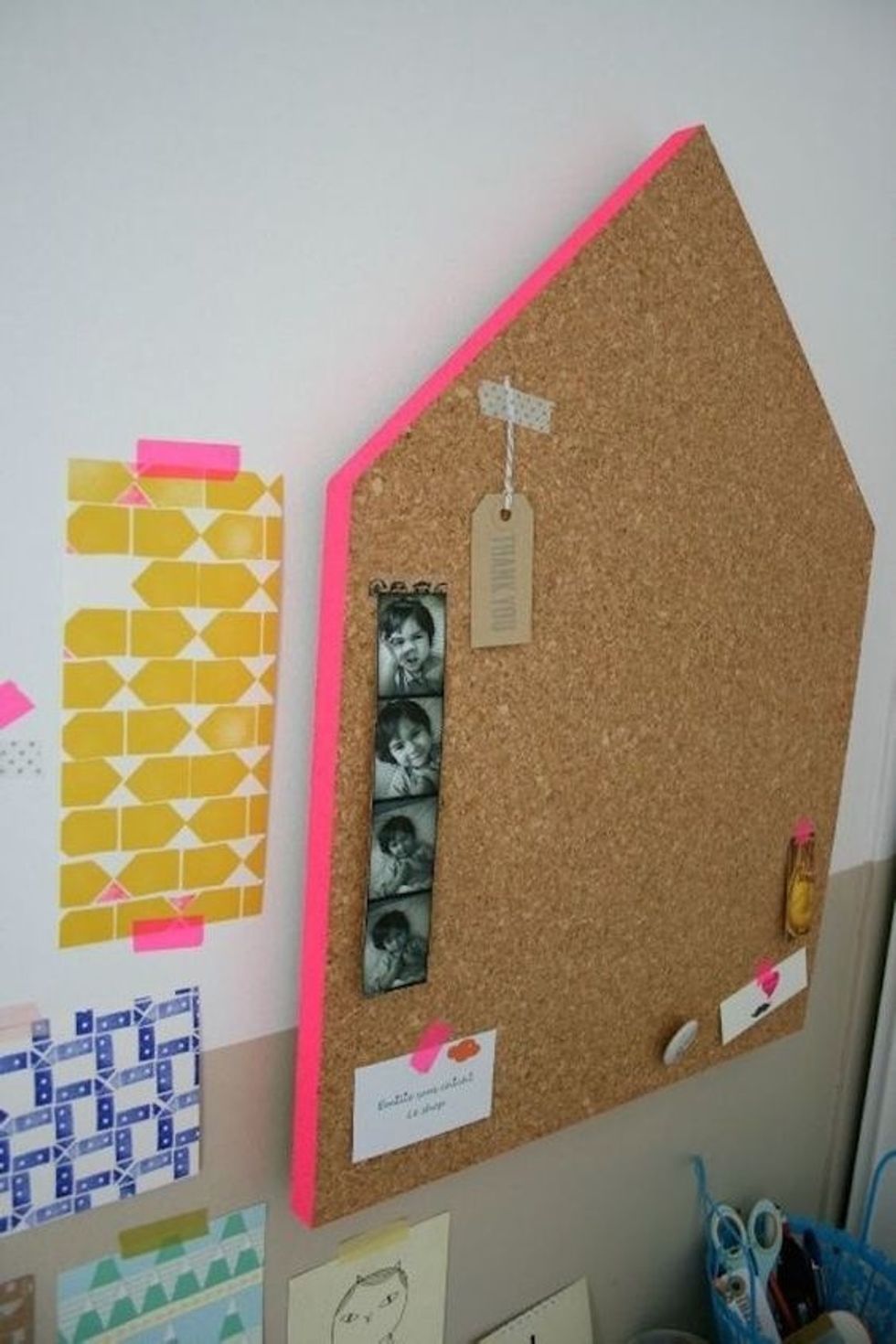

11. DIY Message Board: This simple upgrade is sure to make your message board a lot more sleek. Then sit back and admire just how clever you are with a paintbrush. (via Emilie sans Chichi)

Follow us on Pinterest for more DIY inspo!

This article has been updated from a previous post.