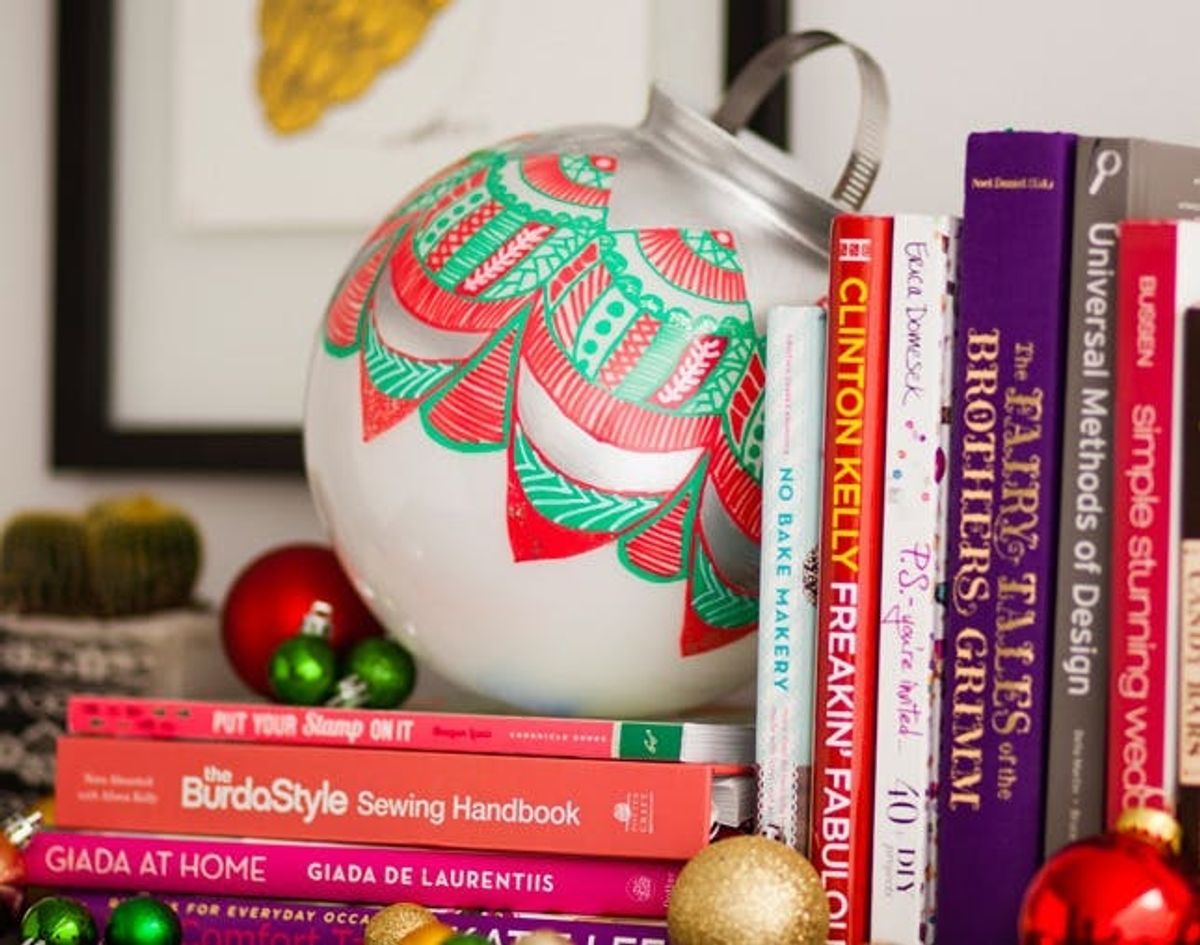

The Biggest DIY Ornament You’ll Ever Make

Looking for an unconventional take on holiday decor this year? Why not take the phrase “go big or go home” more literally? We teamed up with The Home Depot ® to transform a glass light cover into a giant pattern-covered ornament, fit to adorn your mantel, bookshelf, or entryway table. While it’s definitely too heavy to hang on your tree, it’s a fun way to add a bit of holiday charm to another spot in your home. Follow the tutorial below to see how we made ours.

– 1 DecoColor red fine point paint marker

– 1 DecoColor green fine point paint marker

– 1 DecoColor white fine point paint marker

– 1 bottle Martha Stewart Antique Silver Glitter Paint

Tools:

– 1 roll painter’s tape

– 1 hot glue gun

– glue sticks

You could mix up the colors however you like, but we went with traditional silver, white, red, and green.

First, cut off several strips of tape and use your tape roll as a stand for your globe.

Be sure that you use scissors to cut off your tape pieces, at around 3 inches long. Press two pieces of tape together to create a 90 degree corner. Attach to your globe to create an ornament topper design at the top of your piece.

Here’s what a fully taped globe should look like!

Now, to make that topper. Fill in the taped off zone with silver paint using a silver paint marker. We found that paint marked worked way better than regular acrylic paint, and you only need one coat. Let dry for 20 minutes and then peel your tape off.

Onto the pattern portion of this tutorial. You can practice patterns on a piece of paper to make sure you come up with something you like. When broken down, our entire pattern was made of half circles and lines.

Keep going as far down your ornament as you like. We wanted to leave the bottom portion plain — sometimes negative space is essential.

Use your white paint paint to add details to your globe.

And for a little more bling, use silver glitter paint to sparkle up bits and pieces of your globe. We found that the glitter paint shows up best on red or green blocks of color, and doesn’t really do much to the white or silver sections. Use the back end of your paint brush to add bits of glitter to the smaller sections of your pattern.

Now for the finishing touch, your ornament hook! The most important thing to know about his hook is that it is PURELY decorative. The hot glue and hose clamp will not stay attached to your globe if you try to lift it up by the hook. So please don’t try!

Take the hose clamp apart, squeeze some hot glue on the inside edge of your globe, and attach the hose clamp. That’s it!

How cute is that?!

It’s beginning to look a lot like Christmas… ;)