17 Crazy AF Statement Coats You Might Actually Wear IRL

Drastic temperatures call for drastic measures, especially when it comes to bundling up in the dead of winter. With cozy teddy coats and wow-worthy puffer jackets leading the pack, you’ve got plenty of options. Keep scrolling for 17 crazy AF winter coats we wish we had the guts to wear. Beyond providing the utmost warmth on the first mulled cider days of the season, they’re sure to command attention from afar.

1. Mira Mikati Nowhere Rainbow Puffer Jacket ($650): Walking on sunshine, TYVM.

2. Kurt Lyle Veronique Double Breasted Coat in Winning Roses ($396): Rock this eclectic rose-embroidered coat with striped trousers, socks, and mermaid hair en route to your 8am. Be forewarned: A DGAF ‘tude will follow.

Glamorous Mustard Teddy Fur Coat

We don’t typically like to play favorites, but this textured mustard coat with Big Bird undertones is simply too groovy to pass up.

We don’t typically like to play favorites, but this textured mustard coat with Big Bird undertones is simply too groovy to pass up.

4. Missguided Animal Print Padded Jacket ($111): Do RiRi proud with this animal-printed jacket that would look pretty dope with a Supreme logo sweatshirt and Moon Boots.

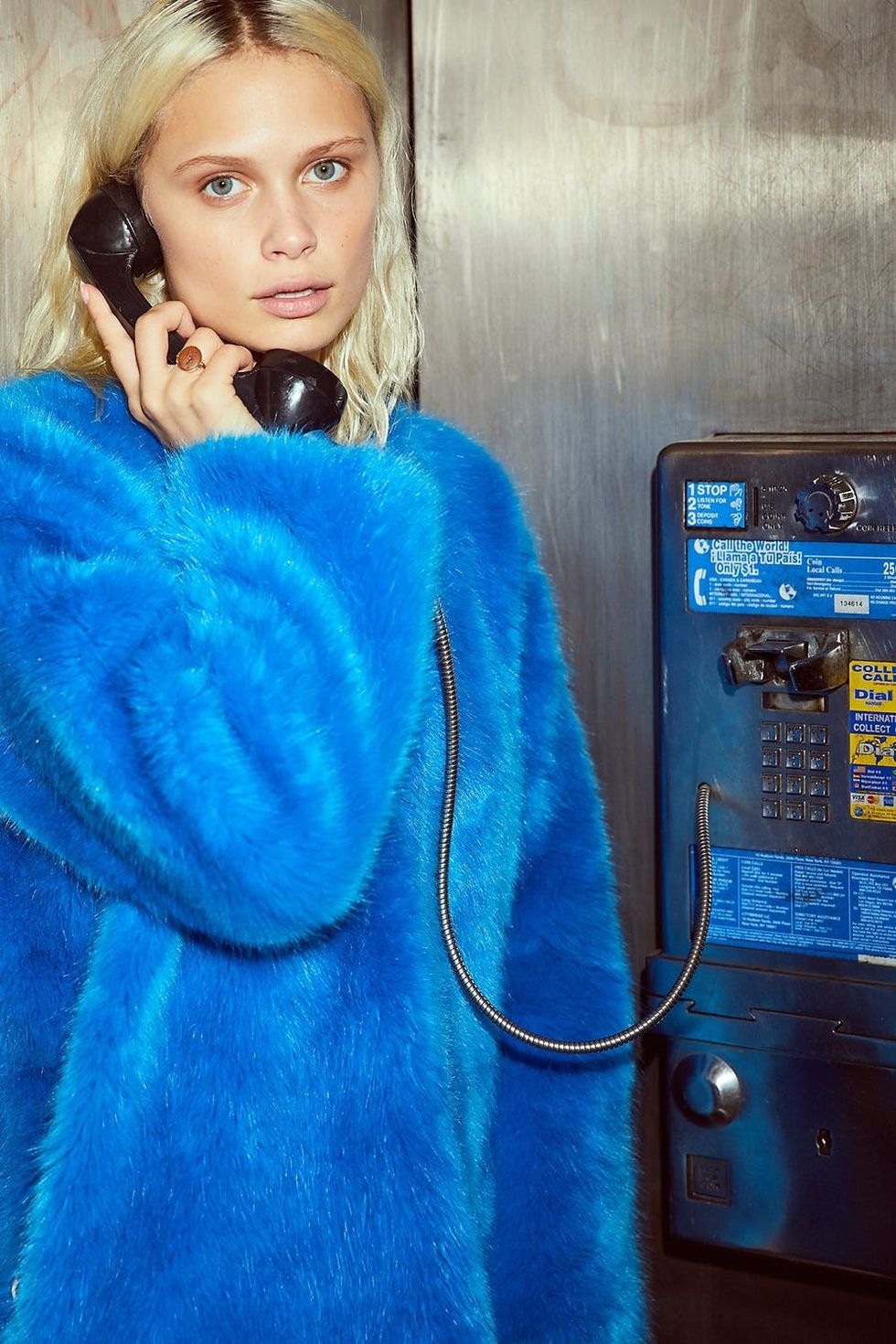

Jakke Tammy Banana Floral ’70s Style Faux Fur Coat

Single digit temps? That’s bananas. Layer up (and slay away) this winter with a faux fur topper that’s made for the zany set.

Single digit temps? That’s bananas. Layer up (and slay away) this winter with a faux fur topper that’s made for the zany set.

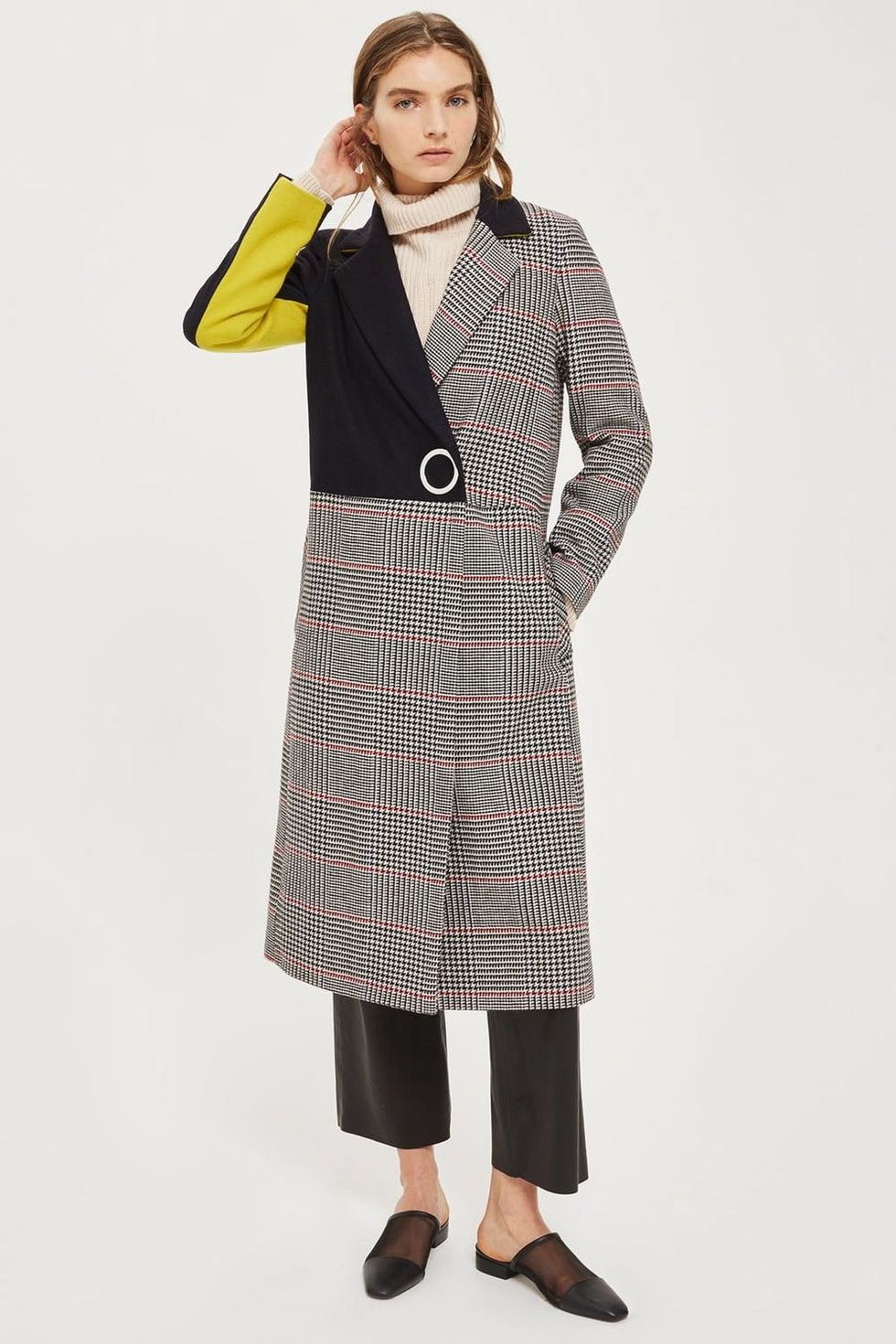

6. Topshop Checked Colour Block Coat ($210): Your run-of-the-mill glen plaid overcoat gets a contemporary update thanks to chartreuse color-blocked sleeves and a super mod silo. Werk it with a pair of Chanel lookalike glitter boots (you know the ones) for around-the-clock domination.

7. Mother Intarsia Long Boxy Jacket ($375): Rah-rah-rah, we’ve got team spirit! Score big with this fuzzy wuzzy varsity-inspired jacket that’s guaranteed to look something fierce with a slinky slip dress.

8. Civil Clothing Division Bomber ($130): It’s your civic duty to bring your A+ game on the streets, starting with a patch-covered camouflage bomber and heavy-duty stompers.

9. Mango Faux Fur Coat ($130): File this textured violet coat under what to wear when meeting your S.O’s parents for the first time. JK.

10. Zara Sequinned Coat ($119): With this shimmery sequined coat in your arsenal, you’re just one sparkly headband away from being ready for a Gatsby-themed fête or masquerade ball.

Urban Renewal Recycled Faux Fur Trimmed Denim Jacket

does exist for all your after-hours shenanigans.

does exist for all your after-hours shenanigans.

12. Opening Ceremony Re-Editions OC x Pendleton Flare Coat ($695): Come the first polar vortex, this Pendleton flared coat with Native American influence will be in heavy rotation alongside a toboggan hat and shearling mittens.

13. ASOS Statement Metallic Sleeveless Puffer Jacket ($79): You toasty marshmallow, you. This metallic pink puffer vest will have you channeling Zenon upon first wear.

14. Unreal Fur Reflections Jacket in Vintage Jacquard ($359): Old Man Winter, look what you made us do! Couple this fab vintage topper with a star-printed wrap dress and a gingerbread martini in hand for a hint of glam.

15. STAUD Corrine Coat ($525): STAUD’s got you covered with a majestic blue velvet robe-style coat that will accompany you from the bedroom to the boardroom (just add backless mules and a pajama-esque blouse for the latter).

Manish Arora Space Sequined Bomber Jacket

Spread the celestial magic with this rad space-themed bomber that will have you seeing stars for days.

Spread the celestial magic with this rad space-themed bomber that will have you seeing stars for days.