On Demand Beauty Pros at Your Front Door: There’s An App For That

This is the scenario. You’ll leave the office at 5pm, run to the makeup counter, then make a stop at the blowout bar before going home to leisurely get ready for the big gala. In reality, your meeting runs long, your shade of lipstick is out of stock, and you totally miss your blowout appoint. So rather than going glam in a big way, you pull a comb through your hair, resort to a top bun, and do your makeup while on a bumpy taxi ride to the party. You know what the best stress reliever is in a situation like this? It’s Vensette.

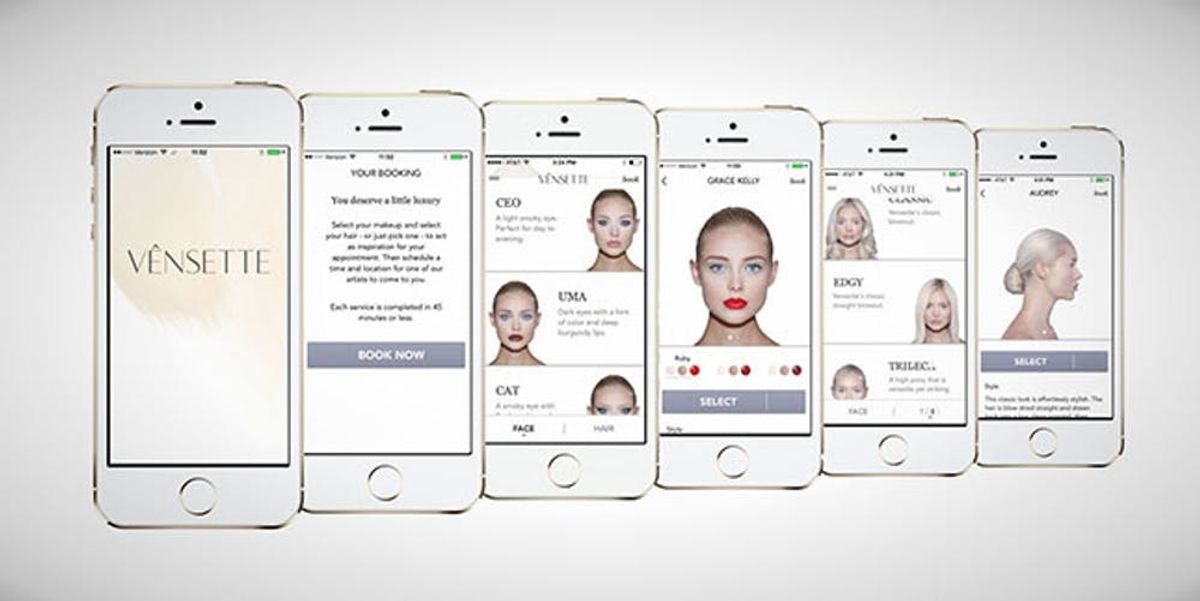

Celeb-status hair and makeup is literally an iPhone tap away thanks to a beauty app created by founder, CEO, and fashionable New York socialite, Lauren Remington Platt. Her members-only service deploys hair stylists and makeup artist, where you want them, when you want them, and for whatever occasion, whether you’re hitting a black-tie wedding or just meeting an old flame for a casual lunch that you want to look casually hot for.

Here’s how it works. Download the app. Pick your time and location, be it your home, your office, or you BFF’s pad. Then, pick your look from a visual menu that includes things like smokey lids and a pale lip (the Cat) or contoured eyes with a bold red lip (the Grace Kelly). The visual menu is awesome because it lets you know exactly what you’re getting. There’s none of that “Oh, I thought a chignon looked like this” stuff going on here.

And this is where things get super exciting. It’s the part where a beauty dream team shows up at your front door. And we really do mean dream team. All the brush-packing pros have been vetted to guarantee killer consistency, and they all have resumes sporting experience in movies, television, and magazines. So rest assured. You’re in good hands.

By now you’re wondering how much this full-service, Avon-lady-gone-glam house call is going to cost you? Probably not as much as you think. Prices range from $150 for hair only to $225 for a complete look, which when you consider the cost of going to the salon (time and energy), plus the service of getting your hair and makeup done, the price point isn’t that much higher. Not to mention, you get to feel totally spectacular with a beauty team swarming around you in your own abode.

The downside? Vensette is currently only available to the busy women of New York. We hope the service spreads fast with beauty consultants at your beck and call in every major city in the US.

Oh, and did we mention that the team arrives with mini bottles of champagne? Because they definitely do that too.

Who’s up for some in-home primping and polishing? Let us know in the comments below!