Make These Geometric Tasseled Pillows in Under 20 Minutes!

Alright, guys, it’s time to revamp your standard DIY throw pillow. We’ve taken your classic square throw and added four more sides and eight more tassels! Oh, and guess what? You can make these pillows in under 20 minutes, tassels and all. We think these poofs are a must for your spring redecorating plans. Now, let’s get to making these Octagon Pillow Poufs, baby!

<br/>

– fabric

– fabric

– four spools of embroidery floss

– thread

– stuffing

Tools:

– sewing machine

– needle + pins

– scissors

– ruler

– pencil

Instructions:

1. Fold fabric in half and measure out a 21 x 21-inch square. Make marks at seven inches and 14 inches.

2. Draw diagonal lines to connect your marks and create an octagon. Cut out the octagon.

3. Time to make your tassels! Hold the embroidery floss in your hand and wrap around your four fingers. Once you have wrapped about half of the floss around your hand, slip the bundle off and wrap string around the top. Knot and cut off the extra string. Create eight tassels.

4. Pin the tassels in between the two layers of fabric. Make sure the area above the wrapping is hanging out of the side.

5. Sew seven sides of the pillow leaving one open for flipping and stuffing.

6. Turn the pillow right side out and start stuffing. Make sure you really get it in the corners!

7. Sew up the open edge with a needle and thread.

Okay, let’s make this thing!

Usually we would suggest using the fold of the fabric as one of the sides of the pillow (less sewing!) but in this case you are going to need all open sides to insert the tassels. Measure out a square that is divisible by three, we chose 21. Divide the height and width into threes by creating a mark at seven inches and 14 inches. Now draw diagonal lines to each mark and create an octagon. Finally, cut it out!

To make your first tassel, you are going to hold the embroidery floss in your hand and wrap it around your four fingers. Wrap about half of the floss around your hand, it should be quite a few strings (the denser the better). Remove the bundle from your hand and wrap extra string around the top. Cut and tie off the string at the top. You will want a total of eight tassels!

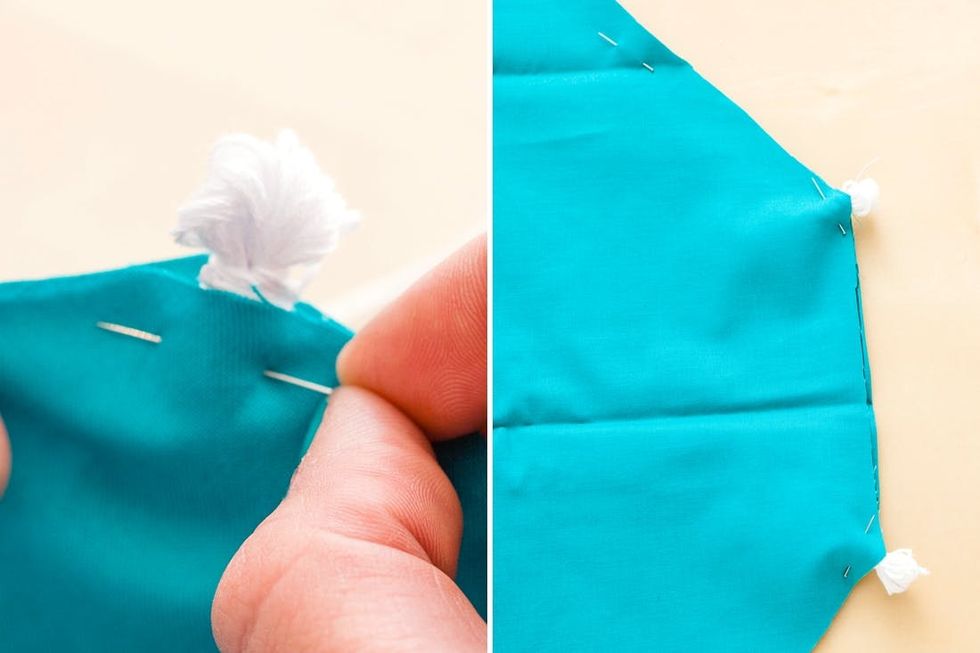

Time to pin those eight tassels in place. Position them in between layers so the top of the tassel is peeking out of the fabric.

It’s best to start sewing right before each tassel. We know it’s kind of annoying, but it will ensure the best results. This way all the tassels will be secure when you are stuffing and you won’t have to deal with hand sewing the tassel on. Make sure you only sew seven sides of the fabric.

Tip for making sharp turns: Anchor the needle in the fabric, lift the presser foot up, turn the fabric, and place the presser foot back down.

Turn the fabric right side out and start stuffing.

Really make sure the stuffing gets into the corners of the pillow.

Once all the stuffing is in place, use a needle and thread to sew up the open seam.

Stop right there. Look at that octagon pillow!

We created three and loved the look of them stacked on top of each other.

Try making different sized octagons. When first measuring out your square, we recommend sticking to measurements divisible by three (unless you’re a math whiz).

Turkey Temple totally approves! ;)