24 Dad Gifts He’ll Actually Want for Father’s Day

Theresa Gonzalez is a content creator based in San Francisco and the author of Sunday Sews. She's a lover of all things design and spends most of her days momming her little one Matilda.

Stumped on what to give the great dads in your life this June 21? We've pulled our faves for all of them: camper dad, music dad, art dad, grill dad, beer dad, even burrito dad or just all of the above. Take your pick and treat him to something that shows a job well done.

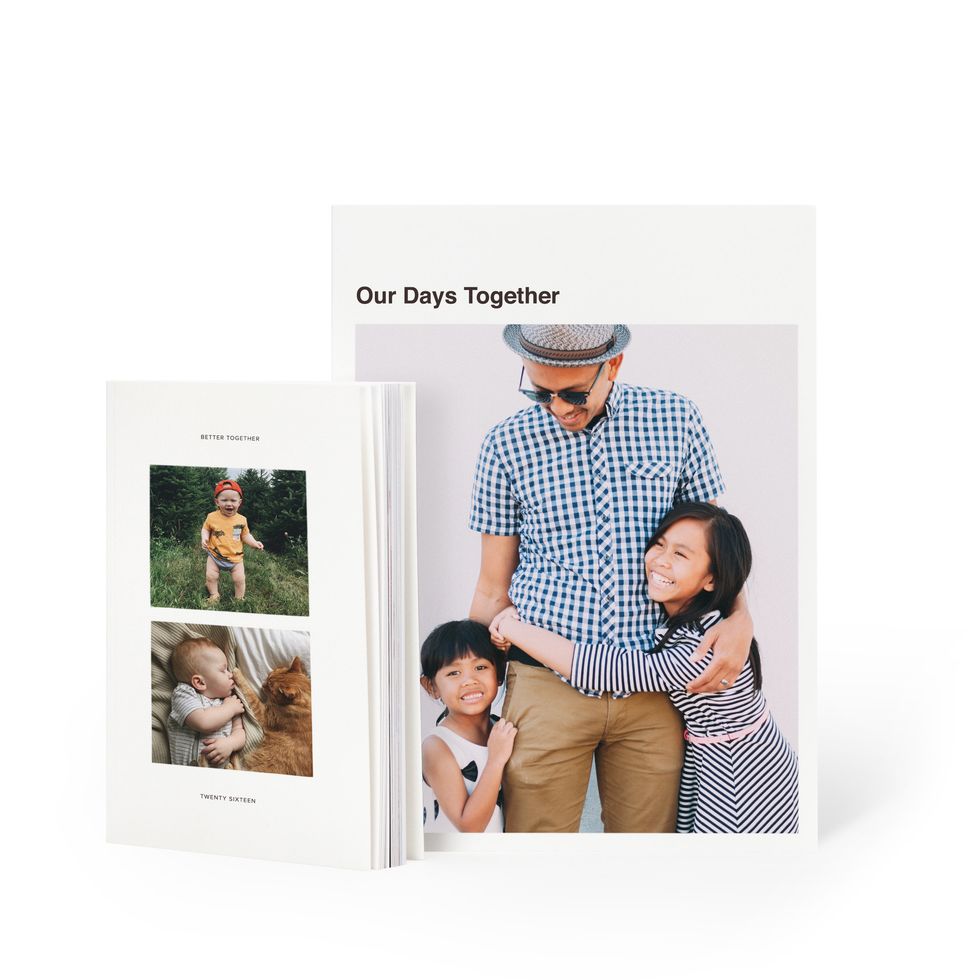

Artifact Uprising Soft Cover Photo Book $15 and up

Put together his favorite dad photos for an annual memory book he can keep on his desk or bookshelf.

Upgrade his camping gear this summer with this freezer-quality, bear-resistant (certifiably so!) cooler, constructed the same way as whitewater kayaks. (So it's durable for rugged adventures.)

LARQ Bottle $95

The LARQ Bottle self-cleans and purifies, using UV-C LED light to take out 99.9999 percent of bio-contaminants from his water and bottle. It looks good too!

Hamilton Beach Electric Indoor Searing Grill $70

For the dad that knows his way around the grill, there's this easy-to-clean indoor one to keep him cooking all year (and all weather) long.

Thousand Helmets Heritage Helmet $90

Inspired by vintage motorcycle helmets of the '50s and '60s these minimalist helmets will get dad to and fro in style.

Exploding Kittens Throw Throw Burrito $25

For the dad who loves burritos *and* dodgeball, there's this card game a la flying foam burritos.

Spikeball Standard 3 Ball Kit $60

Shark Tank fans will enjoy this spikeball game for backyard, beach, park and even indoors as summer staycations become the norm.

Kootek Camping Hammock Double & Single Portable Hammock $22-$35

Got two trees? Dad can bring this portable parachute hammock with him anywhere: backpacking, the beach, backyard, and travel.

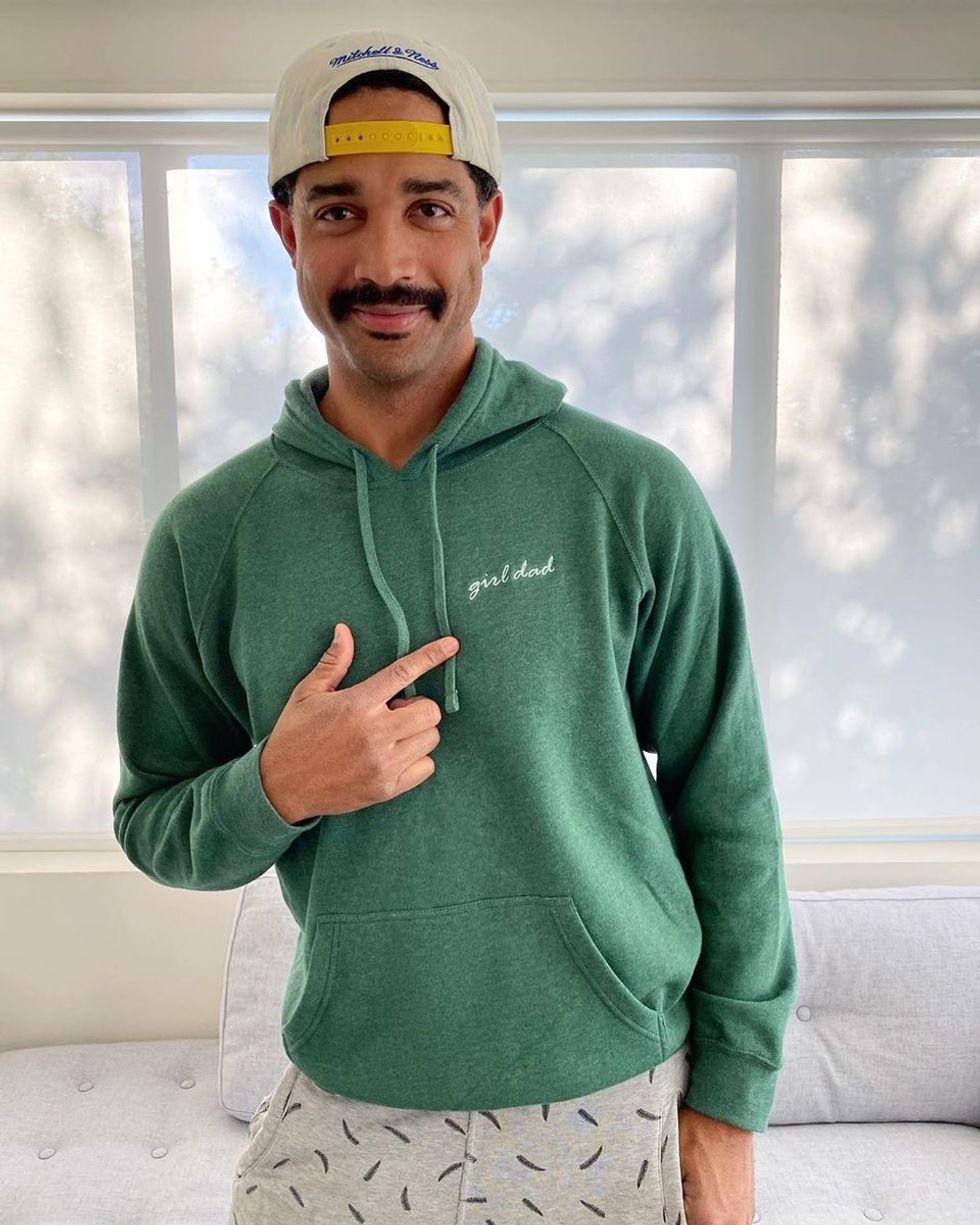

Support the Phenomenal Woman Action Campaign, and along with it nonprofits like Families Belong Together, Black Futures Lab, Native Voices Rising, with this sweatshirt for proud girl dads everywhere.

Patagonia Atom 8L Sling Bag $59

This water-repellent single-strap sling bag is great for exploring the outdoors with kids in tow.

This compact and optimized personal blender will get him back on the health track.

Forest and Harold Money Clip Slim Wallet $45

This stainless steel money clip and slim wallet, available in a bunch of color combos, is the anti-Castanza wallet. The leather wallet is perfect for back pockets and holds up to 8 cards.

These Zoom Gravity sneakers from Nike adds a spring in dad's step and gets him back to what he loves to do, from road to court.

Kanu Surf Men's Barracuda Swim Trunks $18

Get him ready for summer with these cargo swim trunks in camo print, stripes, hawaiian florals and more.

Oura Ring $299

This titanium ring wraps around his finger (where the pulse is strongest) to capture dad's resting heart rate, body temp and more through all stages of the day. He'll get three daily scores on sleep, activity and advice for how to improve. Oura's Moment features a guided meditation and mindful breathing sesh too. (It's one of Brit's faves!)

Bose SoundLink Revolve, Portable Bluetooth Speaker $200

Give the gift of wireless surround sound + wireless range of 30 feet so dad can enjoy up to 12 hours of his favorite tunes, thanks to a rechargeable, lithium-ion battery.

Marshall Kilburn II Bluetooth Portable Speaker $270

For the dad who likes a little vintage style to his portable speaker there's the Kilburn II Bluetooth Portable Speaker with a 20-hour lifespan.

Beats by Dr. Dre Beats Studio³ Wireless Noise Cancelling Headphones $350

As long as he promises to put these on *after* the kids go to bed, these noise-cancelling Beats headphones are a great gift for when you're bingeing on two different Netflix shows.

For the dad who likes to primp and groom, there's this package (worth $290) of clay mask, face oil, night cream and more to keep his face fresh for the day.

Muse M Classic $118

You can add prescription lens to these classic shades available in a bunch of colors.

Bevel Shave Kit $90

A close second to getting a pro shave, this kit will put his disposable to shame with a reusable safety razor (and 20 blades), shave creams, oil, and balm.

Whiskey Appreciation Crate $160

Personalize a handmade whiskey decanter and two heavy bottom rocks glasses for the whiskey-loving dad. The kit comes with two ice molds, slate coasters, a whiskey drinking journal and salty nuts.

Sagamore Spirit Straight Rye Whiskey $44

Add a bottle of this award-winning rye whiskey with vanilla, caramel and spice notes to his kit Here's a recipe to add to his handmade card!

Sagamore Seltzer

Ingredients:

- 1.5 oz. Sagamore Spirit rye whiskey

- Perrier seltzer water

- Squeeze of fresh orange juice

- ½ oz. simple syrup (optional)

Share your Father's Day pics with us @BritandCo! Have a good one!

Brit + Co may at times use affiliate links to promote products sold by others, but always offers genuine editorial recommendations.

- 5 Minutes, 3 Materials, 1 Great Last-Minute Gift for Dad - Brit + Co ›

- The 27 Best Father's Day Gifts for 2018 - Brit + Co ›

- 14 Last-Minute Experience Gifts for Every Type of Dad - Brit + Co ›

- 50 Father's Day Gift Ideas Under $50 - Brit + Co ›

- 25 Thoughtful Father's Day Gifts Your Dad Will Love - Brit + Co ›

- 6 Easy Ways to DIY an Awesome Personalized Gift for Dad - Brit + Co ›

- 29 Gift Ideas for the Hipster Dad in Your Life - Brit + Co ›

- 29 Edible Gifts to DIY for Dad - Brit + Co ›

- 48 DIY Father's Day Gift Ideas - Brit + Co ›

- 24 Unique Father's Day Gifts ›

Theresa Gonzalez is a content creator based in San Francisco and the author of Sunday Sews. She's a lover of all things design and spends most of her days momming her little one Matilda.

Theresa Gonzalez is a content creator based in San Francisco and the author of Sunday Sews. She's a lover of all things design and spends most of her days momming her little one Matilda.