5 Ways to Pack the Perfect Picnic Date

Spring is in full bloom, which means flowers are in full bloom. What better way to check out the floral eye candy around town than with a picnic day-cation? Not sure what a day-cation is? Check out the solo day-cation we took in the new Toyota RAV4. If you’re going for a day outside, you might as well take along that certain special someone in your life, right? Take note, guys and gals: The tips below are a great way to woo your crush. Thanks to Toyota, we got ourselves a sweet ride for this date-cation :)

here — I’m the DIY Editor at Brit + Co, and I’ve got some great ideas for your perfect date. My handsome date picked me up in the

, which was cozy and comfortable. He hadn’t driven a car with a Smart Key System or Push Button Start, so I had a good laugh when he tried to start the car. Honestly, the drive was equally as fun as the rest of the date! We went to a beautiful park, flush with trees and other spring florals.

, which was cozy and comfortable. He hadn’t driven a car with a Smart Key System or Push Button Start, so I had a good laugh when he tried to start the car. Honestly, the drive was equally as fun as the rest of the date! We went to a beautiful park, flush with trees and other spring florals.

There we set up a picnic, ate a delicious lunch, and took some selfies with fun photo booth props (we had to!). Follow along to see the projects.

I don’t know about you, but whenever someone asks me to pack a meal for lunch, camping, or a picnic, I go blank. You know that feeling? Like you’ve had so many ideas in the past, and then when it’s time to make something, you’ve got nothing. Well fear not! I’ve got a plan for you. And I can vouch for it. We had such a great date (I mean me and my belly).

The obvious place to start — get a picnic basket. We bought one that came with silverware, glasses, and a bottle opener. To add a some color in true Brit + Co fashion, we spray painted the basket.

The Perfect Picnic

Here’s a list of items to pack:

Sprinkle-dipped Marshmallow Pops

- mini sandwiches

- fruit (we chose strawberries)

- veggies (we’ve got mini bell peppers in ours)

- pink lemonade

- sprinkle-dipped marshmallow pops

- plates, cups, napkins, straws

- origami cutlery holders and silverware

- picnic blanket (and maybe a second one for your shoulders if it gets cold)

Curious about those pops? We’ve got the recipe for you. In my opinion, a good date isn’t complete without some dessert. And with dessert on a stick, you can have a cute moment feeding your S.O.

Ingredients:

Instructions:

- marshmallows

- white candy melts

- rainbow sprinkles

- lollipop sticks

1. First poke the lollipop sticks into your marshmallows.

2. Then heat up the candy melts in the microwave, stopping along the way to stir.

3. Dip the marshmallows into the melted candy and then roll them in the sprinkles.

4. Let them dry and enjoy!

These are so pretty I didn’t want to eat them. Except that I did want to eat them :)

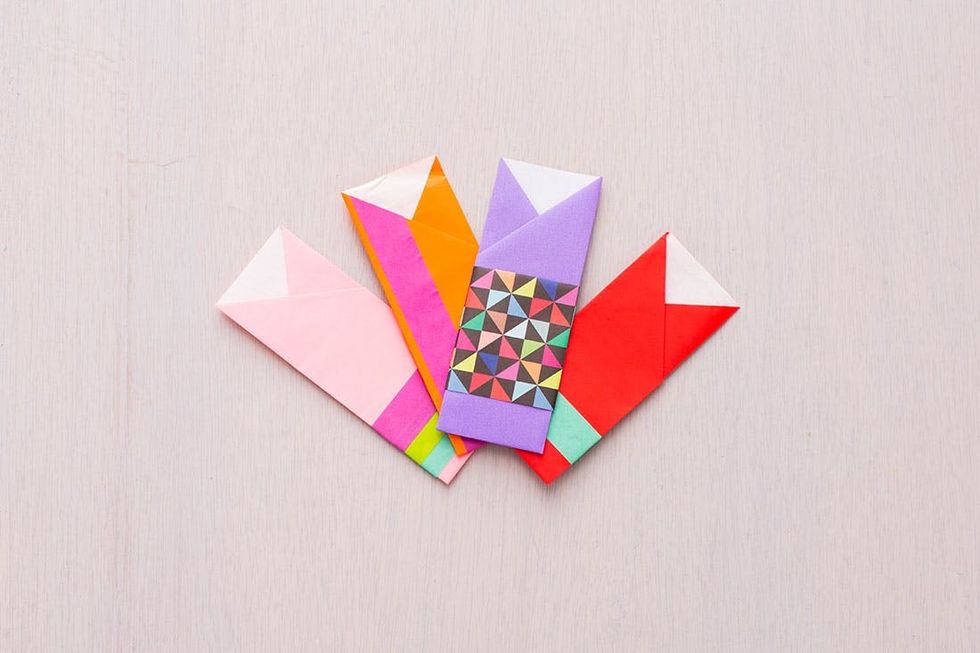

To add a little DIY to the basket, we made these geometric origami silverware holders. Inspired by a post from Daydreamland, we added our own extra touch to these rad cases. Follow along for the folds.

Materials:

Origami Cutlery Holders

Instructions:

- large origami paper

- washi or masking tape

1. Start with a large piece of origami paper. Fold it in half and then fold both the bottom and the top to the center line.

2. Fold the bottom right corner into the center line and the top right corner to the top fold.

3. Fold the top fold to the center line.

4. Then fold the center line over the bottom fold.

5. Flip the bottom piece up, and then fold the left side of your paper over to the right about a third of the way.

6. Flip your holder over.

7. Grab another piece of paper, and wrap around the center of the holder.

8. Secure it with tape. Alternatively, you can decorate the holder with fun strips of washi tape.

How cute are these?!

As a Brit + Co employee, I can’t help but LOVE a photo booth, especially one with unique props. Luckily, my date was into selfies and was down to get silly with me behind the camera. Like the props? Well, here you go: We’ve got them in printable form for you.

What a great day! Date! Date-cation! I got to spend some QT with my date in the RAV4, which was so relaxing to ride in as a passenger. I felt safe and sound, and I could even warm up my own seat with the Heated Front Seat feature! The picnic was romantic, the food delicious, and our activities grin-inducing. Who could ask for a better day? I’m excited for the next one :)

Photo Booth Props

Tell us about your perfect date on Twitter. Where do you like to go? What do you like to do?