Helpful Products Any Mom Will Be Grateful For

Mommin' ain't easy. Whether you're new to this or true to this, motherhood is filled with transitions and can sometimes be downright chaotic. From late night and early morning feedings to tantrums and diaper blowouts, the days of the mother are unpredictable at best, especially for working mothers. Thankfully, there are a plethora of useful products out there that can make #MomLife a little easier, some of which you never knew you needed. We know, you don't want to junk up your house with a bunch of new gadgets, especially when you struggle so hard to keep it semi-clean with your little ones running around. These products aren't just cool, they're practical and solve everyday hassles, which make them great additions to your household. You're guaranteed to add at least one of these products to your mommin' essentials.

The Wanderer Poncho($59): This poncho is not only cozy but "whateverproof", built with a technology that repels all types of spillage making it a neat must-have for breastfeeding and momming in general.

Elvie Double Electric Breast Pump ($500): This wearable breast pump fits inside your nursing bra which makes pumping not only discreet but convenient too.

Croissant Contour Underwire Nursing Bra ($67): Moms swear by this seamless, full-coverage maternity and nursing bra. Unlike some other nursing bras, this bra caters towards fuller busts.

Circle Home Plus ($129): This little gadget helps you to manage screen time by controlling access to the internet as well as filter content.

Washable Organic Nursing Pads ($13): These organic nursing pads are ultra-soft, good for the planet and for your boobs.

Ciao! Baby Chair ($60): This portable baby chair folds up like a lawn chair and fits in a tiny carrying bag. It's perfect to keep in the trunk for picnics, trips to grandma's house and other travels.

Stain & Odor Laundry Detergent Pods ($20): After finally getting around to doing laundry, the last thing you want to worry about is detergent that may be too strong for baby's skin. Dropps has a variety of natural detergent pods that make laundry that much easier.

WiZ 60 Watt Smart WiFi LED Light Bulbs ($38): Control the lights throughout the house without leaving your seat. Schedule the perfect settings for bedtime and mornings with the touch of a button.

PRIA Max 3-in-1 Convertible Car Seat ($330): One car seat to rule them all, the Maxi Cosi carseat grows with your child so no need to fear those impromptu growth spurts.

Wash. It. Later. Soak and Save Bags ($15): Don't fear the blowout, these emergency soaking bags can handle anything your child dishes out.

Compression Socks ($38): Gradual compression can help reduce minor swelling after you've spent the day chasing after your young one.

ÉCLEVE Pulse Ultimate Comfort Hip Seat Baby Carrier ($150): This baby carrier is super comfortable and comes with a detachable hip seat.

HD Wifi Baby Monitor ($200): You can monitor baby at home or on the go with this HD wifi monitor that comes with high image quality and security features.

Golden Milk ($28): Golden Milk is a natural coffee alternative for new and seasoned moms that uses high curcumin tumeric, ashwagandha and ginger that can reduce anxiety and fuel you with energy at the same time.

Car Cache Handbag Holder ($20): Keep your purse at arms reach with this car cache that makes your bag easily accessible.

BuddyPhones WAVE ($80): These headphones offer safe audio so your child can enjoy their favorite cartoons and you don't have to worry about damage to their ears. They're also hypoallergenic and toxin free.

Beanko Baby Diaper Changing System ($90): This changing system makes diaper changing in the car a piece of cake.

The Rowledge ($375): This do-it-all nylon backpack is great everyday bag for working moms. You can fit your laptop, bottles, changing pads and more without sacrificing style.

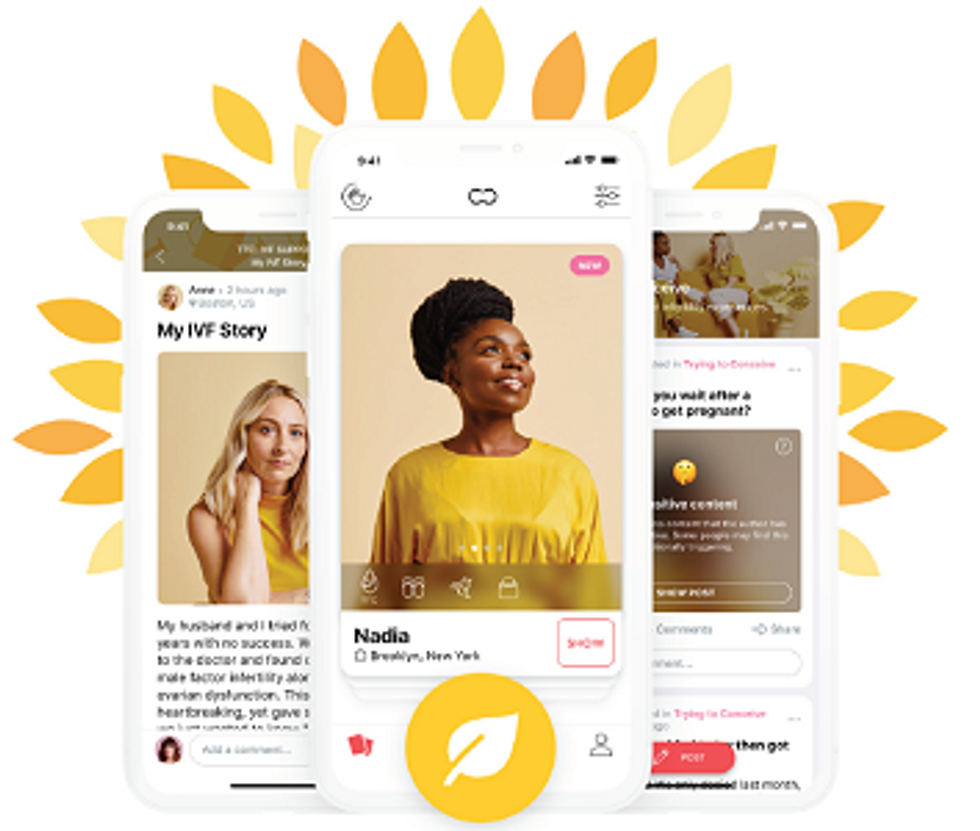

Peanut (Free): Find your mama tribe with the Peanut app. This app is a great place to share stories and find community in your motherhood.

Storq Kit Bag ($48): This diaper bag kit makes changes on the go a breeze.

Rockit Portable Baby Stroller Rocker ($50): Does your little one wake up every time the stroller stops moving? Rockit can help with that. This diaper bag sized gadget keeps your stroller rocking so your baby stays snoozing.

A+D Original Diaper Rash Ointment($11): Let's be real, A+D ointment isn't just great for baby, it's also great for mama who may be experiencing postpartum constipation.

Drink in the Box ( 8 oz: $13; 12 oz: $16): Cut down on waste with these reusable juice boxes.

LaVie Lactation Massager ($40): Gentle pressure and vibration can improve your breast milk flow which makes this tiny massager a must-have for breastfeeding mamas.

Baby Brezza Pro Advanced Formula Mixer ($200): Formula-feeding moms will appreciate this formula mixer that automatically makes a warm bottle for baby.

Multi-Task Eye Gel Cream ($65): Tackle bags, puffiness, dark circles and file lines under your eyes head on with this eye serum.

Lansinoh Lanolin Nipple Cream for Breastfeeding ($8): Nursing moms know you can never have enough this soothing cream.

UV Sanitizer and Dryer ($169): Babies are germy. Sanitize everything from makeup brushes and cell phones to toys and bottles with this sanitizer.

Nutrient Vitamin Coffee ($30 for 30pk): Caffeine and vitamins? Yes, please. This instant coffee comes packed with 13 daily essential vitamins to help you avoid the crash and get the most out of your energy.

Multi Flask 7-in-1 Travel Beverage System ($45): Cut down on pantry space by using this 7-in-1 travel mug.

Brit + Co may at times use affiliate links to promote products sold by others, but always offers genuine editorial recommendations.