5 Best Apps of the Week: The New Social Media App Everyone Is Freaking Out About + More!

Welcome back to best apps of the week time, where we scour the app stores and interwebs to bring the best and buzziest of new apps. This week you’re in for a treat, with a new social messaging app that is going viral as we speak (it was invented by one of Vine’s founders, so what’d you expect?), one that will help you split the tab in a snap and also a couple of apps that might just help you keep on track with your New Year’s resolutions. Check out all the app-tastic goodness that in store for you below.

Peach

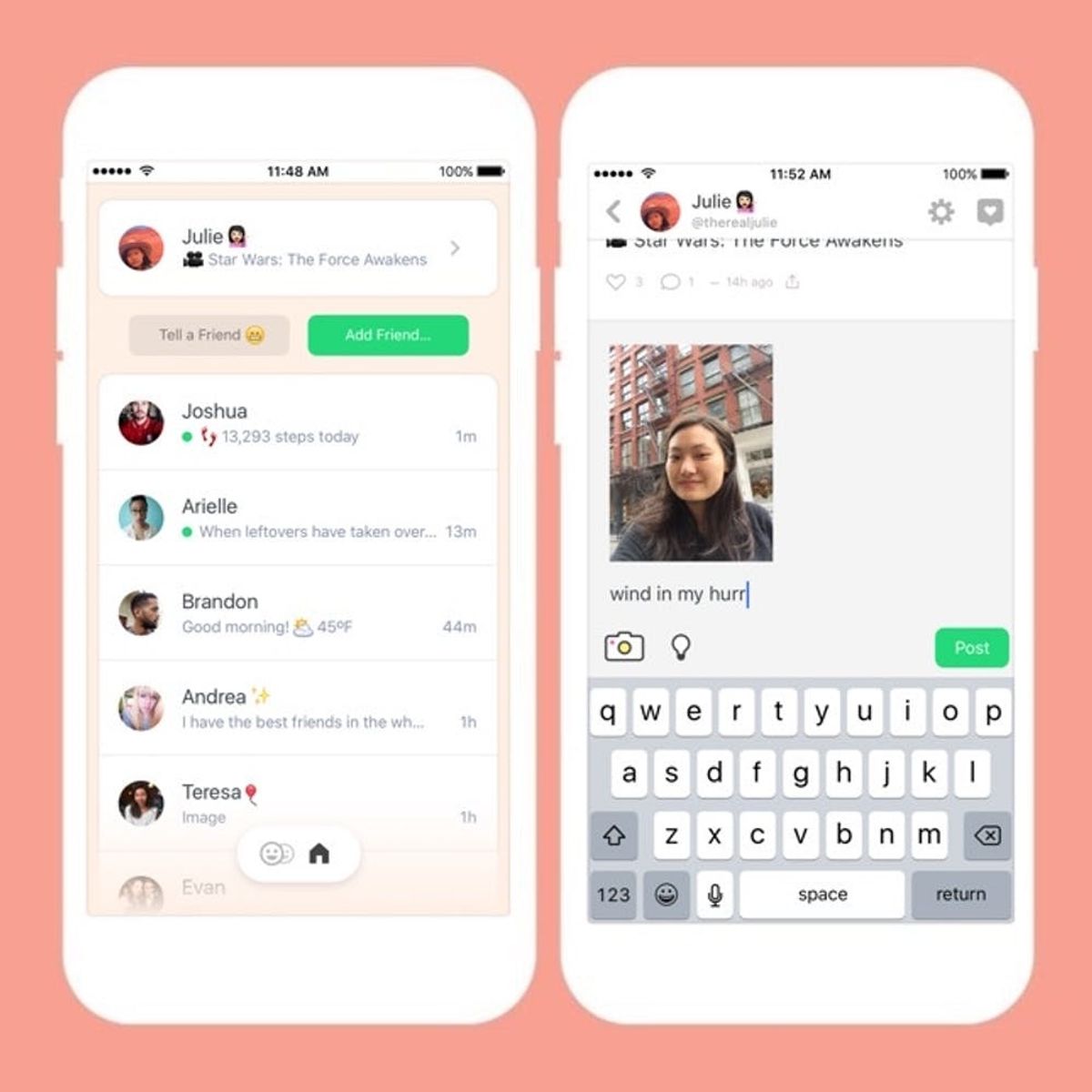

Here’s the new social media chat app that you and your friends are going to love. Peach gives you a little page that allows you to give short and sweet updates like pictures, videos, links and GIFs. Tell your friends where you’re at, what the weather’s like, that you’re watching another ep of Making a Murderer and how many steps you walked. Or didn’t. Your pals are free to drop by and check out your “page” and leave comments.

Here’s the new social media chat app that you and your friends are going to love. Peach gives you a little page that allows you to give short and sweet updates like pictures, videos, links and GIFs. Tell your friends where you’re at, what the weather’s like, that you’re watching another ep of Making a Murderer and how many steps you walked. Or didn’t. Your pals are free to drop by and check out your “page” and leave comments.

DL It: Free on iOS

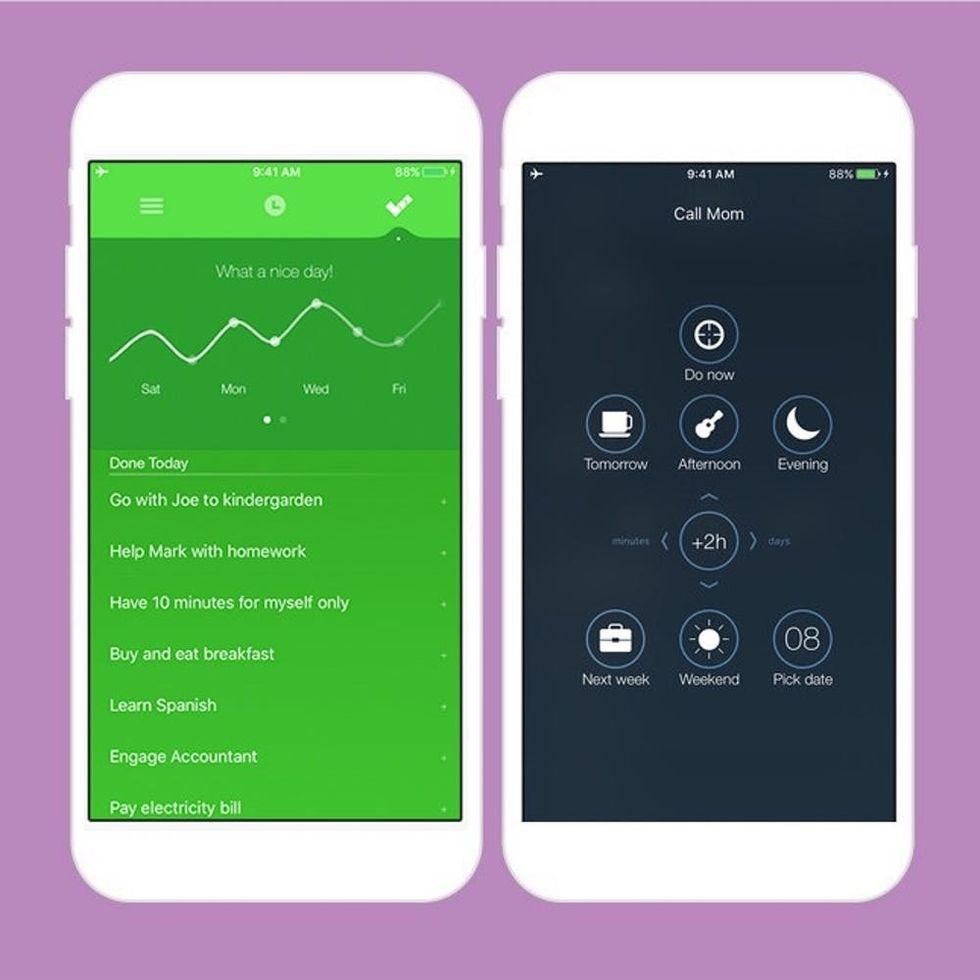

2. Proud: So $4.99 isn’t cheap when it comes to buying an app, but Proud is that app that wants to help keep you organized and less stressed, and help you carry out everything on your t0-do list. That = priceless. You simply add things you need to do into the app and categorize it as to how urgent the item is. Proud will store your lists and send you gentle reminders. You even have fun options like “Give me more time,” “De-stress” or “Travel back in time.”

DL It: $4.99 on iOS

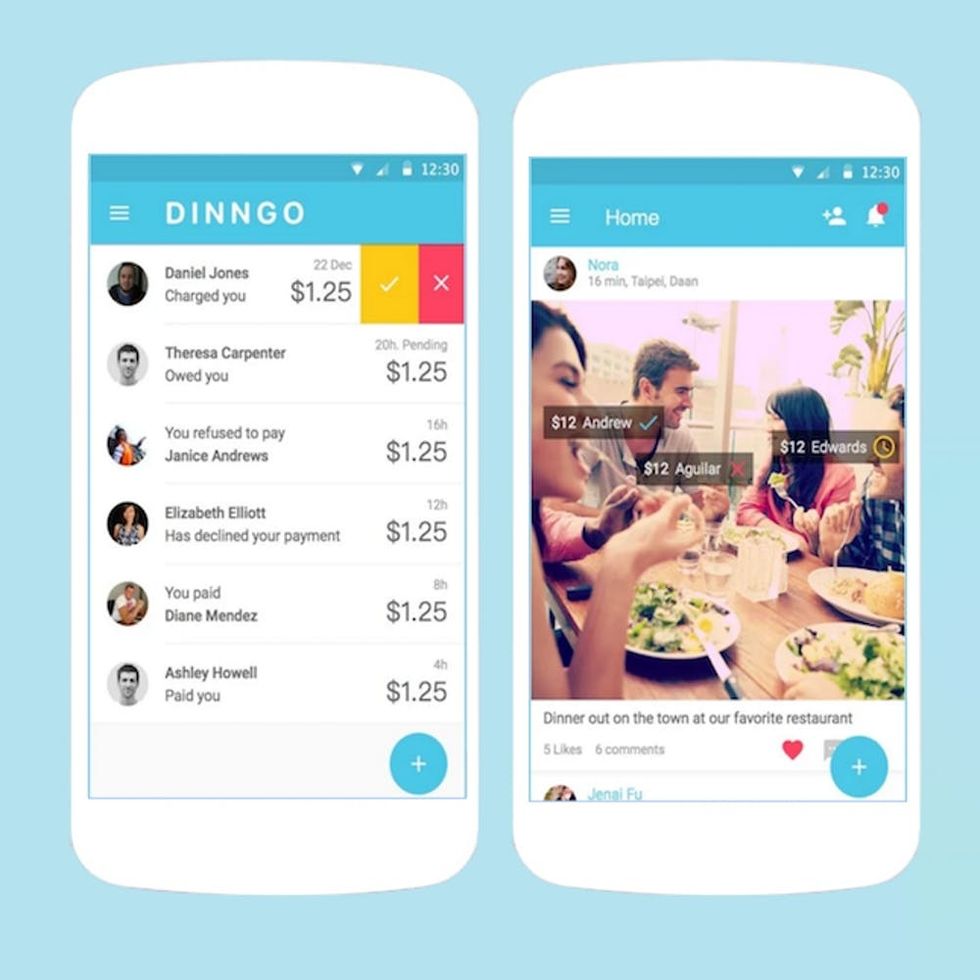

3. Dinngo: Splitting the bill is the biggest headache we all have when we’re out with a large party. That’s where Dinngo steps in. The app socializes paying and it’s as easy as snapping a pic and tagging everyone. After each person calculates how much they need to pay, just upload of group photo and tag the dollar amount each person owes. Then your pals can easily pay you through Venmo.

DL It: Free on iOS and Android

4. Hear and Now: Every once in a while in our busy lives, we need to stop and take a deep breath. Hear and Now wants to help you do just that by giving you a cool interface that reminds you to inhale with deep, focused breathing exercises. Meanwhile, you can measure your heart rate by placing your finger on the flash of your phone and also indicate your stress level within the app. Helpful!

DL It: Free on iOS

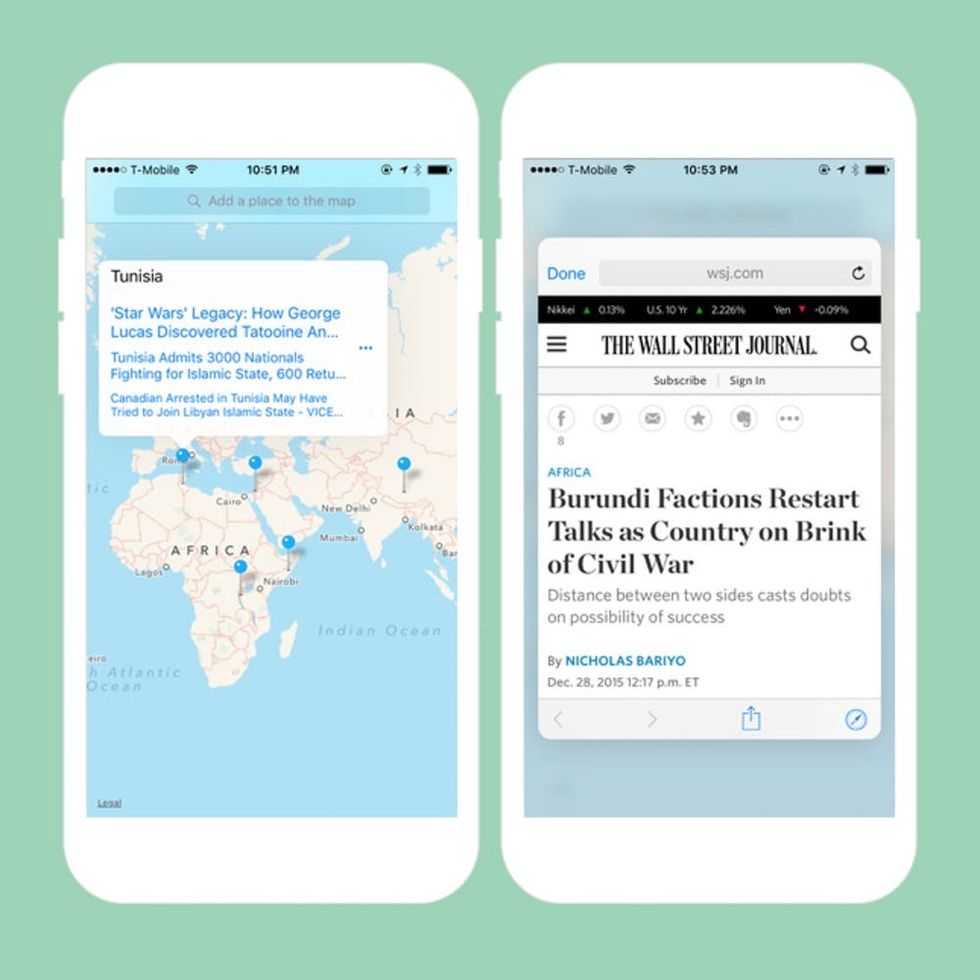

5. Omniscient: Sometimes we get caught up in what’s happening right in our vicinity and we lose sight of the fact that there’s a whole world out there. Omniscient is the news app that wants to make it easy for you to access headlines the whole world over. All you have to do is drop a pin anywhere in the world and the app will show you the latest headlines from that location.