6 Must-Download Apps That Make It Easy to Pay and Get Paid

In the past year we went from having long-overdue IOUs between friends to getting a ton of ways to pay people. Just a few taps and bing, bang, boom, you don’t have to worry about getting going to an ATM or writing a check ever again. (Wait, do people still write checks?) With so many ways to pay, this week, to Upgrade Your Life, we’re giving you the what’s what on your best options.

1. Collect Money From Lots of People: Whether you’re booking a summer hotel for you and your friends or divvying up gas money for a road trip, Glassjar can make paybacks a lot less awkward and difficult. All you have to do is start a jar, ask your friends to contribute a certain amount, and when the jar is full, the money goes to your account.

There’s even a fun roulette option that lets you take a gamble on having to pay for the next round, or not have to pay at all.

DL It: Free on Android, coming soon to iOS

2. To Split the Bill:A dinner can go from laughs and drinks to pen and paper when you have to figure out how to split the bill. It’s a total downer. With Tab, you can take a picture of the bill, and the app reads each of the items and the prices. Then, each person just joins in and claims what they ate. Tab will divvy it all up — tip included. No more pen and paper.

3. For More Professional Payments: While all of these apps could potentially be used to collect money from a client, there’s something about Payzo.io that’s just a bit more professional. Just set up your payment page, complete with your name and picture/logo. When you send someone that link, they put in their payment info just like they would for any online purchase. If you’re only using the service occasionally, you can accept up to $200 per month for free, and the monthly pricing starts at $9 after that. If you’re a Stripe user, this platform connects super easily.

4. Keep It Social: Venmo isn’t the prettiest payment app out there, but it’s great for things like getting coffee for people in the office or making lunch orders. You can pay and get paid just like with the other apps, but there’s also a feed function that lets you see who people in your network are paying. Also, when you’re making a note of what the payment is for, you can use emojis, so that’s fun.

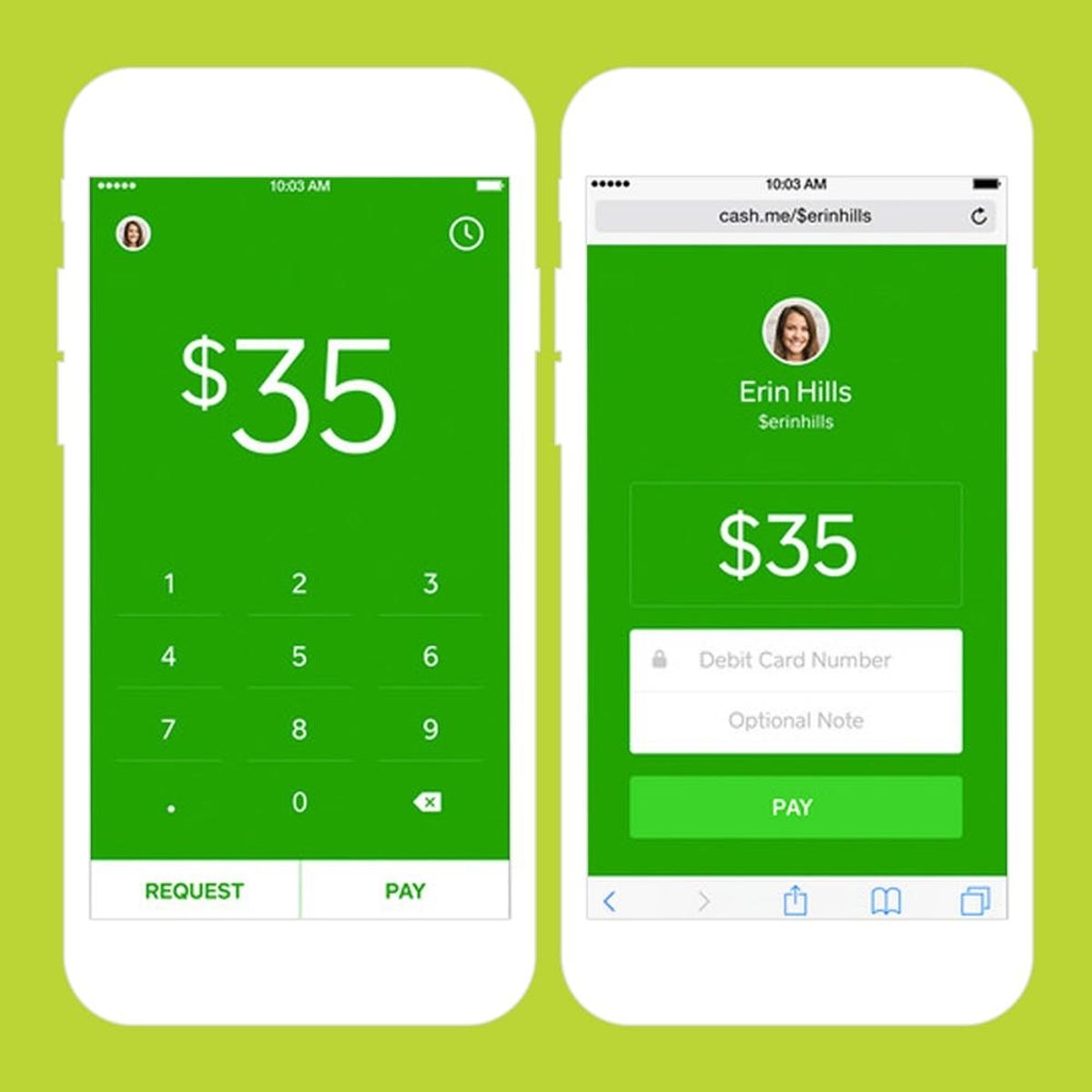

5. Keep It Simple: From the people of Square comes one of the easiest ways to transfer money: Square Cash. The app couldn’t be any simpler: Just put in the amount you want to pay or get paid and then pick a recipient. They’ve recently added a super awesome $Cashtag feature too. Anyone can have a $Cashtag — it’s just a URL you create and send to everyone from clients to roommates so they can pay you from your page.

6. Make It Fun: Dishing out money usually isn’t super fun, but Snapchat is trying to change that with Snapcash. It’s not quite as fun to use as they make it look in their promo video, but it’s pretty simple to navigate and it’s inside of an app that you probably already have.

In case you haven’t tried it yet, you just go into your chat section, and in a message, just type any number after a dollar sign. Your send button will turn green and then you just send the money.

How do you square up funds? Let us know in the comments!