DIY These Pretty Coasters Instead of Buying Flowers for Mom

Very few gifts beat a bouquet of fresh flowers. But a fresh arrangement only lasts a few days, or a week at best, and don’t even get me started on all of the possible combinations of blooms! Unless you’re a professional florist, arranging or even choosing a bouquet can be insanely intimidating. So instead of breaking the bank on a bouquet, opt for inexpensive and quick DIY gifting instead! These DIY pressed flower coasters are the perfect, modern spin on the traditional bouquet and make great hostess gifts. Lucky for you, we also made these Pressed Flower Coasters a kit! PSSST: Mothers Day is coming up — have you thought about what you’re getting her yet?

Keep your recipient’s favorite flowers in mind when looking for pressed flowers and these coasters are guaranteed to make your mom/boss/friend’s day!

(

available in our shop!):

available in our shop!):

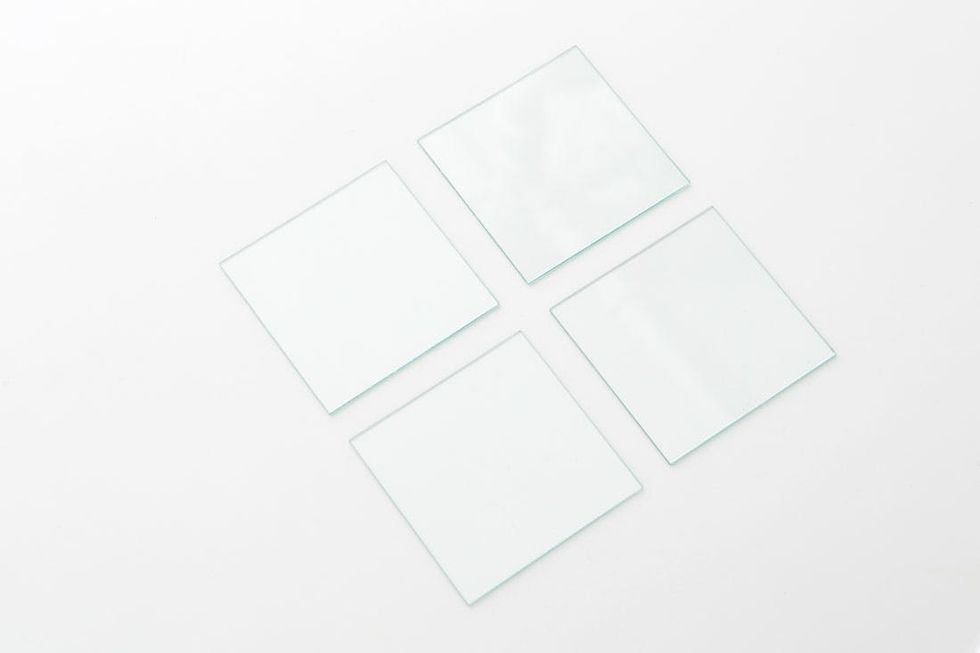

— 4 x 4-inch glass tiles

— dried pressed flowers

— 1/4-inch copper tape

— E6000 glue

*Please note: our Pressed Flower Coasters kit features pretty pink flowers instead of these multi-colored ones.

Get your materials together (or purchase a kit!), and let’s get started!

Instructions:

1. Arrange the flowers on top of four of the glass coasters.

2. Secure the flowers down with a small dab of E6000 glue.

3. Sandwich the flowers with another glass tile.

4. Trim a 16.5 inch piece of copper tape and adhere it along the edges of the glass tiles. Try to center the copper tape as much as possible. This will help make the copper border look as clean and consistent as possible.

5. Press the excess copper tape down to create the copper border detail.

6. Run a smooth object along the copper tape to flatten any ridges that may have formed.

Each coaster will require two glass tiles. Make sure your glass tiles are as clean as possible by wiping them down with window cleaning solution.

Arrange the pressed flowers on the glass tiles. We liked how the touch of green adds a bit of contrast to the bright florals. Rack up some easy bonus points if you’re gifting these to someone by using their favorite variety of flowers ;)

When you’re happy with your arrangement, secure the flowers in place with a small dab of E6000 glue. Once you’ve finished gluing everything down, align the second glass coaster on top of the first to sandwich the flowers.

Cut a piece of copper tape to 16.5 inches. Carefully align the center of the tape along the edges of the two pieces of glass; this will help the copper border detail look as clean and consistent as possible. Applying the copper tape can be tricky, but luckily it is fairly forgiving. If you’re not happy with the positioning of the tap, just gently lift it off and try again.

Then fold the excess tape over to create the copper rim detail and to secure both tiles together. Run a smooth object along the copper tape to flatten any ridges that might have formed.

Repeat these steps for your remaining tiles, and you’re finished!

That’s all it takes to make the perfect gift for hostesses, girlfriends and moms alike! These coasters are so beautiful, there’s no excuse not to use one.