19 DIY String Art Projects

Whether it’s gallery walls, spray paint or posters, we’re always on the lookout for fun and innovative ways to decorate our space. If you haven’t tried string art, you’re missing out. It’s cost-effective, offers endless options and is pretty simple to accomplish… even though the results are so impressive everyone will think you’re a crafting genius. Read on for tons of fun DIY string art projects that will brighten your home and let you unleash your inner DIY maven.

1. String Art Basics: Not sure where to start? We’ve got the basics of string art covered, plus some simple ideas for you to begin with. (via Brit + Co)

2. Live Creatively: This project makes a great addition to a craft room, office or any place where you need a little inspiration! (via Brit + Co)

3. Letter String Art: Hang a string art initial in a child’s bedroom, or make two as a cute wedding gift. (via The Blush Chronicles)

4. State String Art: Represent your hometown pride with these cute state string art projects. Bonus points if you use an official state color as the background! (via Semi-DIY)

5. Heart Monitor Wall Art: If you don’t have nails or wood handy, this minimalist string art project is extremely simple but an incredibly interesting addition to an empty wall. (via Young Bird)

6. String Art Cake Topper: Perfect for Valentine’s Day, Christmas or just because, use a cute cake toppers to add some flair to your baked goods. (via Between Designs)

7. Air Plant String Art: Combine string art with air plants for a look that’s borderline botanical garden as well as chic. (via Brit + Co)

8. Ombre Wall Art: You don’t need a ton of money to create a statement piece of art, just multi-color thread and some patience. (via The Red Thread)

9. Valentine Air Plant String Art: V-Day or not, everyone is going to heart these. (via Brit + Co)

10. Zodiac String Art: Craft a few of these for your friends who just can’t stop reading their daily horoscope. (via Brit + Co)

11. “Joy” String Art: This project combines distressed wood and ombre shading for a sign we’re pretty sure you’re going to want to have at your wedding and then on your wall for THE REST OF YOUR LIFE. (via Dear McKenzie)

12. “Eat” String Art: Want to spruce up your dining room without resorting to big paintings of spoons or wine bottles? This simple sign is your answer. (via Dress This Nest)

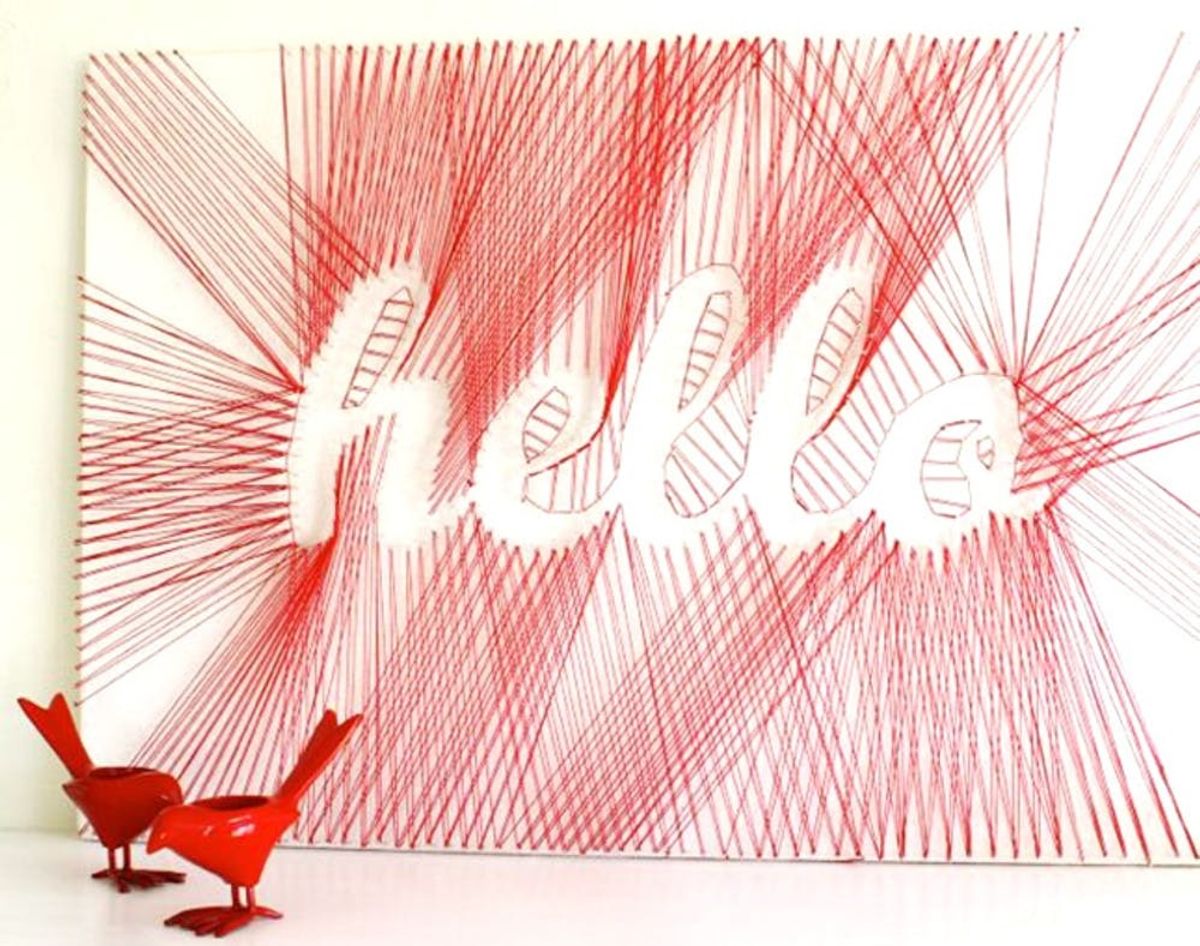

13. “Hello” String Art: Welcome everyone who enters your home with a big red HELLO. (via Poppy Haus)

14. Skull: Who said skulls have to be scary? This fun project is officially on your long Halloween-DIY list. (via A Beautiful Mess)

15. Deer String Art: The horizontal lines offer a twist on the traditional string art look. (via Butler Life)

16. String Art Backdrop: This backdrop makes a great showpiece for an outdoor wedding reception and can double as a giant photo booth backdrop of sorts. (via Wedding Obsession)

17. Monogram String Art: A string art headboard? Yup, Camille Styles went there. (via Camille Styles)

18. Nail and String Wall Art: Let everyone know how you feel about your home with this wall art. You can tie the colors into your decor or use bright shades for contrast. (via Jen Loves Kev)

19. Nail and String Wall Art: Got a favorite song of all time? Those lyrics are going right up on your wall. (via Jen Loves Kev)

What project would you like to have on your walls? Tell us in the comments below or on Facebook!