3 Ways to Update Your Gallery Wall for Fall

A pretty gallery wall is one of the chicest ways to adorn your space. But switching it up *every* season? That can be a lot to tackle. If you’re looking for a fresh way to bring fall into your home without completely overhauling your existing artwork, select a couple statement pieces to focus your arrangement around or add a festive accent, like a garland. On this week’s edition of Decor Resolutions, we’ll give you some new ideas on how to update your gallery wall with a few seasonal additions. Scroll down to see how we’d style a gallery wall for a boho-chic space, a minimalist abode and the preppy home.

A boho-chic gallery wall is *all* about those nature vibes. Think: animal busts, mini framed bugs and leaf prints. One of the trending color palettes this fall is forest green, so pick pieces that complement each other, but aren’t too matchy-matchy. Peachy pinks and gold look stunning together and ensure you can throw up anything, from a rose gold swan to an abstract floral painting.

Oh Joy! Rose Gold Swan Wall Decor ($40), Dot & Bo Pacifica Framed Wall Art ($49), Formhelden Real Beetle in Frame ($113), Attalie Dexter Solar System Wall Art ($78), Clare Elsaesser Rose Queen Wall Art ($228), Dot & Bo Doe, a Deer Art Print ($19), Anthropologie Bronze Leaf Wall Art ($328), Raspberry Moon Weaving Teal Ombre Woven Wall Hanging ($224), Minted-Domino Sitting Pretty ($21), Magical Thinking Metal Triangle Wall Banner ($18)

HOW TO DECORATE A MINIMALIST GALLERY WALL

Sometimes the best color palette is a monochromatic one. For a modern and pared-down look, go for black and white artwork, slim frames and simple graphics. Bring in those seasonal vibes with moon-phase artwork or even a faux neon moon slice. You could even hang a black cat print for a cheeky bit of decor that’s appropriate long past Halloween.

Artfully Walls Joy ($94), Three Potato Four Wood Frame Letter Board ($65), Dot & Bo Full Cycle Print ($26), Oh Joy! LED Moon Wall Light ($50), Joni Majer 1 Art Print ($19+), Suzanne Antonelli Happiness Art Print ($19+), BRIKA Double Circle Wall Hanging ($47), Shannon Lee Black Cat Art Print ($29+), Pillowfort Fab-you-lous Screen Printed Glass Art ($23), Menu Marble Wall Clock ($270)

HOW TO DECORATE A PREPPY GALLERY WALL

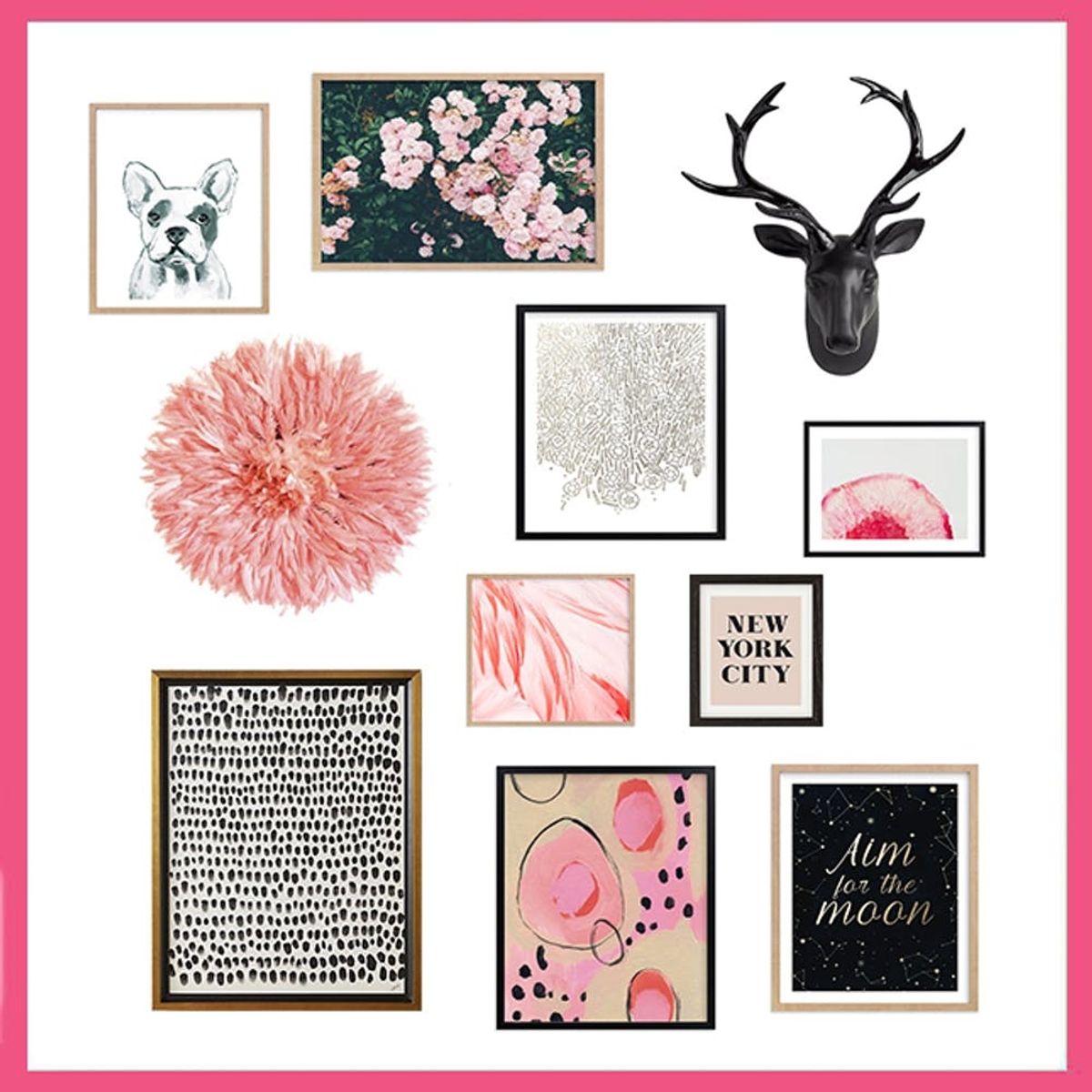

Take a cue from fall’s changing colors and incorporate more dusty pinks into your gallery wall with a new painting or feathery juju hat. Bring a burst of seasonal decor onto your wall with a bold black taxidermy deer, brush-tastic floral paintings and some quirky photographs. Black graphics and pale pink accents? It doesn’t get more on point than that.

PBteen Hey Mr. Dog Wall Art by Minted ($165+), Minted Shining Statement by Lulu and Isabelle ($21+), CB2 Clarke the Wall Hanging Black Stag ($60), Minted Studs and Gems by Alethea and Ruth ($36+), Minted Jewel by Stacy Cooke ($21+), alphonnsine New York City Art Print ($19+), Minted Flamingo by Kamala Nahas ($23+), Minted Aim for the Moon by Yeye62 ($36+), Minted Walk in Closet by Kinga Subject ($21+), Anthropologie Pointillism Wall Art ($698), ZLAMM Juju Hat ($178)

What’s your favorite way to update your gallery wall for fall? If you’re looking for more wall decor ideas, follow us on Pinterest for tips, inspo and DIY projects.

Brit + Co may at times use affiliate links to promote products sold by others, but always offers genuine editorial recommendations.