5 Hacks to Make Your iPhone Feel Like New Again

You’ve probably heard a rumor (or 10…) about the much anticipated iPhone 6. We get it — the mere thought of a durable, scratch resistant screen is enough to make us drool. And don’t even get us started on the 13 megapixel camera with pixel enlarging capabilities. (All unconfirmed rumors, of course. But who could resist?)

1. Clean Out Your Phone: To keep your iPhone in tip-top shape, you need to make sure you have adequate storage space. This will improve your device’s functionality and will enable you to do a software update. Trust us, you’ll feel the difference instantly.

You can do this manually by deleting apps you no longer use as well as those unusual yet creative selfies you took when no one was looking. (Especially those!) Alternatively, you could use PhoneClean, a free software cleaning software, which works in a similar way to CCleaner and CleanMyMac, makes it easy to rid your device of any unnecessary data. With a few clicks, you can kiss damaged media files as well as unnecessary texts, images and other media files goodbye.

2. Protect Your Phone: If you’re anything like us, you spend a considerable amount of time surfing on the go. And while there’s nothing quite like free Wi-Fi to make a morning commute fly by, have you ever stopped to think about your privacy? Unless you’re super savvy about it, your online activity can easily be tracked. That means someone could be reading your emails without you knowing it or worse, could get their hands on your credit card details.

It’s time to get smart about your mobile browsing habits with SurfEasy. This handy app does the worrying for you. It makes sure you’re protected and lets you surf anonymously and safely wherever you may be. (Free on iOS and Android)

3. Upgrade Your Battery: Ever noticed how your iPhone battery never seems to last very long? It’s one of our pet iPhone peeves. But don’t let that make you ditch your phone for a newer model. You could be doing it all wrong — download Battery Doctor and you’ll never get caught with a low battery again.

This app helps you stay on top of your battery and even gives you a good idea of how much power each app is gobbling up. Other useful features include an indication of how long it will take for your phone to recharge as well as tips for preserving your battery. (Free on iOS)

4. Automate It: Backing up your phone will free up space, improve your phone’s functionality and will give you peace of mind. This way, even if you lose your phone, your memories won’t be lost forever. Using the IFTTT app, you can set up automated processes to backup your data. It may sound complicated, but it’s really simple and quite fun!

IFTTT or If This, Then That is an app that lets you create automated recipes — the data, not the food, kind. Think of recipes as rules. For example, if Instagram then Dropbox. This would send any image you upload to Instagram to a Dropbox folder. To really get a taste of it, we recommend giving one of IFTTT’s many recipes a try. (Free on iOS and Android)

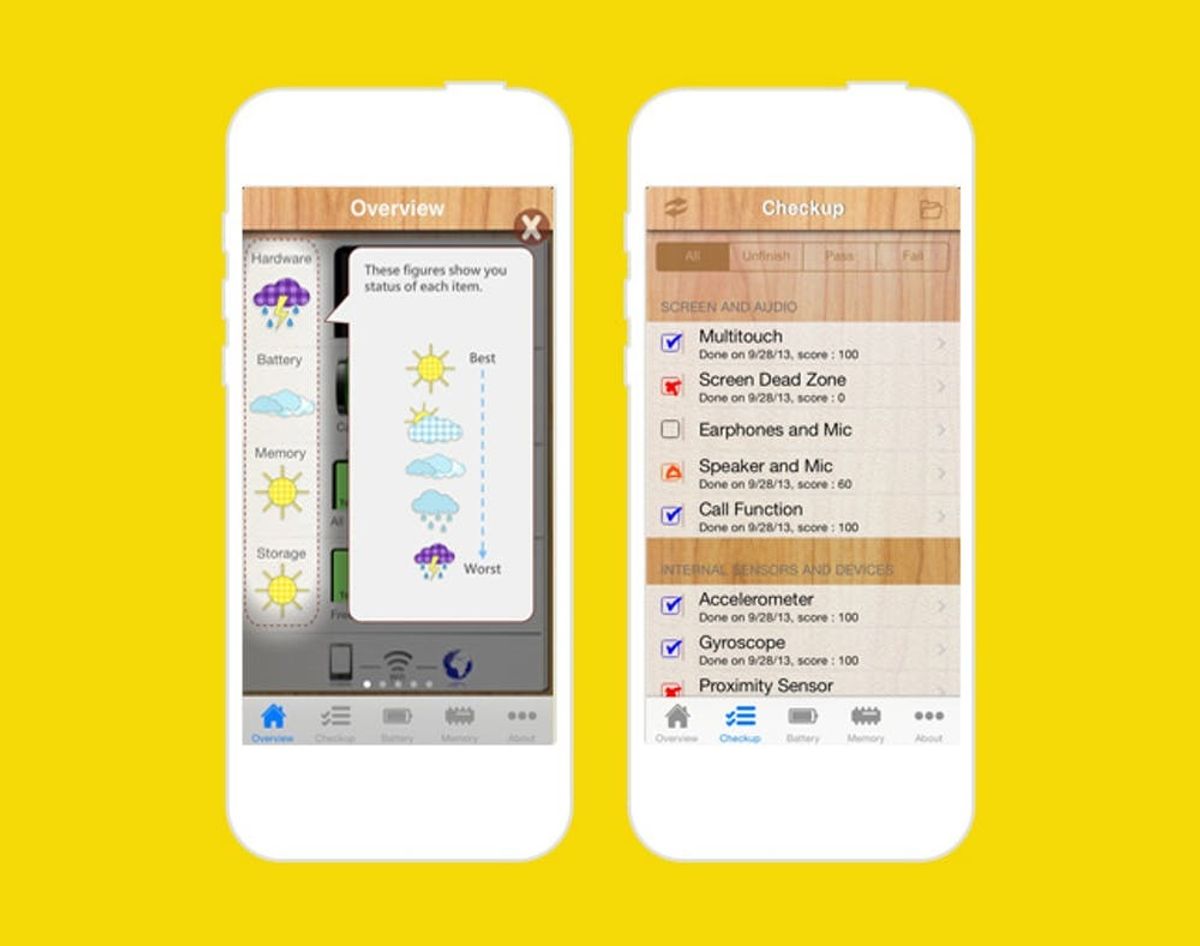

5. Give It a Check-Up: Sometimes, when a phone acts up, there may be something wrong with it. In this case, it doesn’t matter how much free space you have or how healthy your battery is. Using an app like PhoneDoctor will help you pinpoint defects quickly and easily so you can get your phone up and running without any fuss.

In eight minutes, the app thoroughly tests the phone’s hardware including calls, audio and wireless functions. It also gives you an indication of the phone’s hardware, battery and memory health. The app helps optimize the battery and memory so your phone runs faster. Perhaps it’s time you book your phone an appointment with the PhoneDoctor? ($2.99 on iOS)

What apps would you recommend for rejuvenating an old iPhone? Share your suggestions in the comments below.