Imagineer That! 15 Disney Attractions That You’ll Never Get to Ride

You’ve screamed at the top of your lungs while dropping 170 feet from the Tower of Terror. You’ve toured the globe in 15 minutes on It’s a Small World. And you’ve shivered your timbers with the Pirates of the Caribbean. (Pirate humor. Just go with it… ) With more than 100 attractions at Disney World and Disneyland, it’s hard to imagine that there are rides that never made it to the grounds of the Happiest Place on Earth. But there are! Here’s what you could have been riding instead of dozing off at the Hall of Presidents.

1. Herbie the Love Bug Ride: After the success of The Love Bug and Herbie Rides Again in 1976 (the 2005 Lindsay Lohan movie does not count… at all), this ride would have taken guests through scenes from the movies, like driving under the Golden Gate Bridge. At the end of the ride, Herbie would split in half, just like in The Love Bug. The reason it was canceled is unknown. (via Dave Land Blog)

2. Dick Tracy’s Crime Stoppers: Based on the 1990 movie starring Warren Beatty and Madonna, guests would ride 1920s cars and race through the streets of Chicago. Riders would also have guns, like the ones used in Buzz Lightyear’s Space Ranger Spin, to shoot the bad guys and targets along the path. The ride never came to fruition, because it wasn’t as successful at the box office as Disney anticipated and legal issues came into play preventing a sequel… and this ride. (via The Disney Wiki)

3. The Museum of the Weird: This was to be a Madame Tussaud’s-like attraction that showcased strange things from around the world, like a melting-candle man, a chair that stood up and talked with guests and a disappearing organist. Any of those sound familiar? That’s because when the attraction was scrapped, many of the ideas were incorporated into the The Haunted Mansion. (via Dave Land Blog)

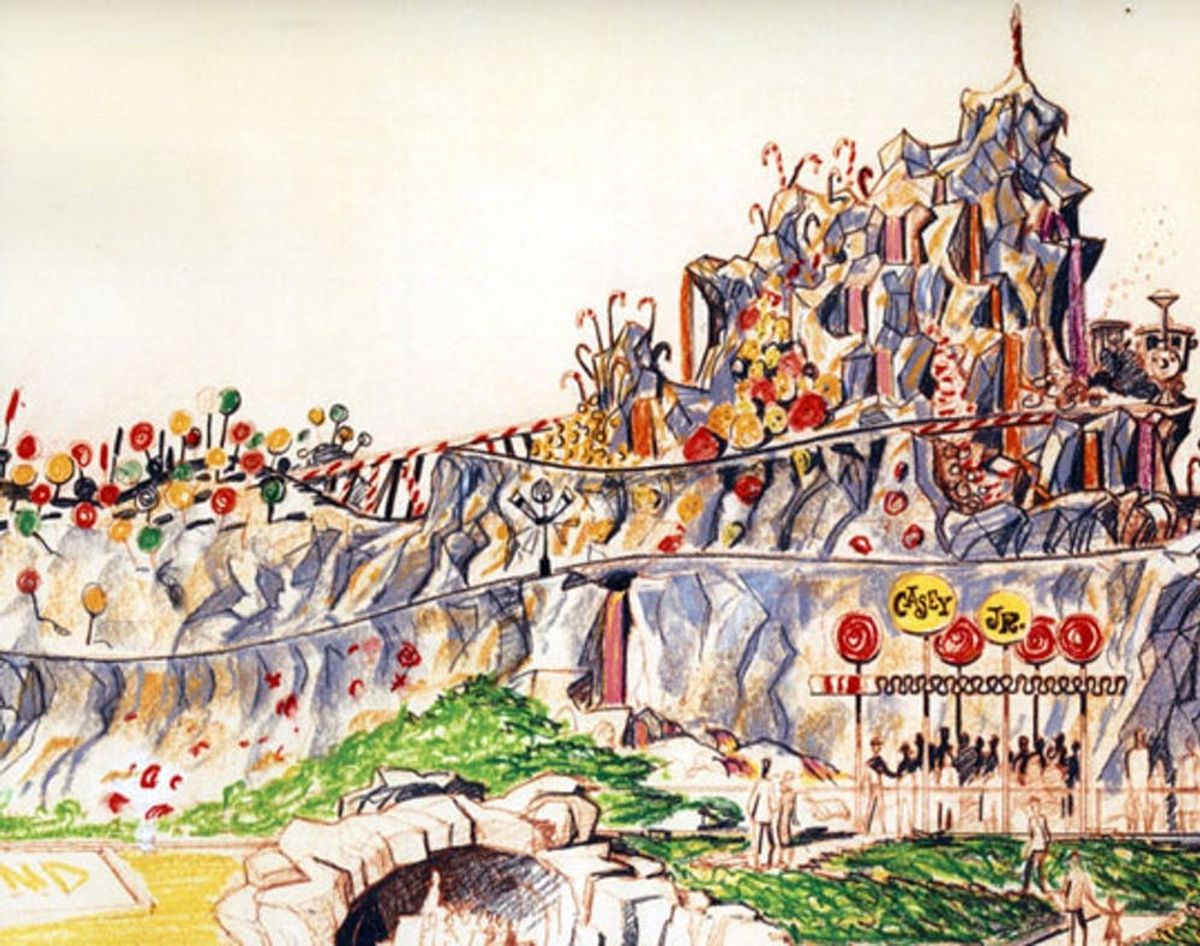

4. Candy Mountain: Candyland comes to life! The attraction was supposed to consist of a ride inside a mountain that looked like it was made out of rock candy, surrounded by other candies like candy canes and lollipops. Walt Disney put the kibosh on the project because of “all the smog” in Anaheim. That’s right, kids. Candy and pollution don’t mix. (via Dave Land Blog)

5. Dragon Tower: The original design for Animal Kingdom was to have a land called Beastly Kingdom, devoted to mythological creatures. When that idea was nixed, so was the ride. However, laid-off Imagineers brought the idea to Universal and it ultimately became the Dragon Challenge in The Wizarding World of Harry Potter. (via Disney and More)

6. Excavator: Set to live in the DinoLand U.S.A. section of Animal Kingdom, a lack of kid-friendly rides and budget cuts shut down this roller coaster through a dinosaur dig. Now in its place? A less intense roller coaster, Primeval Whirl. (via Jim Hill Media)

7. The Great Muppet Movie Ride: This Hollywood Studios attraction was abandoned after the merger between The Walt Disney Company and The Jim Henson Company fell apart. This ride was meant to complete the Muppet Studio section of the park, and would parody the park’s Great Movie Ride, recreating scenes from Frankenstein and Peter Pan. (via Muppet Wiki)

8. The Chinese Theater’s Great Disney Movie Villain Ride: Also living in Hollywood Studios and set to replace The Great Movie Ride, the attraction would feature three-dimensional recreations of Disney’s most famous villains, only to have, in true Disney fashion, forces of good come to the visitors’ rescue. No reason is disclosed as to why there was never a villain takeover. (via Wikipedia)

9. Time Racers: In the early 2000s, there was a push to improve EPCOT’s Future World. Project Gemini was imagineered, focusing on adding more thrill to the park. At the center of Project Gemini was Time Racers, a high-tech thrill ride about fast-forwarding through history. (Read: time travel.) Set to replace Spaceship Earth, the more than $500 million cost was deemed too expensive. Engineers were also concerned that Spaceship Earth’s geosphere would not be able to house the new structure. (via The Tomorrowland Interplanetary Gazette)

10. Rhine River Cruise: This boat ride around Germany’s famous rivers the Rhine, Tauber, Ruhr and Isar included miniature versions of German landmarks like Heidelberg and the Black Forest. But like many other rides that never were, construction on the EPCOT attraction was halted due to costs and not securing a sponsor. The ride entrance and building are still visible at the Germany pavilion. (via Theme Park Tourist)

11. Western River Expedition: The success of Disneyland’s Pirates of the Caribbean attraction fueled the need for a similar boat ride in the Magic Kingdom. The Western River Expedition was designed to live in Frontierland and recreate scenes from the Wild West. But in the end, the overwhelming demand for a version of Pirates for Walt Disney World trumped the addition of the Western River Expedition. The land now houses Big Thunder Mountain Railroad. (via Widen Your World)

12. Stephen King’s Tower of Terror: The original concept for The Tower of Terror was to be based on Stephen King’s horror books. (Cue Pennywise the Dancing Clown from It. Shudder…) But at the end of the day, The Twilight Zone offered more ride-friendly elements to equally frighten visitors. (via Pursuing the Magic)

13. Fire Mountain: This roller coaster was slated to be part of an extension of Advertureland called Volcania at Walt Disney World. The steel coaster would start off as a typical ride with the track beneath the car. Halfway through, the ride would invert into a “flying” coaster with the tracks above the riders’ heads and “lava” bubbling below them. By the time the ride was over, the cars would be back in their original form. But shocker, costs got too high. (via Modern Mouse Radio)

14. Matterhorn Bobsleds: To help build up the World’s Showcase in EPCOT, Disney approached national governments and major corporations from the countries that were on display for sponsorships. The Switzerland Pavilion had plans to host the Matterhorn Bobsleds, a Disney World version of the popular ride in Disneyland. Negotiations with the Swiss government fell through as did the ride. (via Wikipedia)

15. Russia The Bells of Change: As part of the “Disney Decade” in the ’90s, a Soviet Union Pavilion was planned as an addition to the World’s Showcase. The expansion would include replicas of Red Square and St. Basil’s Cathedral, which would serve as the centerpiece. At St. Basil’s a show called “The Bells of Change,” focusing on Russia’s history, would be the main attraction. But when The Union collapsed, funds became nonexistent. (via Modern Mouse Radio)

Which attraction do you wish Disney would have completed? Do you have any ideas for Disney rides? Let us know!