13 Must-Read Cookbooks Out in June

Summer is an excellent time of year to be a foodie. From whipping up go-to summer BBQ party foods to spiking your fave desserts with fresh summer fruit, the delicious bounty of the season is definitely infused into our grub. After perusing a few indie food magazines to see what’s trending, read up on these 13 cookbooks out in June to really make your recipes sizzle this summer.

1. Brooklyn Rustic: Simple Food for Sophisticated Palates by Bryan Calvert ($21): From the chef and co-founder of Brooklyn eatery JAMES, this foundational cookbook seamlessly pairs comfort food with decadent dishes. Using simple and easy-to-find ingredients, Bryan’s gift for experimentation is definitely apparent in this must-try collection.

2. K-Food: Korean Home Cooking and Street Food by Da-Hae West and Gareth West ($17): Do you love Korean nosh but are too afraid to try it yourself? Check out this how-to guide to Korean and Ameri-Korean cooking for lessons in everything from how to cook bulgogi burgers to the proper etiquette next time you’re out for some Korean BBQ.

3. Smuggler’s Cove: Exotic Cocktails, Rum and the Cult of Tiki by Martin Cate and Rebecca Cate ($18): How much do you really know about tiki culture? If you answered “not very much” — or if your mind suddenly went to the tiki room at Disney — you’re not alone. Luckily, tiki experts and owners of Smuggler’s Cove, a popular San Francisco Polynesian-inspired spot, are here to give us the DL on the legend, history and recipes of tiki culture.

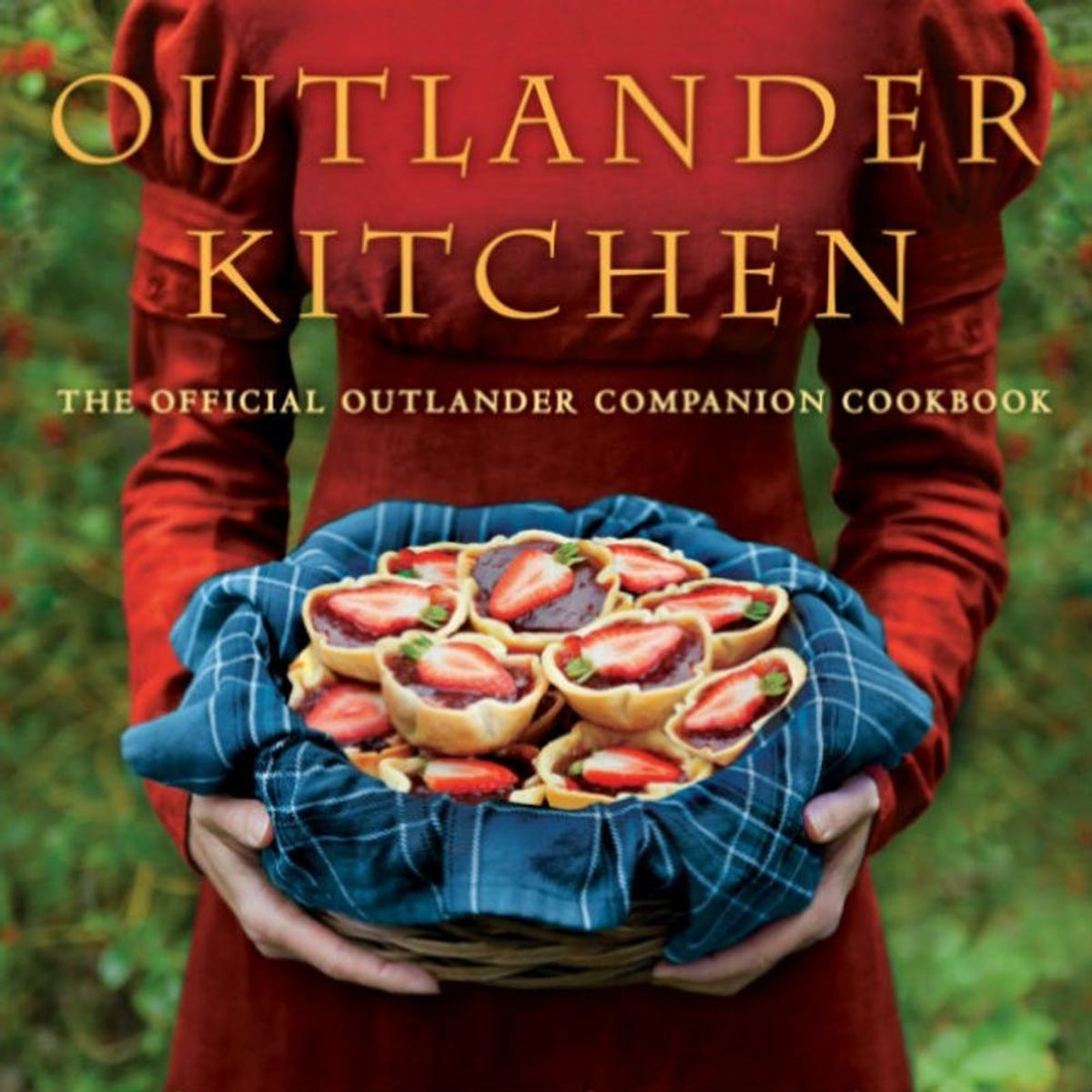

4. Outlander Kitchen: The Official Outlander Companion by Theresa Carle-Sanders ($23): Fans of the Outlander series will love this companion cookbook by Carle-Sanders. With recipes like Black Jack Randall’s dark chocolate lavender fudge and Auld Ian’s buttered leeks, it’s just as delicious as it is fandom-approved.

5. The Spiralizer 2.0 Cookbook by Williams Sonoma Test Kitchen ($10): Spiraling is something that falls in and out of cooking fashion — and right now it’s big. Whether you’re new to the trend or a diehard spiralizer, this guide and recipe hub for spiral dishes will definitely leave your guests wanting more.

6. A Super Upsetting Cookbook About Sandwiches by Tyler Kord ($15): When the chef and owner of No. 7 restaurant and No. 7 sub shops in NY isn’t commenting on pay phones or getting drunk in the shower, he’s most likely in his shop, coming up with fantastic sandwich recipes that take lunch to a whole new level. A debut author, Tyler’s buzzworthy cookbook will be prized by sandwich lovers (ourselves included) all summer long.

7. A la Mode: 120 Recipes in 60 Pairings by Mark Scarbrough and Bruce Weinstein ($16): Let’s get one thing straight: You can never have too much dessert. In this new classic, Mark and Bruce not only teach us how to make over 100 crazy-delicious desserts, but they also tell us exactly what type of ice cream to pair it with. Win-win!

8. Meat on the Side: Delicious Vegetable-Focused Recipes for Every Day by Nikki Dinki ($16): Whether you’re vegan, vegetarian or just veggie-inclined, Food Network star Nikki Dinki has tons of amazing recipes to help you cut back on your meat intake. You’re welcome in advance.

9. Food from Across Africa: Recipes to Share by Duval Timothy, Folayemi Brown and Jacob Fodio Todd ($25): Just looking at this expansive compendium of classic and modern African recipes is enough to make your mouth water. Featuring everything from tamarind-flavored pork to baked broccoli falafel, it’s a culinary adventure that just might have you booking a flight across the globe once you’re finished.

10. Tanya Bakes by Tanya Burr ($17): If you’ve been on YouTube for more than an hour, odds are you’ve heard of London lifestyle guru Tanya Burr. Towing the same line as other YouTube celebrities who have released successful cookbooks — from Hannah Hart to Rosanna Pansino — Tanya’s latest endeavor takes the form of delicious treats for every occasion.

11. The Slider Effect: You Can’t Eat Just One! by Jonathan Melendez ($12): Hostesses and snack enthusiasts will swoon for this recipe-packed cookbook dedicated to one of life’s smallest joys. It includes recipes for homemade breaks, buns and sauces to really make your apps a hit.

12. Nadiya’s Kitchen by Nadiya Hussain ($20): The 2015 winner of Great British Bake Off is debuting her new cookbook this June, and we couldn’t be more excited. With recipes like white chocolate and peanut slice za’atar and lemon palmiers sour cherry and almond bundt cake, we can’t wait to explore all 270 pages of Nadiya’s delicious treats.

13. Melt by Claire Kelsey ($20): Ice cream is having a moment, and Claire Kelsey of Ginger’s Comfort Emporium is leading the charge. With ice cream recipes that are both simple and too-good-to-share, this is a cookbook you need to get your paws on fast.

What’s your all-time favorite cookbook? Tweet us by mentioning @BritandCo.

Brit + Co may at times use affiliate links to promote products sold by others, but always offers genuine editorial recommendations.