Upgrade Your Life: 7 Techy Ways to Spend Smarter

It used to be that the only good thing about going to the bank was when, and if, they sent out a lollipop in those little tubes in the drive-thru. But now banking is getting way more convenient, efficient and dare we say… fun? (And there aren’t even any lollipops involved.) From sending money to your friends to paying your bills on time, there are brand new banks, services and apps that are looking to help you manage your money smarter without spending all of your money to do it.

To Combine All of Your Cards

SWYP is a metal card that combines all of your credit, debit and gift cards all in one hardcore metal card, making it the only thing you need to carry in your wallet. If you’re something of an account hoarder, never fear. SWYP can hold the info of up to 25 cards. You set everything up through the app (available for Android and iOS) by swiping each of your cards through the card reader. When you’re ready to pay, you can just toggle through each card on the SWYP screen until you get to the one you want to use. To keep things secure, SWYP locks when you’re out of a certain range from your phone. This do-it-all card runs on a battery that lasts for two years. SWYP is $49 right now on pre-order and is expected to ship in the fall.

For Managing Your Money on the Daily

For this one, we couldn’t decide between two services, because they each offer perks that the other doesn’t. So, we’re going to give you the scoop on both, which would make great replacements for whatever card you use for daily spending.

Simple lets you track your spending in a super simple way with its nifty Goals feature. Whether you’re setting aside money for your next vacation or groceries, Simple lets you divvy up your cash, leaving you with your Safe-to-Spend amount. The money you’ve set aside is still in your Simple account. When you spend money, you instantly get a ping on your phone (Android or iOS) telling you how much you’ve spent. You can even mark it as an expense from one of your goals right then. (Editor’s note: This card is great if your info ever gets stolen. Once I got a ping that I’d spent money at a store, when in fact I’d been writing on my couch all day. I was able to call Simple right then and alert them. Oh yeah, and their customer service is ace.)

Moven is much like Simple when it comes to making tracking your finances a breeze. But Moven brings the added bonus of having a tap-to-pay feature. You can add this sticker to your phone (Android or iOS) and leave your wallet at home to tap away anywhere that you can pay with PayPass. The Moven app brings all of your accounts together so you can easily transfer funds between them. If you’re all about tap-to-pay and want an app to merge all of your accounts, this one may be the way to go.

To Save Smarter

Digit is a service that doesn’t replace your bank or your debit card, but it connects to them to help you save without even noticing you’re doing it. First, it starts analyzing your spending habits and your income to find little bits of money here and there that it can set aside for you. Week by week, Digit transfers small sums of money (from $5-$50) from your checking account to your Digit savings account.

Your first thought might be “OVERDRAFTS!” But trust that they have an overdraft guarantee that ensures you won’t be caught with a goose egg in your checking account. They’ve made accessing your Digit account just easy enough to get to your savings when you need it, but not so easy that you tap into it for an emergency latte. When you need money from your Digit savings account, just text them. They’ll transfer the funds to your checking account the next day, without any need for an extra card in your wallet.

For Paying Bills

Prism is an app (available on Android, iOS and Windows) that tracks all of your bills and reminds you when they’re due. With Prism, you can pay your bill right from the app for free. To further take the huge weight off of your shoulders, Prism will notify you when you get a new bill and again when it’s due so you don’t miss the deadline. You can pay it right then or schedule it for a later date using any account you want. Once you set it up the first time, you don’t need to worry about PIN numbers and account numbers after that. It really couldn’t be any easier to pay your bills on time. No more excuses.

Breach-Free Credit

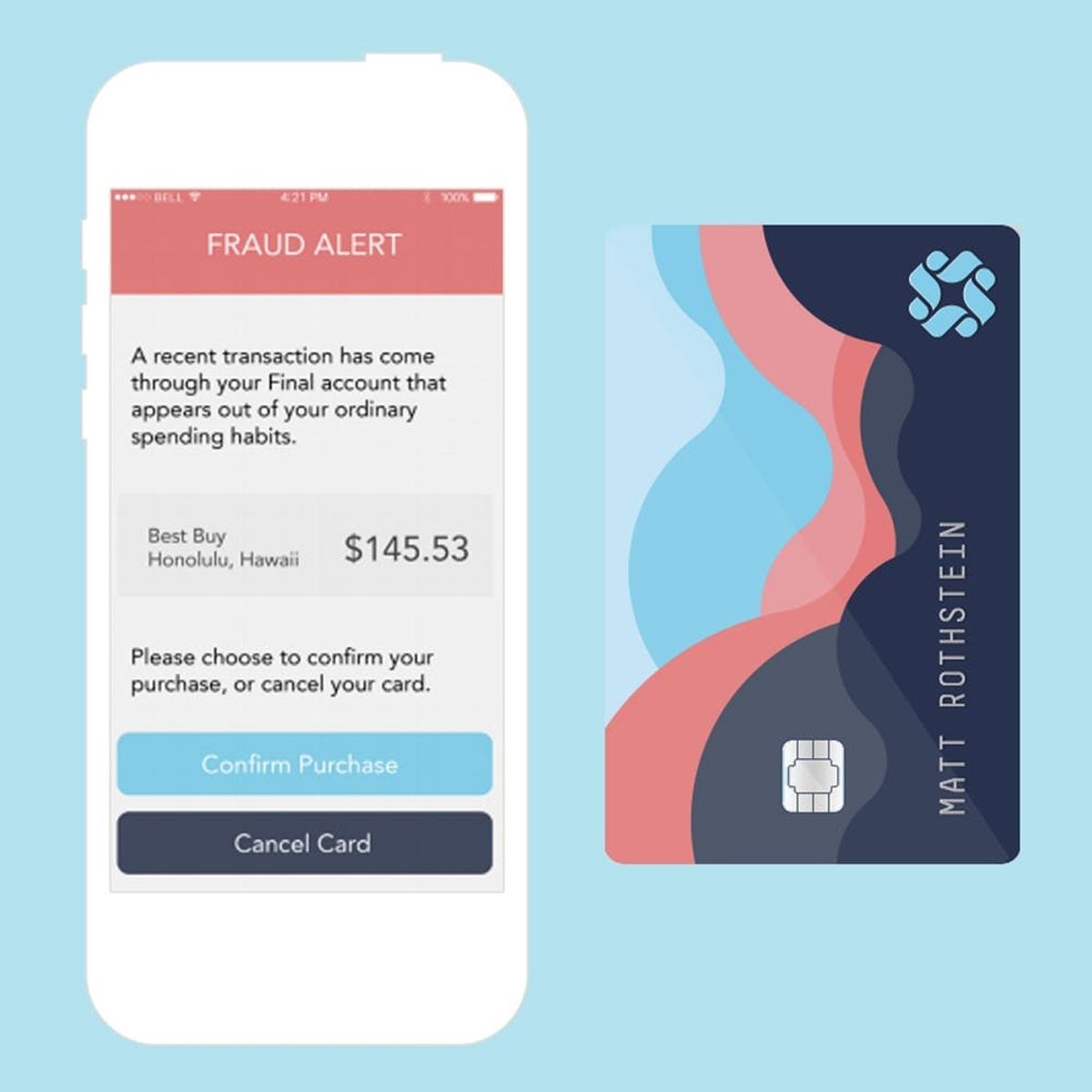

When we first read about Final, we were like “Say, what? Why didn’t someone do this before?” Each time you use your Final credit card, it pays the merchant with a new credit card number, so if someone tries to hack your credit card and steal your number, they’re not going to get too far. That means, the card doesn’t even have numbers on it… THE FUTURE. If anything fishy is going on with your account, Final will notify you immediately to get your confirmation. You can even set a limit for merchants with whom you have a monthly subscription so if they charge you over that amount, you’ll know about it. And you can even limit your own spending. From your phone or computer, looking at your finances is absolutely gorgeous. We’re pretty sure they’ve thought of everything.

Banking for Small Business

Banking for business shouldn’t be so darn expensive, and with Holvi, it’s not. It’s the perfect kind of straightforward banking you need for your small business so you can turn your attention to all of the other things you have to deal with. From freelancers to personal trainers, Holvi gives you the features you need to sell and invoice clients online while tracking all of your income and expenses in one place. It doesn’t replace your bank account, but instead works on top of it, giving small business tools to become super efficient. Opening an account is free, and the service is pay-as-you-go. Right now Holvi is just in 19 countries throughout Europe, and it’s gradually expanding. Don’t worry — we put in our vote for the US.

Picture Banking

Bank Mobile is a new service that’s looking to be the cool new thing for millennials and their money. In fact, the design kind of hits you over the head with it, but once you get past that, it’s actually bringing a new feature set that you can’t get with some of the other services — specifically, picture banking. For example, to open an account, just snap a picture of your license. There’s the benefit of real-time payments, no fees and text alerts for transactions, deposits and balances. You can also pay with photos of your account number, amount due and recipient’s address. This all still seems a little elusive, as there isn’t a video to really show off the features, but we’re keeping an eye on this one to see if it grows into something more efficient.

How do you bank? Let us know if you use any of these services and how you like it in the comments!