Taylor Swift’s Latest Cryptic Clip Answers at Least One Question

Here we go again! After Taylor Swift returned to social media this week with a cryptic new clip, fans were quick to flood Twitter with their (probably mostly on-point) theories about what it meant. A second clip fueled more speculation. Now, a third post has popped up, and while it doesn’t solve the mystery of what Swift is up to, it does clear up one thing.

The first mini-vid showed what appeared to be the flicking end of a reptilian creature’s tail. Many assumed that the creature in question was a snake, but some thought the spiky scales were more dragon-like than snakelike. The second post showed the beast’s coiled body (more snake than dragon). And now, we have the head. But prepare yourself, because this is no cute and cuddly animal friend.

The clip begins with a shot of the creature curled up in the darkness. But a moment later, a head with glowing red eyes snaps out. And just as many fans suspected, it’s a snake. But not the kind you might keep as a pet. This thing has some serious fangs.

The message is clear: Don’t mess with *this* snake!

As fans (and Instagram trolls) know, Swift has an unpleasant history with the snake emoji. But it looks like she’s ready to shake off her haters and claim the fearless serpent as her own fierce new symbol.

Swifties are certainly thrilled to have their snake theory confirmed and are all about Swift turning the tables on her trolls.

You made that snake marks🐍which were sarcastic and full of hatred feelings turning into your new weapon✨💕ただでは転びまへんな😍love you! U go girl✌🏻❤️ pic.twitter.com/rr7BdKuifl

— Diamond (@eiga_girl) August 23, 2017

Everyone called Taylor Swift 'Snake' after that Kanye episode, now she owned it and gonna release an album. The level of savagery though 😂

— MystiRoz (@MystiRoz) August 23, 2017

🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍🐍#TS6iscoming @taylorswift13 🔥🎶😉

— Austin Swift Daily (@AustinSwiftFan) August 23, 2017

One massive fierce snake! You go Taylor

— Becky looney (@sutter4clay) August 23, 2017

Snake🐍🐍#FanKapışması#DreamTv#TaylorSwift pic.twitter.com/EVHIbhy5Ye

— . (@MySirDrew5) August 23, 2017

But some would like to leave actual snakes out of it.

I have a phobia of snakes and almost just threw my phone across the room. Just release a single already 😱

— Rachel Hybarger (@RachelH107) August 23, 2017

I did not ask to be jump scared by @taylorswift13 today… pls just give us answers🐍🐍 https://t.co/gfICSUnhsJ

— Diane B (@dianedancergirl) August 23, 2017

— Jen (@jenleure) August 23, 2017

@taylorswift13 needs to stop with all these snake videos before she gives me a heart attack. pic.twitter.com/whdje6KiJa

— MΛTTHΞW (@DeMattria) August 23, 2017

https://twitter.com/AJGiandhani/status/900370619899957250

Others are willing to switch over to the slithery side if it means Swift’s return to the public eye.

I used to hate snakes, but I'm ALL IN if my queen @taylorswift13 is making them cool.

— Rymansh (@rymansh711) August 23, 2017

Loving the snake but I hate snakes keep up the hard work because u motivate me to do better in life love u @taylorswift13

— Taylor Swift (@lisolethump) August 23, 2017

Taylor swift is coming for blood – and I'm here for it 🐍 #TS6 pic.twitter.com/xKw6P5E3AF

— Nerissa Chetty 🥀 (@nerissa_chetty1) August 23, 2017

Taylor Swift right now. This album is going to be SO GOOD!

🐍🐍🐍@taylorswift13 #TS6ISCOMIMG pic.twitter.com/snNEQH9klI— Trupti Gupta (@gupta_trupti) August 23, 2017

Fans are still hoping that this points to a possible new album, but we’ll just have to wait to see what the “Bad Blood” singer has in store for us next. Will the snake bite? Will it shed its skin? Will it transform into some kind of beautiful (less scary) creature?

What do you think about Taylor Swift’s cryptic snake clips? Let us know @BritandCo!

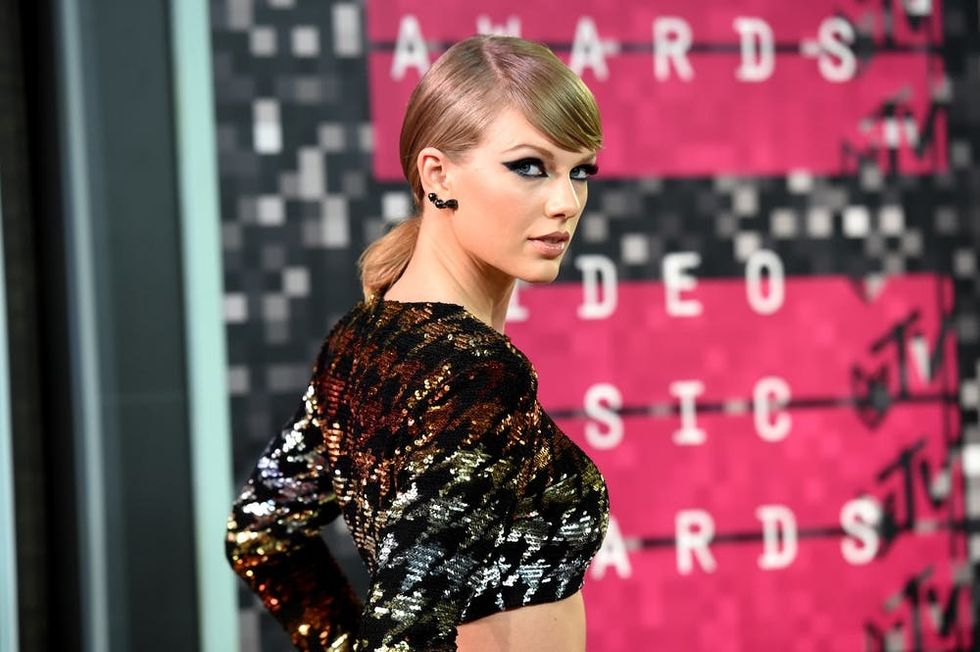

(Photo via Jason Merritt/Getty)