10 Hot Kickstarter Projects We Couldn’t Let You Miss

If you’re one of the lucky ones, summertime means much more sunshine and much less perusing the web. But, while you’re blissed out with summer parties and fruity cocktails, the wheels of innovation will continue to turn. And we’re here to catch you up. Here are 10 recent Kickstarter projects that we wouldn’t want you to miss — and if you did, we have updates on how to pre-order the funded project. Come fall, these may be the hottest products on the market! Or a memory that we’re all glad to share… your funding might just draw the line.

1. Earin: Tired of spending the first five minutes of every workout untangling your headphones? How about the dreaded headphone and key tangle often found at the bottom of your overcrowded purse? Earin wants to fix that by offering the smallest earbud on the market. Not only is the design spectacular, but the Bluetooth audio makes them stand out, as well. Bonus: Backers get a discount off their first order!

2. CA7CH Lightbox: This recently funded project is set to give GoPro a run for its… content. The CA7CH Lightbox is a hands-free camera and video recorder designed for use with your smartphone. With a purpose centered on spontaneity and ease of use, it is now the world’s smallest live-streaming wearable. You can now preorder on their website if you didn’t make the list of backers in time.

3. Craft Your Own Bitters Kit: There’s no passing up a DIY Kickstarter. Tell your deskmate to pinch you now. This handsome craft kit includes everything you need (yes, even instructions) to make bitters for yourself and your guests. Described by the Hella Bitters crew as “salt and pepper” for your drinks, this is a sign to start inviting your friends to your next cocktail party now.

4. Hey Joe Coffee Mug: Fresh on the market and fresh in your cup, the one-cup brewing trend took off with the introduction of Keurig and the like, but you’ve never seen it like this. The Hey Joe mug brews your grounds on the go. You can regulate the brewing temperature, or warm up an old brew, so that it’s always ready to sip. Backers are being rewarded with fresh grounds, so you could say we’re in.

5. Edyn: Remember when we introduced you to Edyn, the connected garden, last month? Great news! The project has been successfully funded, and you can now preorder Edyn on their website. This smart garden system balances your garden’s condition by tracking changes in the environment and responding appropriately. Black thumb, you’ve met your match.

6. Leonard + Church: Born as an answer to the bloated luxury timepiece market, Leonard + Church hope to offer you a new way to buy a luxury watch. Simply put, some accessories are investments. However, market inflation put quality watches out of reach for many of us, which Leonard + Church credit to middle men and retail markups. This Kickstarter has big plans in store to redesign the process and the product. And by the looks of their prototypes, a Leonard + Church watch is likely to make our wish list soon.

7. Bellingcat: Calling all Zoe Barnes wannabes! Your ears should now be perking up. Bellingcat, a response to the ever-growing trend of citizen journalism, aims to level the journalistic playing field. Sure to stir up some controversy, this project will transform the marketplace of information into a horizontal and digital platform. This is certainly one to watch.

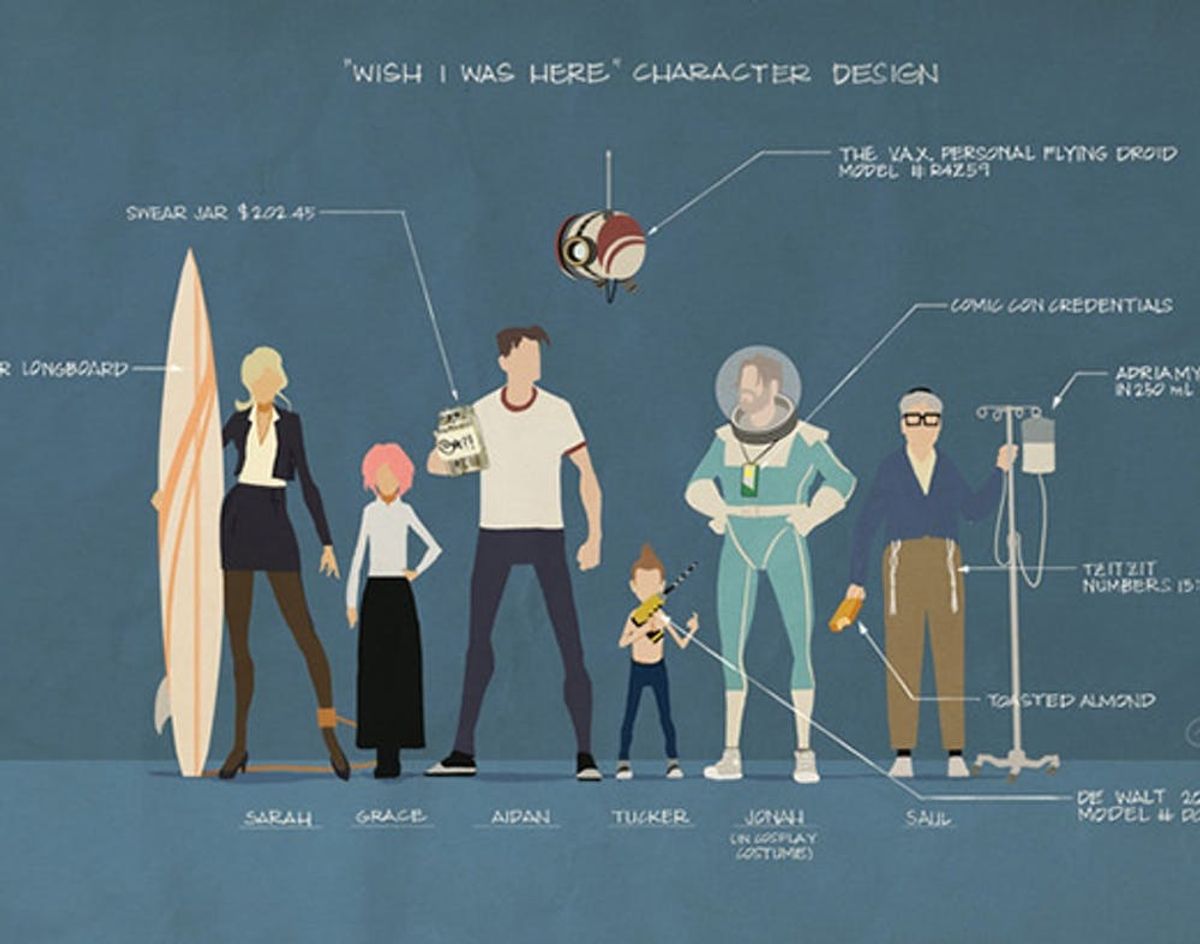

8. Wish I Was Here: Yes… the movie! DYK the whole project started on Kickstarter? Yeah, Zach Braff’s followup to Garden State is now in theaters. Braff, who has backed several Kickstarter projects on his own time, took to the crowdfunding platform in order to protect his creative license over this project. He raised over $3M to fund the film. *Opens Fandango app.*

9. Khink: Leggings for Change: There are two types of people in this world: People who believe leggings are pants, and those who do not. Whichever side you choose, these leggings are fighting a battle even bigger than that. Khink wants to bring you leggings out of Madrid, Spain that are a collaboration of locally sourced art and textile. Introducing themselves as a social enterprise, Khink plans to reinvest profits into worthy causes such as female empowerment, pit bull protection and more. Pick and choose your battles by backing their campaign, and you’ll even claim a reward.

10. Violet: Optimize Your Sun Experience: Like most things in life, sun exposure requires balance. We keep you up-to-date with chic sun protection hacks, but how about maintaining healthy exposure? After all, a few rays do boast health benefits, the most popular of which being vitamin D absorption. This new wearable tech by Violet will monitor your exposure and report back to you based on your personal skin type and sun tolerance.

Hip on a hot Kickstarter that didn’t make this month’s cut? Fill us in below.